Taking charge of your financial future isn’t necessarily an easy task.

Not only do you need to figure out your financial goals and learn budgeting, but you also need debt management skills, an investment strategy, and a retirement plan.

While you can pay for financial planning services, it’s always recommendable that you learn how to do it yourself.

So, let’s have a look at the critical components that you need to know to form a solid financial plan.

The first three key components of financial planning have one thing in common: They give you a clear idea about your current financial situation.

They’re also things that you can do immediately.

Setting Financial Goals

If I were to name one of the most important things you can do for your financial well-being, it’s proper planning.

When you have a clear plan, you know exactly where you’re headed and what you need to do to get there.

Usually, your financial goals are divided into three different categories.

Short-term goals. These are the things you can start to work on immediately, and that are achievable during the next 5 years. Your short-term goals can include things like:

- Paying off credit card debt

- Building an emergency fund

- Saving for something specific you want or need.

Medium-term goals. Your medium-term goals are things that usually take around 5 to 10 years to achieve, such as:

- Paying off student loans

- Saving a down payment for a home

- Creating a passive income stream

Long-term goals. Long-term goals are the ones that can the rest of your life to achieve. Usually, they take a minimum of 10 to 15 years, and can include things like:

- Paying off your mortgage

- Saving for retirement

- Becoming financially independent

Your financial goals and their time frames largely depend on your current income level and financial situation.

It’s also important to adjust your goals according to your situation and make them as specific as possible.

For example, if your goal is to have 1 million dollars saved when you retire, you’re going to need a lot more detailed plan than just having a certain amount of money at some point.

Also, there’s nothing wrong with being ambitious with your personal financial plan.

If you want to achieve big things, you gotta have a big mindset!

Come Up With a Net Worth Statement

To know what your current financial situation really is, you need to come up with your net worth statement.

You can calculate your net worth by listing all your assets and subtracting all your liabilities from them.

Assets are things you own. The most common assets include:

- Investments

- Cash

- A home

- Real Estate

Liabilities, on the other hand, are something you owe:

- Credit card debt

- A mortgage

- Car loans

- Unpaid bills

Having a positive net worth is always a great thing, but more often than not, your net worth can be negative.

Especially if you’re young, have a lot of debt, and haven’t had the time to accumulate wealth and assets.

Cash Flow Management

The point of knowing what kind of cash flows you have is that you know whether your cash flows are positive or whether you’re hemorrhaging money everywhere.

Figuring out your cash flows is extremely simple.

All you need to do is first calculate how much your income is per month. If you have a regular monthly income, you don’t really need to calculate anything.

If, on the other hand, your income varies monthly, just take your yearly income and divide it by 12 to get your average monthly income.

You can do the same with all other types of income you may have. These usually include things like interest, dividends, rent income, etc.

After you know how money is flowing in, it’s time to figure out what’s flowing out. Tracking your expenses is an essential part of budgeting, which we take a look at next.

Create a Budget

Successful budgeting is the cornerstone of your financial success and the first step toward financial security.

A budget is simply an estimation of your net income and expenses, usually calculated on a monthly basis.

Furthermore, you can plan your budget and decide how much money you aim to spend on different things.

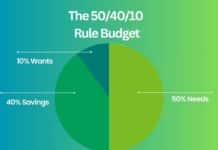

Your personal budget type depends on your current financial situation and your goals. It can be an extremely simple budget model like the 50/30/20 model or something entirely different.

The main idea is that you should strive for a budget surplus – having your income exceed your expenses. No matter how high your income is, if your expenses exceed just a little, you’ll eventually be in financial trouble.

Creating a budget has many perks. It gives you peace of mind, can help you get through emergencies, prevents you from spending too much, and gives you control over your finances.

If you’re new to budgeting, you can check out my beginner’s guide to budgeting, that’ll get you going in no time!

Build an Emergency Fund

No matter what kind of financial planning process you have, saving has to be a part of it.

