In case you’re new to my site and haven’t read my posts before, I’m a long-term stock investor at heart and I firmly believe that stocks are the superior investment in the long-term.

Then again, why should you believe me? Well, rather than toot my own horn, I decided to bring in the big guns.

My comrade will be one of the giants of the financial world: Mr. Jeremy J. Siegel.

Armed with his legendary investing book, Stocks for the Long Run, I charge to the battle and storm the financial barricades.

Because this whole article lies heavily in Siegel’s work, I’d like to point out that the credit from all this goes to Jeremy Siegel and the people who’ve conducted the original research in his book.

So, let’s see exactly why stocks are the superior long-term investment, and why stocks are less risky than bonds in the long run!

Stocks for the Long Run

They say that a picture is worth a thousand words.

If that’s true, then imagine the worth of multiple pictures and even more words.

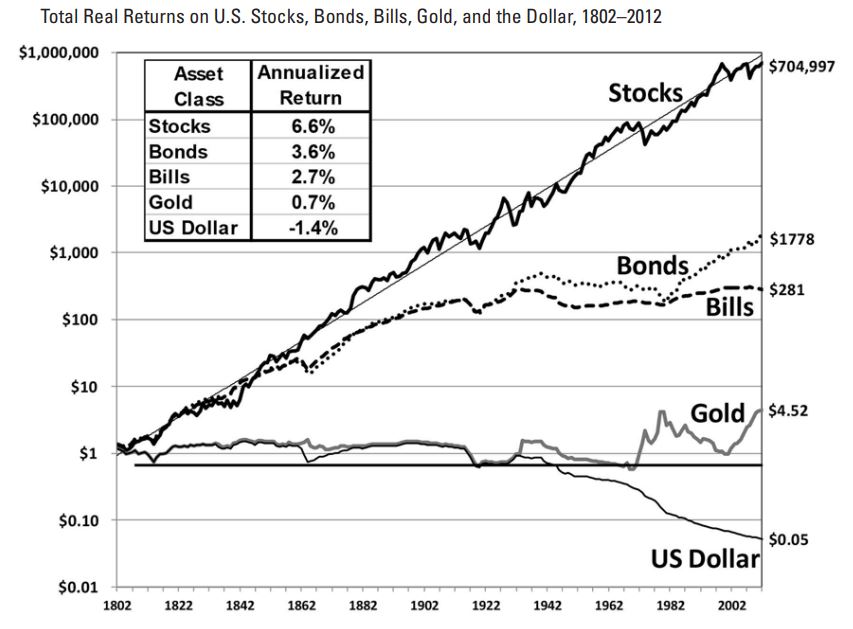

Let’s begin by examining the real returns on U.S. stocks, bonds, bills, gold, and the dollar:

The idea of long-term investing is to get a real (inflation-adjusted) return for your investments. In other words, the purchasing power of your assets should be increasing.

As you can see from the graph, stocks offer just that. In fact, there has never been a 20-year period where stocks have offered a negative real return.

Think about it. If you stay invested for 20 years, there’s virtually no chance your real returns would be negative.

When you look at the US Dollar line, one thing is painfully obvious: Inflation does erode your savings. Historically speaking, stocks have proven to be the best hedge against inflation.

What about gold then?

Well, gold does work as an inflation hedge, but when it comes to real long-term returns, it falls extremely short.

There’s one thing we need to consider, though. When it comes to stocks, it largely depends on what you invest in. The returns examined here are based on a broad-based capitalization-weighted index of U.S. stocks. Capital gains or losses and dividends included.

If you would invest in, let’s say, ten companies you picked yourself, the results can and probably would be completely different.

Okay, I know what you’re probably thinking. How about international stocks? It’s true that we’ve only been talking about the U.S. markets, and there are other markets in the world.

