Long-term stock investing is a beast of a topic to tackle. There are as many different investment strategies as there are investors.

Back when I started investing in stocks for the long term, I hoped for a clear guide that would help me understand the basics.

Therefore, I decided to write a little introductory guide to long-term stock investing that will introduce you to the very basic concepts you need to know!

What Is Long-Term Investing

The idea of long-term investing is to gain real and compounding returns by holding investments for longer periods of time.

It’s about buying assets and holding them for long-term profits, not buying assets with the intent to sell them for a quick profit.

A long-term investor ignores short-term market volatility and focuses on steady long-term gains. In other words, it’s a somewhat passive approach to investing.

Of course, choosing what to invest in requires quite a bit of effort, but managing long-term investments is a rather passive activity.

How Many Years Is Considered a Long-Term Investment

While we all have a certain idea of what a long period of time is, coming up with an accurate definition has proven to be quite hard.

Financial advisors and other professionals usually view long-term investments as investments that are held for more than five years, preferably ten. That’s as good a definition as any.

I’d say that there are a couple of things that define a long-term investment.

First, the investment has to have enough time to even out short-term volatility. Second, it has to be held long enough to achieve compounding. And third, if you invest in individual companies, they need to be given sufficient time to grow their business.

Usually, it takes around 5 to 10 years to get started on all three. Therefore, a long-term investment should have a time horizon of around 10 years, preferably more.

Different Types of Long-Term Investments

Stocks. As you might’ve guessed, stocks are one of the most popular long-term investments. These include stock investments such as mutual funds, ETFs (Exchange Traded Funds), index funds, and different types of individual stocks.

Bonds. Alongside stocks, bonds and other fixed-income assets are the go-to long-term investments for many individual investors and most institutional investors. Bonds such as government, municipal, and corporate bonds are especially useful for investors who want to have fixed income as well as to protect their capital.

Real Estate and REITs. Investing in real estate is the third most common long-term investment alongside stocks and bonds. It can serve as a great way to reduce the volatility of your portfolio.

Nowadays, you can also invest in real estate through REITs (Real Estate Investment Trusts). REITs are publicly traded companies that own real estate and have generous dividend policies. As a long-term investment, REITs have offered a serious contestant for stocks.

Alternative assets. Alternative assets, such as private equity, cryptocurrencies, precious metals, and other commodities are also used for long-term investments by many investors. The problem with these types of assets is that they’re highly risky, somewhat complex, and lack regulation.

What Are the Best Long-Term Investments

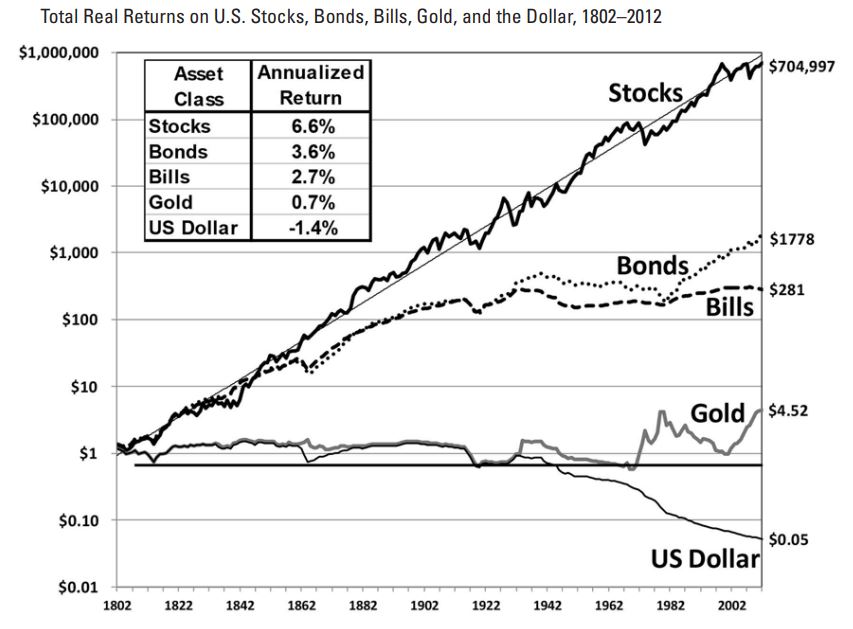

As you can see, there are a lot of different asset classes that can be considered for long-term investments. But what does the data say about the best long-term investments?

