Of all the long-term investment strategies, investing in stocks has proven to be the superior long-term strategy.

While we all have different investment styles and personalized portfolios, there are a couple of things that the most successful investors out there have in common.

Here are my best tips for successful long-term investing that are guaranteed to help you succeed!

Create and Maintain a Long-Term Perspective

First and foremost, having a long-term perspective is accepting that creating wealth by investing in stocks doesn’t happen instantly.

While people nowadays (including yours truly), would like to have it all and preferably fast, the world doesn’t really work that way.

All the things worth achieving take time, and successful investing is no exception.

The main idea of long-term investing is to buy assets that increase their real value over time. That’s it.

It should, therefore, come as no surprise that long-term investing requires a lot of patience, discipline, and mental fortitude.

In fact, achieving success in the long term is mostly a psychological feat.

While I’m completely convinced that you can be a successful long-term investor without any specific math skills, it does help to understand the concept of compound interest.

Understand the Importance of Compounding

What makes long-term investing so effective is the compounding effect. Compounding makes your money grow faster and faster as time goes on.

The reason why being a successful long-term investor requires an immense amount of patience is the fact that compounding takes a long time to work.

During the first years of your investing career, there’s not much going on compound-wise. Usually, it’s the first five years or so that are the hardest, because it feels like you’re really going nowhere.

Luckily, after compounding starts to work, it works wonders.

Because compounding is essentially a phenomenon where your profits start to generate additional profits, it takes a long time. Therefore, it’s the time you stay invested that’s important.

The best ways to enforce the compounding effect are to reinvest your dividends, start investing as early as possible, and not sell your investments.

Secure Your Financial Status

To be able to stay invested for a long time, you need to make sure you don’t have to sell your investments to pay for bills.

So, to become a successful long-term investor, you need to have a strong financial status.

The way to do this is financial planning. First of all, make sure you have a budget surplus to begin with. It’s hard to invest in anything if your expenses exceed your income.

After that, you should build an emergency fund that you can use for surprising expenses, so you don’t need to withdraw funds from your long-term investments.

When it comes to compounding returns, the first years are the hardest. Every time you sell your investments, you prevent them from compounding further, and you have to start all over again.

If you constantly sell your investments, they never get the chance to compound, and your long-term investment strategy will never work.

Have a Well-Diversified Portfolio

If there’s one investment quote that everyone has heard, it’s “Don’t put all your eggs in one basket”. What it means is that you shouldn’t invest everything you have in just one company, for example.

The idea of diversifying is to buy assets that don’t have a strong correlation between them. In other words, you want to buy assets that tend to go different ways.

For a crude example, you could buy a sunscreen company and an umbrella company. The other makes a profit when it’s sunny outside, and the other makes big bucks when it’s raining. Asset allocation is, of course, a bit more complicated than that, but you get the idea!

The most common (and effective) ways of diversifying include diversification across time, asset classes, industries, and countries.

In other words, you should own different types of assets from all around the world, and you should purchase them over time.

The easiest way to make sure you’re well-diversified is to invest in a broad global index fund or a mutual fund, that invests in hundreds and thousands of different companies.

Because timing your buys is one of the hardest things for an investor to do, it’s sometimes best to remove the problem of timing completely.

Having a regular, monthly purchasing plan makes sure you buy stocks when they’re expensive as well as cheap. It’s also called dollar-cost-averaging.

(Mostly) Forget about Timing

When I say you should mostly forget about timing, I mean forgetting the idea of always trying to buy low and sell high.

While you would, theoretically, achieve superior returns by selling at market highs and buying at the bottom, it doesn’t work like that in the real world. We can only recognize the tops and bottoms in hindsight.

So, the people who say they can predict market movements are either delusional or trying to sell you something. Consistently timing your buys perfectly is, as far as I’m concerned, impossible.

Luckily, as a long-term investor, the timing doesn’t really matter all that much. If you hold a winning stock or a stock index for decades, the role of timing becomes less and less meaningful.

That being said, there are some occasions when you might want to increase your holdings in certain stocks.

