The definition of personal finance, according to the Corporate Finance Institute, is that it’s the process of planning and managing personal finance activities such as income generation, spending, saving, investing, and protection.

But what does it REALLY mean in your everyday life?

Personal financial planning means creating a budget, tracking your income and expenses, learning how to save money, living within your means, and learning how to invest.

In other words, personal finance is being smart about your money.

Creating your personal budget is usually the best place to start. To make all the other stuff work, you need to know what can and cannot afford.

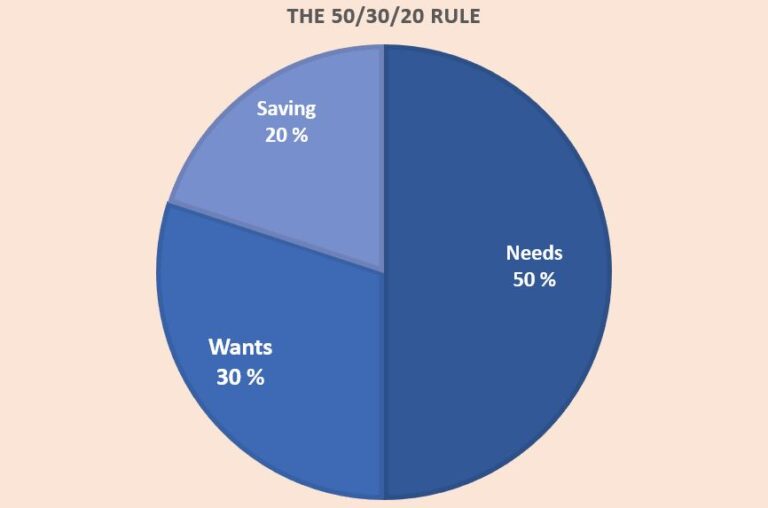

One of the most popular ways to create a budget is to follow the 50/30/20 rule, where you divide your expenses into needs (50%), wants (30%), and saving (20%).

An essential part of budgeting is knowing where your money comes from and where it goes. You can track your expenses and income by hand or use a budgeting app to help you out.

Tracking your monthly budget might open your eyes to how many unnecessary expenses we actually have and makes managing expenses a lot easier.

After you’ve created a balanced budget and saved an emergency fund, you should start investing your savings to keep inflation from eroding them.

While we all have different approaches to managing our finances, you might find these basic rules of personal finance extremely helpful!

Why Personal Finance is Important

Learning personal finance skills prevent you from getting into financial trouble and gives you peace of mind.

One of the major consequences of neglecting your finances is money-related stress.

Prevents Money-Related Stress

According to American Psychological Association, 72 percent of Americans have felt stressed about money in the prior month of taking the survey. For comparison, the same percentage in Finland is about 60 percent.

In Canada, almost half of the population has reported having difficulties getting through the month if their pay is late.

Let’s think about this for a second.

What this means is that out of 100 people, around 60 to 70 of them are living in a constant state of financial stress.

In his book, Stolen Focus, Johann Hari mentioned a study by the British Office of National Statistics, where they found that a child’s chances of being diagnosed with attention problems go up by 50% if there’s a financial crisis in the family.

It also goes without saying that living in a constant state of stress causes overall health problems like heart issues, weight problems, high blood pressure, etc.

What this all means is that not only does worrying about money decreases your quality of life and the lifespan itself, but it also devours the resources you’d use for other activities.

It’s almost impossible to focus on bigger goals when you’re worrying about whether you can make it through the month or not.

Helps Prevent Financial Trouble

I do realize that these things are a hell of a lot easier on paper than in real life. As a financial advisor, I often work with people who are in over their heads in debt, and we try to come up with ways of not having to sell their houses, losing credit scores, and possibly their jobs.

It’s not an easy task to do.

Once things start going bad, they tend to get worse. After a certain point, there are no good solutions, and the measures you need to take are indeed drastic.

This is why the best way to keep your personal finances in check is to start paying attention to them before things get bad.

While it’s always important to start budgeting and learning how to save money, it’s a lot easier when you don’t have a crippling amount of credit card debt to pay off.

In short, it’s best to learn how to take care of your personal finances before you are forced to do it.

Gives You More Freedom

Having financial security and achieving your personal financial goals gives you more freedom to live as you please.

The most important thing in personal finance is to manage your debt and have some money left over every month. While we usually talk about bad debt like credit card debt and other high-interest loans, the same principles do also apply to mortgages.

When you have too much debt, it drastically limits your options. Let’s imagine you’re stuck in a horrible job that you hate from the very bottom of your soul and are considering a career change.

If you live from paycheck to paycheck and have a mountain of debt to take care of, you can’t risk your income, which means that it’s not so easy to pursue the things you really want to do.

Also, if you’re in financial trouble, you’re always dependent on others. First of all, you must rely on your employer to pay you your salary exactly as it is since you need every cent of it. If you have too much debt and need to come up with a more flexible payment plan, you also have to depend on banks and their goodwill.

All this adds to your stress and gives you the feeling that you’re the one responsible but not in control.

When you have savings, a balanced budget, and a reasonable amount of good debt, you have more control over your life.

When you take care of your finances, they take care of you.

Personal Finance and Investing

A major part of managing your money is learning how to invest.

After you have taken control of your spending habits, learned how to save money, and built an emergency fund, it’s time to take money management seriously and begin investing.

The reason why you should invest a portion of your monthly income instead of just saving money in your bank account is to beat inflation and achieve compounding returns.

If you’d keep all your retirement savings in your savings account, inflation would slowly eat your hard-earned money and you’d have very little left of your retirement fund.

This is why creating real personal wealth and achieving financial independence is next to impossible without some form of investing.

While there are loads of different investment opportunities, this site mainly focuses on stocks and long-term investing.

You can read more about investing in the investing archives!

How to Learn Personal Finance

The best way to get personal finance education is to take an active approach.

While it’s always beneficial to learn in theory, it’s even more effective when you put it into practice.

So, how does one begin one’s journey in the different areas of personal finance?

No matter what your situation is, you first need a plan. Creating a financial plan helps you define your financial goals and gives you clear guidelines on how to manage your finances.

I wrote a post about the most important steps for financial planning, that you might want to read to get started!

The steps not only include the very things we covered in the beginning such as budgeting and tracking your expenses, but they also give you strategies to adopt in different financial situations.

Once you’ve learned how to get started, you can start to develop your financial literacy. The fastest way to become financially literate is, in my opinion, by reading.

I’ve gathered the best financial literacy books for beginners that cover pretty much everything you need to know about finances, investing, and the economy.

I think that reading is, by far, the best method to learn the basics of something. Numerous studies have shown that we tend to learn best by reading something in an old-fashioned way.

While there is, of course, an endless supply of different YouTube channels, podcasts, free online articles, and other media-based sources of information, I truly believe it’s best to start with books.

There’s also a wide selection of different personal finance classes you can take that can help you learn things faster.

No matter where you choose to start, the most important thing is to start!