A great long-term investment has to offer a return that’s above the average inflation rate, and stocks have offered just that:

Long-term investors usually battle over whether you should invest in stocks or bonds. According to the data, stocks have proven to be the superior investment in the long term. Also, as we’ll learn later on, they do it with a lower relative risk level than bonds.

It’s worth noting, though, that REITs have offered even better returns in the past 50 years, so real estate investments also have their place in a long-term investment portfolio.

Gold, on the other hand, somewhat lives up to its reputation as an inflation hedge but is questionable as a profitable long-term investment.

When looking at different performance charts, it’s important to remember that past performance is not a guarantee of future results. The future can never be accurately predicted, but I do believe that over 200 years of consistent operating history does give you some idea of what to expect.

Does Long-Term Stock Investing Really Work?

I can say without hesitation that yes, long-term investing really does work.

When we look at the historical returns on different asset classes, it’s evident that stock investing is on the top of all long-term investment strategies.

If you think about all the events that have happened in the past 200 years, the record for stocks is truly impressive.

There have been countless stock market bubbles, different crises, and even a couple of World Wars, but stocks have prevailed in the long run.

But why do stocks do so well, exactly?

The main reason why stocks go up in the long run is that the economy and the businesses that operate in it, tend to grow over time.

Think about Apple, for example. Back in 2002, Apple was worth about $5.16 billion. In 2010, it was already worth $297.09 billion. One might’ve thought at the time, that the company couldn’t possibly grow any more. Well, it’s worth around $2,700 billion today.

For comparison, back in 1901, the biggest company in the world was the United States Steel Corporation, valued at around $1.4 billion (or $49.2 billion today).

The point is that the economy and businesses can grow much faster and much larger than one could possibly imagine. As a long-term investor, you’re basically the owner of the companies you invest in, which means that your invested capital will grow alongside them.

Compounding in Long-Term Investments

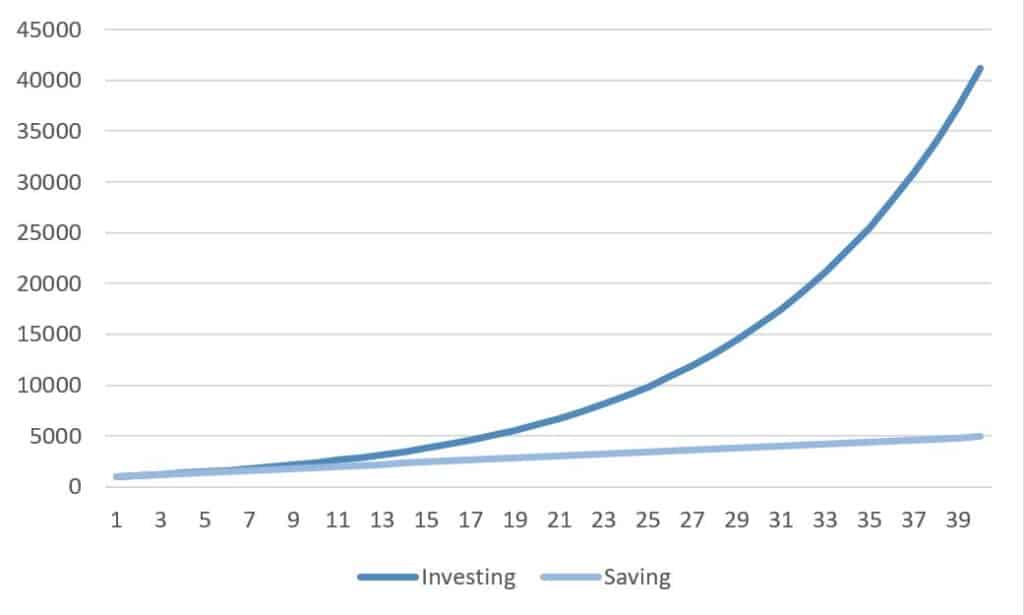

A major part of why long-term investing is so effective is compounding. But what exactly is compounding, and how does it work?

To put it simply, compound interest is the interest you earn on interest. In investing, it’s the phenomenon that happens when you reinvest your earnings, and they start to generate additional earnings.

The thing in compounding that can confound some people is that compounding is by nature exponential, not linear.

Imagine you’d invest $1,000 for 40 years with an annual return rate of 10%. After 40 years, you’d have accumulated over $41,000.

Then again, if you’d put that $1,000 into a savings account and saved an additional $100 (10%) each year for 40 years, you’d have only $4,900.

The difference between the two is that the former has compounding returns, and the latter doesn’t. Here’s how it looks graphically:

It’s a bit of a crude example, I know, but it does illustrate the great effect of compounding you get by investing.