For example, if a company you own is hit by a temporary problem that does not affect its long-term fundamentals, it might be a great opportunity to buy more at a low price. The challenge here is figuring out whether the problems in question are temporary or permanent.

Match Your Investments to Your Risk Tolerance

When you hear about people losing sleep over their investments, it usually means they’ve invested in something too risky.

It’s practically impossible to succeed as a long-term investor if you spend all your nights worrying about your investments.

Taking on too much risk leads to hasty investment decisions and undesirable results. For example, if you’ve invested money you can’t afford to lose, you’ve already taken way too much risk, no matter what you’ve invested in.

Another common mistake is to invest in something risky, like highly volatile growth stocks without knowing how you react to extreme changes in stock price.

Both of these situations usually lead to panic selling, and sometimes giving up investing for good.

The way to avoid this and become a successful long-term investor is to define your risk profile correctly and invest accordingly.

Stick to Your Investment Plan

Sometimes, especially during turbulent market conditions, it’s hard to stay true to your investment plan.

For example, during strong bull markets, you might want to get the urge to make a quick profit and go all-in on volatile growth stocks. Then again, during long and severe bear markets you start to question yourself, your portfolio, and everything you’ve ever believed in.

Also, for a long-term investor, it can be excruciating to watch day traders make exceptional short-term returns, while your long-term portfolio is performing adequately at best.

Those are exactly the times when you should review your initial long-term investment plan and have faith in the process.

It’s also worth remembering that no matter what your investment strategy is, it will most likely take quite a bit of time to see whether it truly works or not. For a long-term investment strategy, even more so.

Ignore Short-Term Movements

The longer your time horizon, the less you need to care about short-term market volatility.

Since the everyday movements in stock prices are mostly random, they offer little valuable information for a long-term investor.

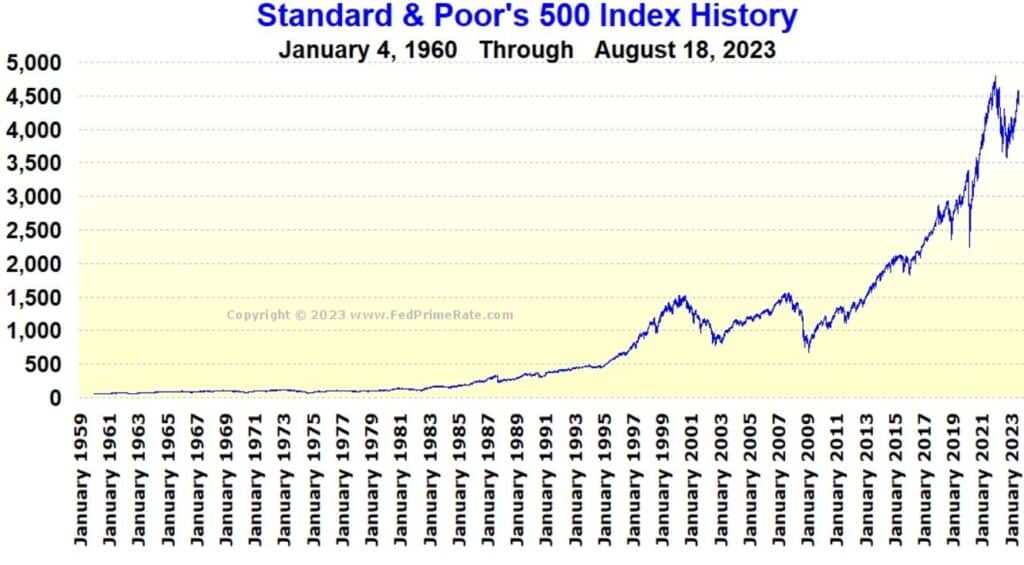

Also, take a look at this graph about the S&P 500 index history:

What can we learn from this graph? Well, the first thing is that graphs are pretty neat.

The second, and maybe the more important thing is that the things that seem devastating in the short term aren’t that important in the long term.

During the past 60+ years, there’ve been a couple of wars, more than a few crises, and a handful of stock market crashes. Still, the stock market has gone up tremendously in the long term.

