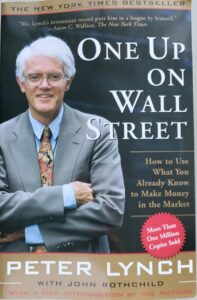

Financial literacy is one of those essential personal finance skills that can make your life infinitely easier if you have it, and a lot harder if you don’t.

Becoming financially literate is somewhat easy, but knowing where to begin is often not.

I remember being somewhat befuddled when I first started reading about investing and finance since I had no idea whether some beginner finance books were worth reading or not.

There are some financial education books that stand the test of time and retain their relevance decade after decade.

During the past 15 years or so I’ve read quite a few books about investing and personal finances. While some of them have been amazing and provided real value, others have turned out to be a complete waste of time.

Here I’ve gathered 5 finance books that I’m sure will help you with your quest to become financially literate and achieve financial independence.

In fact, if you’d only read these five books for the rest of your life, I’m certain you’d do just fine.

I’ve listed the books in the order I would read them if I was just starting out, so let’s start with one of the giants of the financial world, Burton Malkiel.

A Random Walk Down Wall Street by Burton Malkiel

A Random Walk Down Wall Street, written by the famous economist, author, and investor Burton Malkiel, is one of the most-read investing and money management books ever written.

The main lessons in Malkiel’s book are that it’s difficult to beat the market, most of us will fail during the process, and the simpler way is to invest in passive index funds. This way you beat most professional and amateur investors with little effort.

Ironically, investors usually get the best results by doing less. In fact, one of the biggest challenges in index fund investing is to maintain your regular investing and trust the process.

A Random Walk Down Wall Street covers the most common concepts in investing like diversifying, the relationship between risk and reward, the efficiency of the market, and many others.

The way I see it, you can start with zero knowledge, read The Random Walk, and go straight to investing and achieve considerable success in the long term.

A Random Walk Down Wall Street is by far one of the best financial books for beginners there is. It is the kind of book that when you read it, you can invest for the rest of your life without reading any other book about investing and achieve financial success.

The Intelligent Investor by Benjamin Graham

“By far the best book on investing ever written.” – Warren Buffett

While The Random Walk will guide you through the basics and puts you on the path to index fund investing, The Intelligent Investor will introduce you to value investing. Or, to put it more accurately, it is THE book on value investing.

Written by Benjamin Graham, who’s better known as the father of value investing. The book was first published in 1949 and has maintained its position as one of the best finance books for beginners of all time for over 70 years.

If you’re at the beginning of your financial literacy journey, you might want to read A Random Walk Down Wall Street first. It gives you the basic knowledge you need to get the most out of Graham’s book.

The Intelligent Investor is a sort of book that has always something new to offer.

I read the book for the first time when I was about 17 years old and understood extremely little. I was also a lazy reader and didn’t look into concepts I didn’t understand. After reading it again and again as my skills developed, the greatness of the book started to dawn on me.

To this day, I strive for the rationality of Graham and fail on a daily basis. The book is that good and the logic is that sound.

For new investors, it’s probably best to Google everything unfamiliar to you and study the concepts thoroughly. I know it’s a pain, but if you internalize what the book is about, it’s well worth it and will speed up your learning process immensely.

The Intelligent Investor is one of the books greatest finance books ever written, and it has helped countless people in achieving financial independence.

One Up on Wall Street by Peter Lynch

“Investing without research is like playing stud poker and never looking at the cards” -Peter Lynch

Written by Peter Lynch in 1989, One Up on Wall Street is full of wisdom from one of the best fund managers of all time.

The book is written in a conversational style and is extremely down-to-earth, which makes it one of the best finance books for beginners and a pleasure to read. While the book is mostly stock-picking, it’s also a tremendous personal finance book.

One Up on Wall Street goes through the very basics of investing, how to categorize companies, and how to pick stocks that are most likely to succeed in the long term. What’s even better, it does so with practical advice that anyone can follow.

Lynch is a long-term investor at heart. The logic behind long-term investing is sound – if you don’t hold the winners long enough, they don’t have time to achieve compounding returns.

The biggest factors of successful investing, according to Lynch, are knowing what you own, holding the winners for a long time, and basing your investment decision on business fundamentals.

Lynch’s main message is that it is entirely possible to beat professional investors as an amateur. All you need is common sense, curiosity, and elementary math skills.

I believe that the more you are able to resist that “get rich quick” instinct we all have and rely on your common sense, the better off as an investor you are. It’s also one of the main points of Lynch’s book.

One Up on Wall Street is also extremely useful for investors who’ve been in the game for a long time since the basics are often overlooked. The longer you do something, the more important it is to revise the basics regularly.

Economics 101 by Alfred Mill

Economics 101 is a part of the 101 series that covers a wide range of topics like philosophy, psychology, and music theory.

The book is written by Alfred Mill, who’s also the author of Personal Finance 101 and Social Security 101.

For the Record, Personal Finance 101 seems like a book that should also be on this list, but since I don’t own it nor have I read it, I can’t really recommend it.

While the name may be less than tempting, this little book offers you pretty much everything you need to know about economics. And what’s best, you can do it without attending an actual economics 101 class.

Economics 101 teaches you why things happen in your economy the way they do. So, if things like central bank policies, GDP growth, or rising inflation rates are causing you a headache, look no further.

What I especially like about this book is the fact that every sentence in it serves an informational purpose. There’s nothing redundant.

It offers you just the right amount of information without going too deep into a single subject. Economy 101 is one of the best introductory finance books there is.

This is the book I wish I had when I was a beginner.

The Psychology of Money by Morgan Housel

The book is written by Morgan Housel, a former columnist for The Motley Fool and The Wall Street Journal, who nowadays operates as a partner at The Collaborative Fund.

The Psychology of Money is, in my opinion, one of the most useful and insightful books about money ever written. Especially for a long-term investor.

The book reminds us that the most important thing in investing and creating wealth overall is time. Time not only helps your small investments grow exponentially but it can also correct a lot of mistakes like bad timing.

One of the most valuable and helpful money lessons in the book, for me, was the fact that you shouldn’t compare your short-term results as a long-term investor to those who’re playing a different game.

The same stock can be a great investment for a short-term investor and a horrible investment for a long-term investor, and vice versa.

Also, the book reminds us that becoming wealthy and staying wealthy are different skills. To accumulate considerable amounts of wealth requires quite a bit of risk, but maintaining that wealth requires the opposite.

This absolute gem of a finance book is a definite must-read for everyone who is serious about not only building wealth but also maintaining it.

The Simple Path to Wealth by JL Collins

Written by the investor and blogger JL Collins from jlcollinsnh.com, The Simple Path to Wealth offers you pretty much everything you need to be financially successful.

It covers the very basics of how the stock market and investing work, and why your best bet is to invest in index funds instead of picking your own stocks.

The book also makes sense of the confusing jungle of 401 (k)s, 403(b)s, Roth buckets, and the like.

While the book has a certain amount of stuff that’s mostly for people who live in the U.S., I myself found it useful, nevertheless.

Collins has a way of expressing complicated concepts very clearly without any extra fuss. The book is a quick read, but it addresses all essential areas of investing and wealth creation.

Moreso, it does it in a way that’s suitable even if you had no idea about investing or personal finance to begin with.