If you’re not able to save money, it’s practically impossible to prepare for your future. Once you’ve come up with a budgeting model that works, you should be able to save a portion of your monthly income.

The first thing to do with your savings is to create an emergency fund.

An emergency fund is basically money you keep in your savings account in case of emergencies. The idea is that you don’t need to resort to high-interest loans like credit card debt to pay for surprising expenses.

The size of your emergency fund depends on your lifestyle and financial situation.

Usually, a sum that covers 3 to 6 months of living expenses is enough. Around six months is usually enough to pay for most accidents, get a new job if you happen to lose one or support your lifestyle if you wish to take an unpaid leave for a couple of months.

Having an emergency fund ensures you don’t get into debt trouble because of unexpected expenses.

Debt Management Plan

Speaking of debt, it’s hard to create any sort of financial plan if you’re heavily in debt.

Having too much debt increases your risk of getting into financial trouble because no matter what, debts have to be paid.

In fact, one of the first and most important things a professional financial planner does is come up with a plan to reduce debt, if it has become a problem.

Moreover, since interest rates aren’t in your control, you might run into serious trouble when interest rates rise rapidly.

When you create your financial plan, it’s best to separate good debt from bad debt. Good debt, like a mortgage or a student loan, is something you can use to increase your net worth.

Bad debt, on the other hand, is something that is usually a high-interest debt that is used to purchase goods that don’t bring you wealth.

Paying off bad debt first is often the best way to manage your debt so that you don’t overburden yourself with expensive loans.

Also, it’s worth remembering that it’s a lot easier to prevent getting into too much debt than to deal with it. The best way to do this is to manage your budget carefully and live within your means.

Investments

If you think about it, the first part of personal financial planning is ensuring you have a balanced budget and some money left over.

The rest is all about what to do with that money, and that is to come up with an investment strategy to start investing.

You can’t really have a comprehensive financial plan without also planning your investments.

While there are countless reasons why you should invest, these are the three most important ones.

Firstly, by investing you can beat inflation. When you earn a return higher than the average inflation rate, you can prevent inflation from eroding your savings.

The second reason is that investing is the most convenient way of creating passive income streams like dividends, interest payments, or rent.

The last and biggest reason is compounding returns. Investing allows your profits to accumulate more profits, which is called compounding.

If you’re new to investing, I’ve collected the best investing books of all time to get you started!

Insurance Coverage

No matter where you live, it’s smart to have the very basic types of insurance.

These usually include health, life, home, and disability insurance. The rule of thumb is that if there are people who depend on you, the more comprehensive insurance you should have.

What you want to achieve is to make sure you’re covered if you happen to get into an accident, lose your job, or if your house burns downs. These things do happen, so it’s extremely risky if you don’t prepare for them.

It’s also advisable that you should have life insurance if you have a family or a significant other with whom you share your finances with.

Retirement Planning

One of the things people would universally like to have is a comfortable retirement.

The key to creating a successful retirement plan is to start before you’re nearing retirement.

Planning for your retirement is basically dealing with uncertainties.

Because you have no idea what condition you’ll be in when you’re older, it’s best to prepare as early on and as well as you can.

The most important thing is to have a retirement savings plan and try to be debt free when you retire.

While there are numerous different ways how you can prepare for retirement, they should include some form of investing to ensure inflation doesn’t erode your savings.

Another role of thumb is that the more passive income you have when you get older, the better.

As mentioned in the financial goals chapter, saving for your retirement should be one of your long-term, lifelong goals.

Estate Plan

All the key components so far have been about decisions and plans you make for your lifetime.

Unfortunately, none of us is here forever, and there’s a very real chance that you’re not able to take care of your financial needs as you get older.

The first thing you want to do is to write down a will where you specify your wishes concerning your assets. That way you have some control over your finances even when you’re not there anymore.

Another important thing is to come up with a power of attorney to appoint someone to make financial and health decisions for you.

If you have a lot of assets and things start to get complicated, it’s often best to consult financial planning services to make sure you get everything right.