Also, we can learn from this picture that for compounding to work, it’s essential to stay invested.

If you’d had to sell all your investments say, after 10 or 20 years, the effect of compounding would be greatly reduced. Therefore, a long-term investor should take great care in staying invested at all times. The best way to ensure you’re not forced out of the market is to avoid taking needless risks.

How Risky is Long-Term Investing?

As with all other investments, long-term investing involves risks.

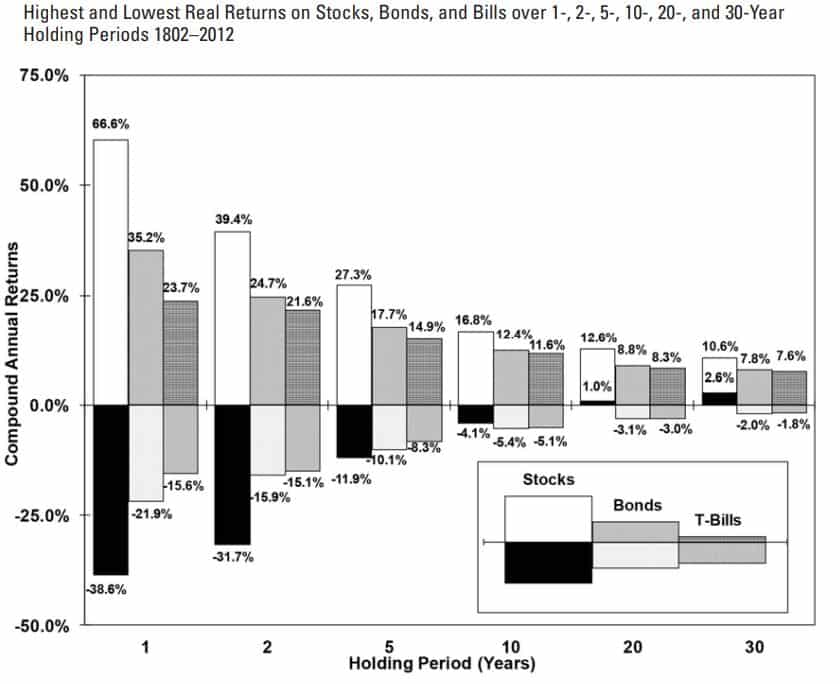

Whenever people talk about the riskiness of long-term stock investing, I like to use this graph from Jeremy Siegel’s outstanding book, Stocks for The Long Run. It shows the highest and lowest real returns on stocks, bonds, and bills over different time periods:

As we can learn from the graph, stocks are indeed quite risky when owned for less than five years. Around 10 years, though, something strange happens.

Stocks become less risky than bonds. When we think about long-term investing, we think about holding periods of 10 years or more. This means that being a long-term investor is significantly less risky than people might think.

The study in question was made on a broad-based capitalization-weighted index of U.S. stocks, so it’s worth remembering that results can be quite different for individual stocks.

There are a lot of companies that have done well for decades, but there are even more that haven’t. Therefore, if you invest in individual stocks you need to keep an eye on the companies you own.

It’s also worth remembering that there are great differences in risk between different stocks. It’s a lot riskier, for example, to have a portfolio full of aggressive growth stocks than a cautious portfolio of stable dividend stocks.

Fortunately, depending on your asset allocation, long-term investing is exactly as risky as you make it to be. If you diversify widely, avoid excess leverage, and keep the long shots to a minimum, you’ll most likely do just fine in the long run.

The Main Benefits of Long-Term Investing

We’ve already addressed a few benefits of long-term investing, but let’s take a closer look at the most important ones.

A higher probability for compounding returns. As we learned in the compounding chapter, the longer you stay invested, the more compounding you will theoretically get. Therefore, long-term investing is the best way to achieve compounding returns.

Fewer fees and expenses. Because long-term investors make fewer transactions, they also pay fewer fees and overall expenses. Especially for ETF and passive index fund investors, the overall expense level can be extremely low. Compared to active traders who have to pay a lot of transaction fees and taxes, long-term investing is a considerably low-expense way to invest.

Less risk in the long term. A long-term investment strategy is a lot less risky than day trading, for example, and therefore requires a lower risk tolerance. Because the market and businesses tend to grow over time, the odds are on your side.

Even if you invest in individual stocks and happen to make a bad investment, you’ll have plenty of time to either sell it or wait for the possible turnaround. The beauty of long-term investing is that you get a lot of opportunities to correct your mistakes.