Of course, past performance can’t be used to predict future results, but it does have some informational value on what you can reasonably expect.

For a long-term investor, it’s important to ignore the short-term panics and stay invested.

Forget Hot Tips and Hype Stocks

If there’s one thing, I’m not good at, it’s making money on hype stocks and hot tips.

In fact, the only hot tips that are useful are inside information. Unfortunately, using that not only gives you great returns but also a one-way ticket to Azkaban (that’s prison, in case you’re not a Potter enthusiast).

The problem with hot tips is that when you or I hear them, everyone else and their mother have also heard them. A hot tip has already gotten pretty cold when you hear it.

Therefore, the chances are that once you get in, there are no more buyers left, and the stock price starts to fall.

So, hot tips aren’t really that hot to begin with.

What about hype stocks, then? Well, the problem is that they’re usually so overpriced that they tend to make poor investments for most people. These are the kinds of stocks that are expected to grow way faster than the market in general, which means it’s already priced in.

The risk is that the growth doesn’t happen as expected. When it starts to slow down, the stock price will soon follow.

Another issue with hype companies is that they’re often extremely high-tech and difficult to understand, which leads me to my next tip.

Invest Only in Things You Understand

Imagine owning something you have no idea what it is or what it does. How would you determine whether it’s doing as well as it’s supposed to? Well, you can’t, and that’s the point.

Investing for decades in something you have no idea about is extremely risky – not to mention insane.

And still, there’s a great number of investors who occasionally do exactly that.

This was quite evident during the dot-com bubble in the late 90s when investors went all Charlie Sheen over tech stocks. Most of them seemed to have no clue what the companies actually did, they just got on board the hype train.

Eventually, the bubble burst and people realized that most companies had no real business to begin with.

Needless to say, they lost a ton of money. Around $5 trillion, to be exact. The way I see it, the number one factor that predicts success as a long-term investor is the ability to stay rational while others are not.

Knowing what you own dramatically decreases the risk level of your investments. When you know what you invest in, you can at least evaluate the likelihood of making a successful investment.

Of course, when you invest in broadly diversified index funds like the S&P 500, you don’t really need to know what every company on that index does. What’s more important is to understand how the stock market works in general, and that’s a whole other topic.

Mind the Expenses

One thing that every investor should keep in mind is that whatever expenses you’re paying, you need to make up for them in extra return.

So, when you think about it, the only absolutely certain way to get extra returns is to pay as little expenses as possible.

The most common investing costs are fund-related expenses, financial advisory fees, and transaction fees.

For long-term investors who invest regularly in funds, the most important ones are transaction fees and ongoing fund expenses.

Luckily, passively managed funds like index funds have extremely low total expense ratios, often less than 0.25% or so, and have no sales charges.

The fees for financial advisors vary greatly, some are more expensive than others, and if you use those kinds of services, you should be aware of their annual management fees.

If you want to minimize expenses, the best way is to do your own research, invest in low-cost index funds, and pick a broker with low expenses.

Consult a Professional

Sometimes, even the best and most experienced investors can use a little help achieving their financial goals.

A financial advisor can help you with everything from defining your risk profile to managing your investment portfolio. Depending on your situation, they can also help you with tax and estate planning, as well as overall financial planning needs.

Especially for beginner investors, consulting a professional financial advisor can prevent a lot of expensive mistakes.

It’s worth remembering that there are a lot of different advisors out there, so you might want to consider consulting more than one before making big decisions.

The ideal situation would be to find an independent and unbiased financial advisor who has a real passion for the craft, and with whom you can build a long-lasting professional relationship.

Keep It Simple

I decided to save the best tip for last.

If you want to be a successful long-term investor, it’s best to keep things simple. Investing can be extremely easy, and more often than not, the simple methods provide the best results.

There’s no need to get involved with complex investment vehicles or other close-to-insane strategies that you may see on YouTube or wherever.

The easiest way to get great results is to set up a regular, monthly investment plan for a widely diversified (and accumulative) index fund and keep investing for a couple of decades. That’s pretty much it.

By doing this you won’t beat the market, but you will definitely do better than most investors (and fund managers, for that matter).