When you begin to take control of your financial future and personal finances, it may feel like a daunting task with all the information available.

The tricky part is that there’s no simple solution to handling your finances. Everyone’s situation is different, and what works for me may not work for you.

After browsing through endless websites and reading countless books about personal finance and investing, I decided I could simplify all that information into 5 simple steps.

When it comes to creating a financial plan, it’s best to stick with the basics and make it as simple as possible. Especially in the beginning.

Here are the 5 steps for financial planning that are guaranteed to improve your financial status, help you form a comprehensive financial plan, and make your life a lot easier.

Know Where You Are

No matter the situation, before you decide what direction to go, you need to know where you are.

The first thing to do is to come up with your personal finance statement, where you go through all your assets and liabilities.

In other words, write down everything you have, everything you owe, all the expenses you have, and all the income you receive. This will give you a clear picture of your current financial situation and expose your financial weak points.

The key thing here is honesty! There’s no point in writing down anything if you’re not honest with yourself. It can be extremely painful, but the truth is that the more painful it is, the more necessary it is.

Once you’re thoroughly familiar with your current financial circumstances, it’s time to decide where you want to be.

Form Your Financial Goals

Your goals are the thing that guides your behaviour. There’s really not much point in knowing your situation but not knowing where you’re headed.

Sometimes we are financially right where we’re supposed to be, but most of the time our situation is something less than ideal.

Depending on your financial goals, you may need to do only small adjustments or take massive action.

The best way to start is to divide your goals into long-term and short-term goals.

Short-term goals can be things that you want to accomplish in the next year or so. These are things like building an emergency fund and cutting down your immediate expenses.

Long-term goals, on the other hand, may include things like saving for retirement and building an investment portfolio. These goals can have a period of 5 years up to 50 years.

The main idea is to know what goals are achievable in the short term and what requires more time. If you plan on achieving financial independence in a year or two, you’ll probably be disappointed.

A clearly defined timeframe helps you to avoid disappointments and keeps you committed to your goals.

Come Up with Suitable Strategies

All right, so now you should know where you are and where you want to be. It’s all smooth sailing from here.

The action you should take now depends on your current situation and goals.

Here I’ve gathered the three most likely scenarios people are usually in, and what to do in each situation.

No Budget Surplus

The first part of any financial plan is to make sure you have something to strategize with. If you’re running a budget deficit and are bleeding money in every direction, there’s not much room for creating a savings or an investment plan.

So, the first step here would be to review the personal financial statement you did in the beginning and see what expenses you can cut to turn your cash flow positive.

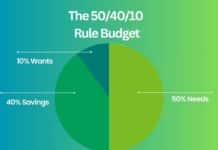

In most cases, you can use the 50/30/20 rule as a basis. This means that 50% of your net income should go toward your essential needs, 30% to your less-essential wants, and 20% to your savings.

To create a budget surplus, you’ll most likely have to cut your wants-related expenses. In other words, consume fewer goods you don’t really need.

On the other hand, if your essentials like debt payments and must-pay bills require more than 50% of your income, you may need to take more drastic measures. These may include things like moving to a cheaper apartment or downgrading your car to a more affordable one.

If you’re accustomed to a certain standard of living, this step can be quite painful.

It’s also worth remembering that if you’re struggling with your finances, you can always consult a financial planner.

A Budget Surplus but No Savings

This is, in my experience, the most common problem of these three. Usually, when people have a stable job, earn a decent wage and live a normal lifestyle, they have some money left over.

The problem is that the extra money doesn’t go into savings, it goes into consumption.

Saving is the kind of habit that once it becomes natural, it’s almost impossible for you to spend your money on something useless. Your financial goals will start to affect your spending habits.

When it comes to saving, why is often more important than how. We do know how to save, but we often don’t have a strong enough reason to.

The trick is to find reasons that resonate with you. For me, the reasons are freedom, peace of mind, and independence. That is, freedom to do as I please, peace of mind from having to constantly worry about my finances, and independence from employers as well as other people.

Once you have your why, your how becomes a lot easier.

Savings but No Investments

I believe the number one reason why people have savings, but no investments are indifference and fear which are caused by a lack of knowledge.

While you can retire early with your savings without investing in anything, it’s an extremely hard path to take. It would require a high salary and a frugal lifestyle, and it still wouldn’t deliver you even adequate results.

If you keep all your savings in your savings account, inflation will slowly erode your savings. This is why you need to invest in something that beats inflation.

The way I see it, all long-term financial goals pretty much require investing your money into something that produces profits.

Luckily, becoming an investor is not as hard as it may at first seem. I won’t get into it too much in this article, since most of the content I’ve created is about investing.

Suffice it to say that you should start investing by defining your risk profile. After you know how much risk you can take, it’s wise to mirror your risk tolerance to your investment goals. For example, if you wish to be financially independent through investing, but you don’t want to take any risk, your goal is not realistic.

The idea is to balance your financial goals with your risk profile. Once you’ve done that, it gives you a realistic picture of what you can expect out of your finances. Then you can proceed to learn more about investing and make your first investments.

And, as always, if you need additional investment advice, it’s always worthwhile to consult a financial advisor.

Track & Review

No matter what situation you’re in, the key to financial security is tracking.

By tracking, I mean keeping a score of your income, expenses, investments, and savings.

It’s important to keep track of your behaviour because our minds tend to play tricks on us, and our perceptions don’t often reflect reality.

For example, we might think we’re living extremely frugally, but in reality, there might actually be a lot of unnecessary expenses we just don’t notice anymore.

If you’re just beginning to take responsibility for your personal finances and have started saving, it’s best to track every expense on a daily basis.

You can do this by hand or use a budgeting application to help you out!

After you’ve tracked your financial behaviour for a while and have cut down needless expenses, you might want to review your budget every now and then. Sometimes we start to slowly slip back to our old ways without even noticing it, which is why reviewing is as important as tracking.

Adjust

The final part of your financial planning process is to adapt to changing circumstances.

Sometimes it’s due to changes in your life situation, and sometimes it’s because your initial strategies might’ve not worked as well as you had hoped.

Whatever the reason, it’s important to be adaptive and have the ability to adjust when necessary.

For example, it’s pretty certain you’re able to save more when you’re single compared to a phase where you have a family, mortgage and a ton of other mandatory expenses.

When there are major changes in your life, it’s best to review your personal finance strategy and adjust accordingly. No one expects you to make a plan and stick to it unyieldingly for the rest of your life. It’s just not how it works in real life.

The important thing is to adjust while sticking to your principles. If you can’t save 20% or 10%, save 5%. Sometimes your obligatory expenses consume your whole budget, and that’s okay too if you’re back on track after that.

Summary

To summarize, all you need to do in your financial planning process is the following:

– Know where you are

– Decide where you want to be

– Choose the right strategy to get there

– Track and review your progress

– Adjust your goals and strategies when necessary

The beautiful part is that this same pattern applies to every part of life. We make plans, think about ways to get there, and adjust our behaviour according to the results we get.

Of course, it’s a deceptively simple pattern and a lot easier said than done. There are countless variables that you need to take into account, and mistakes are inevitable. This is why financial planning is an ongoing process.

The important thing is to keep going until you achieve your financial goals. It may take a long time, but it will be worth it in the end!