What is Financial Planning

Financial planning is an essential part of your personal finance.

A typical financial plan includes steps such as defining your financial goals, creating a budget based on your income and expenses, defining your risk profile, and creating an investment plan.

I’ve written a more comprehensive article about the steps for financial planning, that will cover the subject a bit more thoroughly.

To summarize, it is a process where you analyze where you are, decide where you want to be, develop suitable strategies, track your progress, and adjust accordingly.

You can come up with a written financial plan yourself, or consult a professional financial planner.

Because planning your finances can be a strenuous task, I decided to put together a little something to show the importance of financial planning.

Why Is Financial Planning Important

Provides You with Clear Goals

A key part of the financial planning process is to create clear goals you work toward.

Usually, we define these goals as short-term, medium-term, and long-term goals.

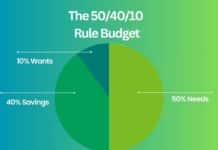

- Short-term goals include budgeting, tracking your spending habits, and learning how to save money.

- Medium-term goals include building an emergency fund, paying off credit card debts to improve your cash flow, and developing financial literacy.

- The biggest long-term goal you’ll have is to come up with an investment strategy and start investing.

The idea is that you need to have your short-term goals in order to achieve your medium and long-term goals.

Let’s imagine a situation where you had no reason to save at all. Or even better, you don’t even KNOW that you should save. If you have no idea how to save, you can’t build an emergency fund or have investments.

It’s the things we don’t know we don’t know that get us.

Once you know how to save, have your budget in order, and are financially secure, you have a lot more mental capacity for investing and creating other long-term financial plans.

Exposes Your Financial Weak Points

Financial planning requires you to form a complete picture of your current finances, including your strengths and weaknesses.

Common financial weaknesses include too much debt, too little income, and too much spending on non-essential goods.

These weaknesses aren’t really that dangerous if you’re aware of them and don’t let the situation get too bad.

The real problems begin when we have no idea of the things that put our financial well-being in danger, and things start to escalate.

The sooner you realize your weaknesses, the easier it is to contain the damage.

Gives You Peace of Mind

Being financially sound creates peace of mind.

The thing is that we’re all 100% guaranteed to face a financial emergency at some point. There’s no question about it. The problem is that the human mind isn’t very adept at grasping these probabilities.

It’s like when a smoker is certain that he’s not the one getting lung cancer. The same goes for accidents.

When you’ve created a good financial plan and have an emergency fund and investments, the emergencies that will happen become less destructive. You have a more secure future and have enough money to survive emergencies.

In my book, peace of mind is something that’s hard to put a price on.

Improves Your Life Quality

One of the biggest factors that determine our quality of life is the amount of freedom we have.

The main reason why I’m pretty much obsessed with being financially secure is the freedom to do and live my life the way I choose to.

When we are in financial trouble, we have to rely on somebody else’s goodwill. When we’re in a tight spot financially, we have to rely on banks to renegotiate our debt payments or hope that our employers still have use for us and let us keep our jobs.

This can be extremely stressful, and excessive stress can be harmful.

It’s a well-known fact that the more secure you are financially, the better off you are health-wise.

According to research, financially secure people have fewer chronic diseases, tend to live longer, and have more functional years when they get old.

The importance of financial planning is that it improves your overall quality of life.

Teaches You Financial Skills

Planning your finances requires you to learn financial skills like budgeting, saving, and investing. These are the kinds of skills that help you achieve your goals and can really make a difference in your life.

Even if you lost everything, you would have the skills to start again and rebuild. This gives you an immense amount of confidence and reduces stress, since you know you’re going to be fine, no matter what.

The beautiful part is that financial skills are pretty much universal. There are, of course, things that differ in each country like tax systems, income level, and the cost of living, but the main principles do apply no matter where you are.

If you are just beginning to improve your personal finances, I strongly recommend consulting a financial advisor. It saves you quite a bit of trouble and helps you learn the basics faster.

Financial skills are the kinds of skills that make your life a lot easier.

At the very best, you know how to become and stay wealthy without having to stress about money ever again.