What is the Magic Formula Investing Strategy

The Magic formula investment strategy is the famous stock-picking method from Joel Greenblatt. He introduced the formula in his book The Little Book That Beats the Market.

Published in 2005, the book has received a lot of attention and is one of the most-read investing books of the past two decades.

What’s interesting is that while the book is famous for the magic formula it provides, it’s also a solid introductory book to investing, and is a must-read for every beginner investor out there.

I’ve also listed the book as one of the Best Finance Books for Young Adults (and for anyone else).

I have to admit that I was more than skeptical about Greenblatt’s formula before I even read the book. For me, the name itself sounded like something straight from daytime TV that I wouldn’t go near in a million years.

Once I actually read the book and realized that the idea of the magic formula is simply to own good companies with a high earnings yield at a cheap price, you can only imagine how quickly I changed my mind.

In essence, the magic formula aims to beat the market by sorting out undervalued companies that are highly profitable.

The magic formula investing strategy is based on the idea that “companies that achieve a high return on capital are likely to have a special advantage of some kind.”

How Does the Magic Formula Investing Work?

As it almost sounds too good to be true, I think we need a closer look at how the formula works.

Now, when it comes to investing, buying profitable companies at a bargain isn’t exactly a novel idea – it’s called value investing.

How value investing works is that you do your research, find a great company that’s a bargain, and then you own it until it stops being a great company or becomes overpriced. It’s that simple.

The problem, of course, is to know which companies are truly great and reasonably priced. Value investing is one of the hardest of all investment strategies to master.

It’s extremely difficult to buy low and sell high, which is why many investors never succeed in the long term.

So, what do we need to do to increase our chances of success?

It’s actually pretty simple. Just remove the timing problem and the analysis process. That’s the magic part of the formula.

The idea is to sort companies by their profitability and pricing, buy the stocks that are the cheapest and most profitable, sell the companies after holding them for a year, and repeat the process.

How Has the Magic Formula Performed?

Okay, so now we know how the magic formula investment strategy works, but has it actually lived up to its name?

A short answer is, yes. It does work.

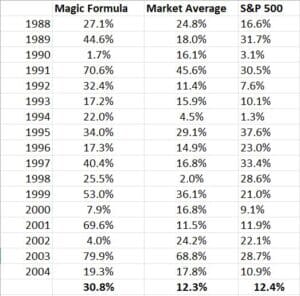

As you can see from this table, the magic formula strategy (according to the book) had an average return of 33% between the years 1988 and 2004 in the U.S.

In other words, it would’ve turned $11,000 into over $1 million. At the same time, the average market return was a little over 12%.

According to Quant-Investing.com, the magic formula managed to outperform the market in Belgium, Luxembourg, and the Netherlands by approximately 7.7% for over 20 years. It also beat the market in Finland.

Step-by-step Magic Formula Investing Guide

Overall, it seems that the magic formula does indeed work! So, how do you apply it?

There are two ways to do that: the easy way, and the hard way. The easiest way to start is to use magicformulainvesting.com to screen the stocks and buy according to the website.

There are plenty of websites dedicated to the magic formula, but www.magicformulainvesting.com was specifically created for the book, so it’s the go-to site at the moment.

The hard way, or the do-it-yourself way is to use any stock screener and do the work yourself.

Here’s a step-by-step guide from the book.

The Simple Way

1) Go to magicformulainvesting.com.

2) Choose the company size. Usually above $50 million or $100 million should be enough.

3) Buy five to seven companies that are ranked at the top, but only invest about 20 to 33% of the money you’re going to invest during your first year.

4) Repeat step 3 every couple of months until you’ve invested all the money you plan on investing. You should end up with around 20 to 30 stocks.

5) Sell each stock after holding it for a year. Use your proceeds to buy new companies to replace your old ones using Greenblatt’s magic formula criteria.

6) Continue the process for at least three to five years.

7) Thank Joel Greenblatt!

The Do-it-Yourself Approach

1) Screen stocks with ROC (return on capital) and set the minimum to 25%.

2) Sort the resulting stocks with the lowest p/e ratios (price/earnings).

3) Eliminate all financial and utility stocks, and, if you’re from the U.S., exclude foreign companies. Also, investigate and possibly eliminate stocks with exceptionally low p/e ratios, since there might be something unusual going on.

4) Follow steps 4 to 7 from the previous list.

If you REALLY want to do things yourself, here’s how you can calculate the necessary numbers:

- Company’s earnings yield = Earnings Before Interest and Taxes (EBIT) divided by the company’s enterprise value.

- Company’s return on capital = EBIT divided by the company’s net fixed assets + working capital.

Conclusions

As we have seen, the magic formula strategy does indeed work around the world.

Buying good companies that produce exceptional profits at bargain prices is a winning strategy if there ever was one.

So, what could possibly go wrong?

As it is with most long-term investing strategies, it’s the long-term part that’s the most difficult. You need to give the magic formula strategy time. Even the very best strategies take time to produce the desired results.

If you utilize the magic formula investment strategy for a year or two, it will most likely fail to deliver.

Another issue is that you need to trust the process and sell your stocks after the one-year holding period. Even if they’re doing great or it feels insane to sell, it’s part of the process.

When you start to time your buys and pick your stocks in a different way, the magic formula will not work. Simple as that.

If, on the other hand, you follow Greenblatt’s formula to the letter year after year, there’s a very real chance you will clearly outperform the market.