The 50/40/10 budget rule is a more savings-oriented version of the famous 50/30/20 rule.

As pretty much all different budgeting methods and rules, it’s also based on percentages. The core idea is to take charge of your spending habits and categorize your monthly after-tax income (net income).

If you’re new to personal finance and budgeting, I recommend also checking out my guide on how to create a budget for beginners.

It gives you all the basic information you need to handle your personal finances.

What Is the 50/40/10 Budget Rule

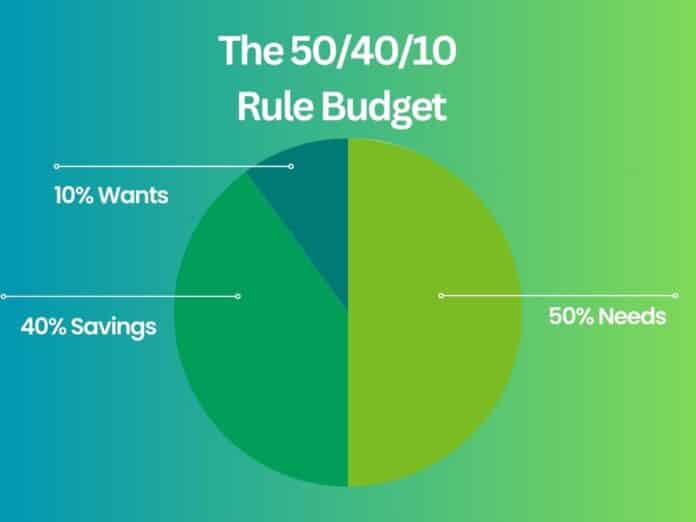

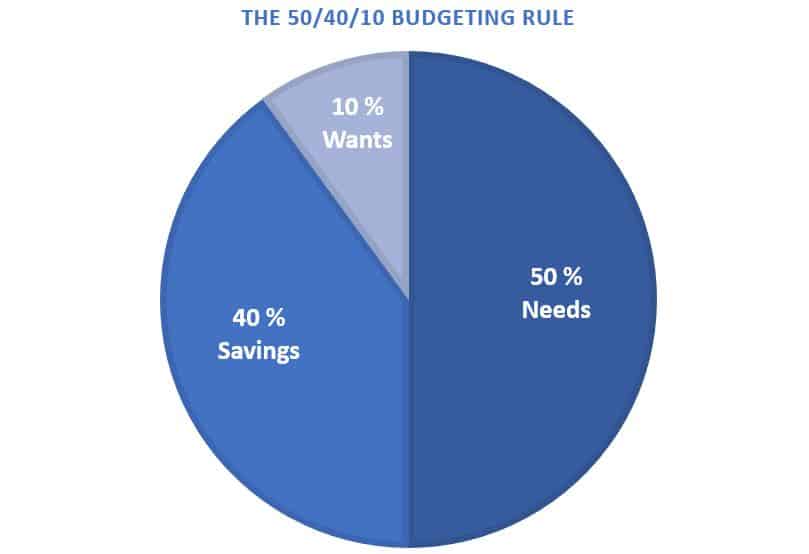

The idea is the same as in the 50/30/20 rule, which is to divide your income into three categories – needs, savings, and wants:

These categories give you an idea of how you should allocate your monthly after-tax income.

In practice, you can start by tracking your expenses from previous months and see how you’re spending money. You can do this by hand or using a budgeting app.

Once you’ve tracked all your expenses, you should categorize them and see how far off they are from the 50/40/10 categorization.

Now, let’s take a closer look at these categories and see what they include.

Needs – 50%

Needs are the things that you absolutely, definitely, most certainly need and will have to pay for. These include:

– Rent/Mortgage

– Mandatory insurances

– Bills

– Groceries

– Medication

– Loans

As you can see, these are the things that you can’t really cut back on without making your life considerably worse. Therefore, whatever budgeting method you may use, you must make sure you can afford all your needs.

Savings – 40%

The savings category covers all you use your saved money for. The most common things include:

– An emergency fund

– A downpayment for a house

– Investments

– Paying off existing debt

– College for kids

– Retirement savings

For most people, building an emergency fund is the first thing they should save money for. Unexpected expenses arise sooner or later, which is why you need to be prepared for them to ensure your financial health.

After that, the order of importance depends on your life situation and financial goals. If your goal is to get wealthy fast, for example, then you might want to invest most of your savings. Then again, if you have no emergency fund and a lot of debt, it’s probably wise to focus on savings and debt repayment.

Wants – 10%

This is the fun category since it contains all the little things that make a life worth living. There’s an endless supply of such non-essential expenses, but here are the most common:

– Hobbies

– Traveling

– Partying

– Shopping

– Dating

– Entertainment

You might be thinking that there are not a lot of nice things you can afford with merely 10% of your monthly income, and you’re completely correct.

When 90% of your salary goes somewhere else, you don’t really get to enjoy the finer things in life while you’re saving that much.

It’s due to the strictness of the 50/40/10 rule that makes it unsuitable for some people.

For Whom is the 50/40/10 Rule Suitable For?

As you can see, it’s a pretty strict budgeting rule and requires a relatively high income. A 40% savings rate is no joke.

Considering that the average savings rate in Europe is around 13% and about 8.5% in the U.S., it’s not likely that most people can pull it off.

I’m quite sure that for most people, spending only 50% of your salary on your needs is not realistic, which is why you shouldn’t be disappointed if your needs exceed 50 percent of your monthly budget.

Then again, there are people who may find this budgeting method suitable.

The 50/40/10 budgeting method may suit you if you have:

– A relatively high income

– Low expense level

– Experience in budgeting

– A major savings goal that requires a large amount of money

Does the 50/40/10 Rule Really Work?

This one is somewhat of a no-brainer since if you’re able to save around 40% of your income with any sort of budgeting method, it definitely works.

The are a couple of things to consider, though.

First, if you don’t have an exceptionally high income, a 40% savings rate will most likely require a frugal lifestyle. In the long term, some may find this easier than others. Therefore, before you apply this method for longer periods of time, you should prepare for quite a modest lifestyle.

Second, it’s extremely important to put your savings to work. Every once in a while, I come across elderly folk who’ve lived extremely frugally for decades only to have their money in their savings account with little to no interest.

It’s almost unbearable to think about how much inflation has eroded those savings during three or four decades. Therefore, to maintain the real value of your money, you should invest it in something (like stocks, for example) that works as an inflation hedge.

Third, remember to live. If you’re able to pull the 50/40/10 method off, you’re most likely financially stable. These types of strict budgeting methods can take all the fun out of your life, so don’t be too hard on yourself. ¨

You can occasionally spend more on your wants than a mere 10%, and that’s okay. It’s the big picture that matters.