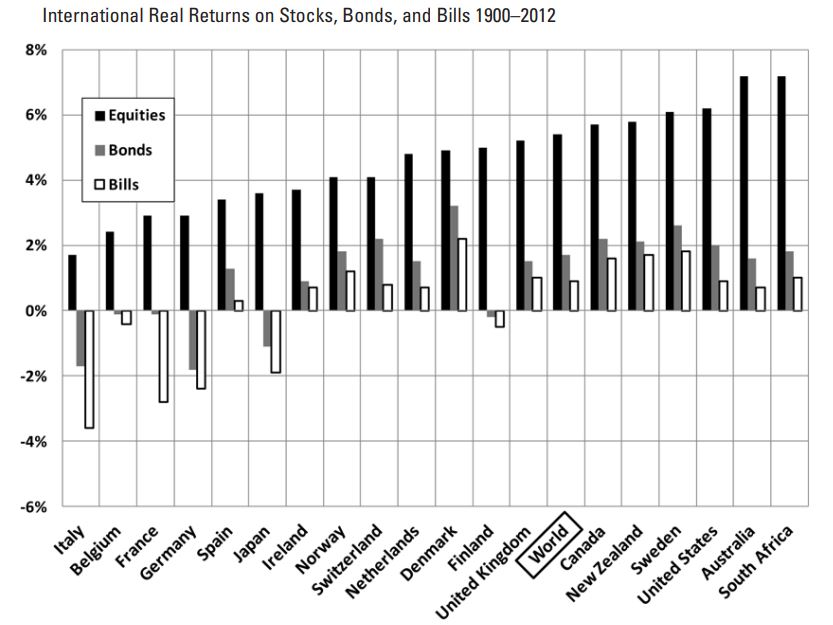

International Real Returns on Stocks, Bonds, and Bills

Some say that the results we get from examining the U.S. stock returns aren’t really relevant, since the U.S. equity market has been so successful for the past 100+ years.

Considering the success of U.S. stock market has had in the past 100 years, the argument is more than relevant.

So, how have stocks fared in other parts of the world?

Well, take a look at this neat little graph:

As you can see, stocks have outperformed bonds and bills everywhere in the world.

While there are great differences in real stock returns between different countries, they all have one thing in common. Stocks have outperformed bonds in each and every one of them.

There’s really nothing surprising here since stocks should be outperforming bonds in the long run anyway.

After all, you should be well-compensated for all the excess risk you take when investing in stocks.

But are stocks actually riskier than bonds in the long run?

Stocks vs. Bonds – The Surprising Truth About Risk

One universal truth that no one really dares to question is that bonds are less risky than stocks. In fact, bonds are usually used to lower the risk level of your stock portfolio.

What if I told you that bonds can actually increase your portfolio’s risk level in the long run?

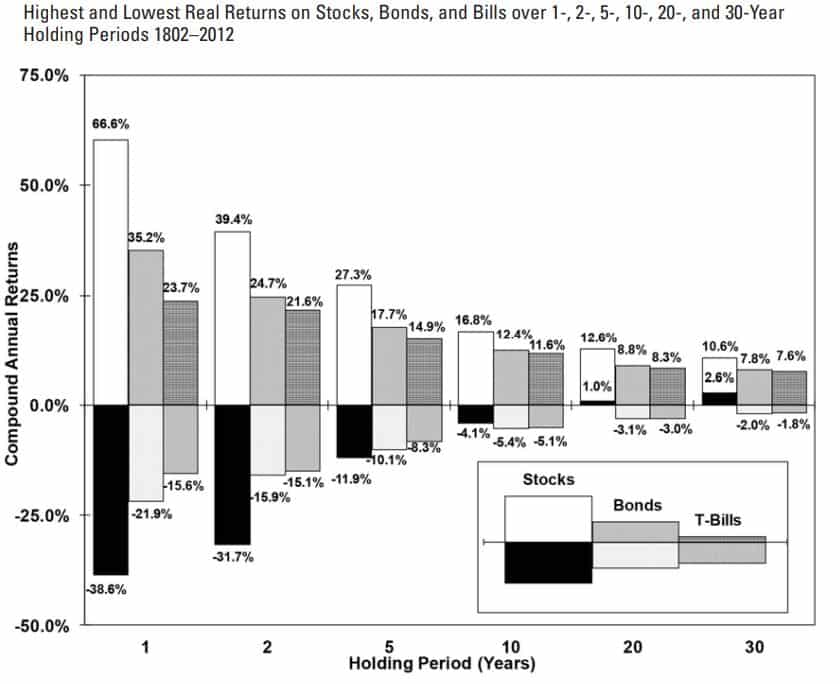

Let’s examine the highest and lowest real returns between stocks, bonds, and bills over different holding periods.

When investment advisors say that you should own stocks for at least five to seven years, it really comes down to this graph.

As you can see, stocks truly are a lot riskier than bonds or T-bills if your plan is to invest for just a couple of years at most.

When held for more than five years, though, the overall risk level of stocks starts to rapidly decrease.

To put it in another way, since 1802, in every five-year period that has been measured, the worst return on stocks has been just slightly worse than on bonds.

As you can see at the 10-year mark, there’s something even more interesting happening. Stocks are actually becoming less risky than bonds.

Bonds are often viewed as a great way to diversify or reduce overall risk in your portfolio.

If you have a widely diversified stock portfolio with a long investment horizon, bonds can actually work against you in the long run.

Summary

When it comes to long-term investing, stocks truly seem to be the superior investment, no matter what stock market you invest in.

Not only do stocks outperform bonds in the long run, but they also become less risky as time goes on.

Although the average holding period for stocks has reduced dramatically, long-term stock investing seems to be the most efficient investment strategy.

However, this is not to say you shouldn’t invest in bonds or other asset classes on any occasion.

It all comes down to your investment strategy and time horizon. If you have a widely diversified portfolio and you really do invest for decades, stocks really are the superior asset class.

Then again, if you need a safe place to park your cash for a few years, bonds and bills can and often are the best solution.