What is an Emergency Fund?

As the name suggests, an emergency fund is money that you put aside in your savings account for emergencies.

It serves as your safety net against unplanned expenses and improves your financial well-being immensely.

Having a sufficient emergency fund is the foundation of your personal finances.

Why You Need an Emergency Fund?

The point of having an emergency fund is that you can pay for unexpected expenses straight away.

This way you don’t need to take expensive high-interest loans to pay for emergencies and avoid taking on too much high-interest debt.

I can say with confidence that most of the big personal finance troubles can be prevented by having emergency savings.

During my time as a professional financial advisor, I’ve rarely seen someone with an emergency fund getting into financial trouble.

The thing with emergencies is that they happen to all of us. It’s not a question of whether they happen or not, it’s a question of when.

When you know something’s going to happen sooner or later, you might as well do the smart thing and prepare for it.

In other words, having an emergency fund for unplanned expenses gives you financial security.

How Much Money Should You Have in Your Emergency Fund?

Thinking in pure numbers, there’s no simple answer. It all depends on how much money you need to run your household.

Usually, a suitable amount is one that covers your living expenses for about 3 to 6 months.

Why 3 to 6 months’ worth of expenses?

That’s usually how long it takes for a person to find a new job, to recover from most accidents, and it’s enough money to replace most of the things that might be broken.

It can also be used as a down payment for a bigger loan, if things go REALLY bad.

It’s also worth saying that you can have too much money in your fund. What I mean by this is that since you shouldn’t invest your emergency fund, it’s mostly money that doesn’t turn a profit.

We do want profit for our money, however, which is why you should only save a certain amount of money in your emergency fund and invest the rest for profit.

Should You Invest Your Emergency Fund Money?

To put it plainly, no. You should not invest the money in your emergency fund.

Some people put their emergency savings to work and invest them in low-risk funds or other similar assets.

Personally, I wouldn’t recommend this. Here are a couple of reasons why.

First of all, you should never invest money you can’t afford to lose. Period.

Second, you can’t predict emergencies. They can happen ten years from now or tomorrow.

When you invest your emergency fund, you have no idea when you need to sell your investments. This increases your risk level immensely since you might be forced to sell your holdings at a loss.

There’s also the problem of risk and return. When you invest money you can’t lose, you’re forced to invest it in something that has low risk and thus a low return. After all the transaction fees it’s extremely hard to make a decent return.

How to Build an Emergency Fund

Create Your Monthly Budget

The very first thing you want to do when you begin to build your emergency account is to create a budget and decide what your monthly savings goal should be.

Creating a budget helps you stick to your financial goals and allows you to save more money.

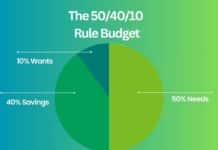

A common way to form a budget is the 50/30/20 rule, where you divide your budget into three categories. According to the rule, you should spend about 50% of your net income on your needs, 30% on your wants, and save the remaining 20%.

You can create your budget and track your expenses either manually, or use budgeting software or an app to make things easier.

Open Up a Savings Account

Once you’ve created a budget and know what your savings goals are, you can start saving.

As mentioned before, investing your emergency fund money is not a good idea, so the best option is to open a plain-old savings account.

While there are a lot of different bank accounts, it’s best not to save in your checking account, but to have a separate account where you save automatically.

When you choose what kind of emergency savings account you’re going to open, always go with the one that pays you the most interest (AKA a high-yield savings account).

Sometimes there are restrictions in savings accounts on how you can withdraw your money, so make sure your money is available to you at any time.

Since the idea is to save money, it’s also the best idea to choose an account that has no fees.

If you have trouble setting up your bank account, you can always consult your local financial advisor.

Automate Your Payments

The simplest way to begin saving is to set up an automated payment from your checking account to your savings account.

When you keep your emergency fund payments automated, you remove the burden of making the monthly decision of saving money.

A good rule of thumb is that the easier you make your saving, the more likely you’ll stick to it.

Rebuild When You Withdraw

It goes without saying that you should only use your emergency fund money for true emergencies.

As they will happen sooner or later, you should already mentally prepare for rebuilding your fund.

More often than not, it’s the rebuilding phase where things go wrong. Having the mental strength to start again when things go bad is not as easily said as done.

That’s why it’s essential to start rebuilding right away after an emergency.

When and How to Use Your Emergency Savings

As you can guess from the name, your emergency fund is for emergencies and other absolute necessities.

Therefore, it’s essential to know what an emergency is.

Most common examples of unexpected expenses that count as emergencies include things like medical expenses, home repairs, and the time you’re unemployed.

These are things that you need to deal with immediately and that will cause bigger problems if they’re not taken care of.

The most important things in using your emergency fund are to only use it as much as is needed and, as stated before, to start building your emergency savings again immediately.

If you don’t, there’s a very real chance you never will.

Most Common Mistakes in Building an Emergency Fund

o Using credit card debt as an emergency fund

o Spending your fund for non-emergencies

o Letting your fund run out

o Saving without a goal

o Not having a separate savings account

o Failing to create a balanced budget

o Investing your emergency fund