I believe the earlier you start to obtain financial literacy and learn how to manage your money, the more likely you are to achieve financial independence.

This is why especially young adults should at the very least learn the basics of personal finance.

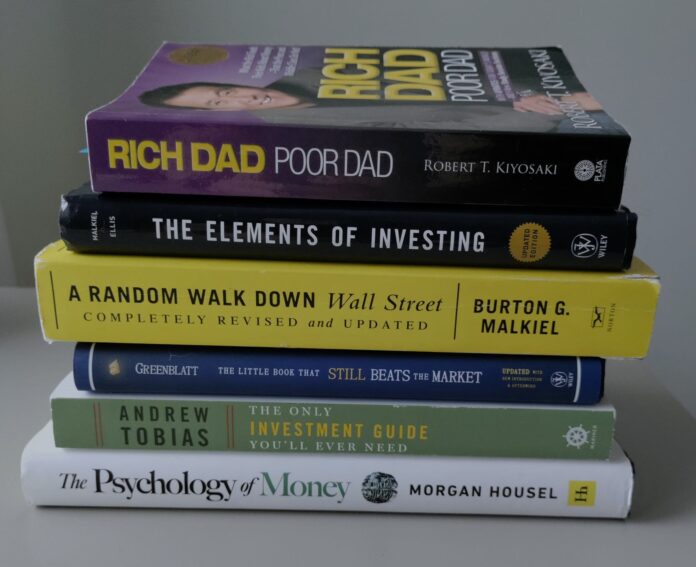

During the past 15 years, I’ve read quite a few books about investing, and so far, the books I’ve listed here are the ones I honestly believe to be the very best.

So, without further ado, here are the best personal finance books for young adults.

Rich Dad Poor Dad by Robert L. Kiyosaki

Rich Dad Poor Dad is probably one of the most famous personal finance books ever written. The author, American entrepreneur and businessman Robert Kiyosaki, tells a story about himself and his biological poor dad and a non-biological rich dad who teaches Robert how to accumulate wealth.

The book advocates entrepreneurship, learning, and taking control of your own financial future.

Out of all the books listed here, this one is especially for young adults because they usually have all their options open.

The main ideas of the book revolve around acquiring assets like stocks rather than liabilities like a new car. The key difference between the two is that an asset generates wealth while a liability consumes it.

Another key issue is the idea of working for a wage. In the book, the poor dad worked for someone else, and the rich dad worked for himself.

Overall, the book is a great read. The truth is that in the real world, working for someone else and “investing” your wage in liabilities will most definitely not make you wealthy. Doing the opposite might.

Of course, the story behind the rich dad poor dad setup is a bit iffy, but the concepts are sound. I do believe you get somewhat ahead in life and improve your financial status by following the lessons taught in this book.

A Random Walk Down Wall Street by Burton G. Malkiel & The Elements of Investing by Burton G. Malkiel & Charles D. Ellis

Burton Malkiel is a household name as far as economists go, and it’s said that A Random Walk Down Wall Street is THE book to read when you start investing. I believe this to be completely true.

The reason why I put these two together is that they are essentially the same book with the same message.

Both books cover the most common concepts in investing like diversifying, the relationship between risk and reward, the efficiency of the market, and many others.

It’s worth noting that both books also advocate broad diversifying, dollar-cost averaging, and investing in index funds

For the record, I think it’s enough to read only Random Walk since it takes a more comprehensive glance at the subject. It also covers some historical events about the madness of the markets and takes a glance at behavioural finance.

The reason why I included the Elements of Investing is that it offers the core lessons of Random Walk in about 170 pages. So, if you’re in a hurry or don’t enjoy reading all that much (yet), the Elements might be the best choice for you.

The Little Book That Still Beats the Market by Joel Greenblatt

What would you expect of a book written by a wildly successful hedge fund manager with a value investing approach, who brings forth a magic formula that has guaranteed results?

Honestly, I would call it a scam and move on.

But, as you learn once you actually read the book, it’s probably one of the smartest books ever written on investing.

The book is most famous for its magic formula that can be used to achieve higher returns.

Now, while the magic formula seems to actually work (to some extent), the real value of the book is not the formula but the approach it teaches.

This is one of the few books that not only manages to simply explain the idea behind stock picking and value investing but does it in less than 190 pages.

As mentioned, the book focuses on value investing and picking stocks, so there will be no indexing and broad diversifications here.

The Only Investment Guide You’ll Ever Need by Andrew Tobias

This one is a book that certainly lives up to its name.

It covers everything from actually saving your money and making a financial plan to different ways of investing and the most common concepts in investing.

What’s worth mentioning is that this book also offers a step-by-step guide to managing a fictional gift of a million dollars. Nowadays young adults are starting to inherit money more than ever before.

Overall, the book is about taking responsibility for your personal finance and will go as far as offering advice on how to teach your own children to invest.

The book is mostly directed to people living in the US, so if you live somewhere else, you should obviously remember that the tax and retirement-related advice won’t probably apply to you all that much.

That being said, it’s safe to say this book will help you achieve your financial goals wherever you’re from.

The Psychology of Money by Morgan Housel

All the books mentioned above teach you how to take your financial future into your own hands through investing.

The thing is that investing is equally about numbers and psychology, sometimes even more about psychology.

To get and STAY wealthy, you also need to know yourself and why you might react to certain things the way you do.

The Psychology of Money helps you to avoid the most common pitfalls and make better financial decisions by explaining why we think about money the way we do.

The book covers topics like compounding returns, the importance of a long investing horizon, and the nature of the stock market. It doesn’t offer any specific financial advice in a traditional sense, but it is guaranteed to make you a better investor.

I firmly believe that if everyone were to read this book, we would all be better off.