Tax benefits. Depending on where you live, long-term investing can be an extremely tax-efficient form of investing. Almost universally, long-term investments are taxed less heavily than short-term returns.

A sustainable way of investing. The greatest benefit of long-term investing is that it’s sustainable for a lifetime. Unlike day trading, your chances of getting positive returns increase the longer you stay invested.

What it means is that you don’t constantly have to fight an uphill battle of making profitable trades. Most of the time you’re doing nothing, which also means you don’t need to work full-time to achieve success as a long-term investor.

How Do You Learn to Invest

There are tons of different ways to learn about stocks and investing. The best way, in my opinion, is to read books.

Investing is a sport where knowledge really does pay off, and I believe that reading is the best way to get comprehensive knowledge about a subject.

I think the best way to start is to read some very basic books for beginners without anything too fancy. After you’ve learned the basics, you can advance to more complex theories and strategies, if you so wish.

Mind you, you’ll do just fine (and possibly even better) with the very basic strategies like the buy-and-hold strategy.

If you’re not a reader, there are, of course, tons of YouTube videos and different websites you can choose from. I would advise starting with extremely reliable ones like Investopedia.com and Nerdwallet.com and venture forth from there.

While it’s best to learn in practice, it’s also crucial to acquire as much theoretical knowledge as possible to avoid making serious mistakes.

What’s funny about investing is that it’s mostly a psychological challenge. You can read a thousand books about why you shouldn’t do something, and yet you may end up doing just that.

Sometimes making poor choices is the best way to educate yourself and gain experience, which is why a hands-on approach is also mandatory.

How to Start Investing in The Long Term

For beginners, it’s best to start by investing monthly in a widely diversified ETF or a passive index fund. This way you can make sure you achieve the average market return rate in the long run.

Individual stocks are an equally good option for long-term investing, but picking the right stocks isn’t easy. It takes some time to learn how to analyze stocks and, to be honest, most investors don’t do that well when it comes to stock-picking.

Therefore, the safest way to start investing in the long term is to set up a regular investing plan on a widely diversified portfolio of index funds.

Regular index investing offers you a simple way to diversify your investments not only across industries and markets but also across time through dollar-cost averaging.

The best part of investing is that there are no rules. You can invest passively AND actively if you so wish. That way you can ensure you get the average market return and still maintain the possibility of above-average returns through individual stocks.

It’s worth remembering, of course, that individual stocks can also offer below-average returns, depending on your stocks.

When Should You Start Investing

When it comes to long-term investing, the sooner you start, the better. As we found out in the chapter about compounding, it’s crucial to start as soon as possible to get compounding going.

One of the most asked questions about investing is whether it’s a good time to invest or not. The truth is that the stock market can’t be predicted, which makes timing the market extremely difficult.

Knowing whether it’s a good time to invest or not is practically impossible to say for sure.

If you invest in individual stocks, the right time depends on firm-specific factors. Then again, if you’re a passive long-term investor, it’s practically always the right time.

Even if you happen to invest in an unfortunate time, you will eventually bounce back if you stick to your regular, long-term investment plan.

Therefore, it’s better to start investing as soon as you’re financially capable instead of waiting for the exact right moment.

The bottom line is that when you invest for decades, it doesn’t matter all that much how the market is doing when you start. Time will eventually correct your possible timing mistakes.

Why Can Long-Term Investing Be Difficult

While it can be difficult to come up with an investment strategy that suits you the best, it’s not the hardest part of long-term investing.

The really difficult part is to stick with your investment strategy through thick and thin.

Achieving success in long-term investing requires an extraordinary amount of rationality and emotional control. The stock market is, above all, an uncertain place. And the human mind doesn’t deal very well with uncertainty.

Sticking to your investment plan through bull and bear markets can be an excruciating task. You may be 100 percent correct and successful with your investment strategy, and yet it can take years for the stock market to prove it.

Another thing is that it can take a long time for compounding to work and profits to run. The human mind doesn’t do very well with waiting either.

Impatience often leads to chasing short-term wins at the expense of your long-term success.

That is why I so often say that investing has more to do with psychology than numbers.

Tips for Successful Long-Term Investing

Here I’ve gathered some of the most important tips that will surely help you succeed in the long term.

Have patience and maintain a long-term perspective. One of the key challenges of long-term investing is to maintain your long-term mindset, trust the process, and resist the urge for quick short-term wins. In the end, it’s not the high returns that make the difference, it’s time.

Don’t lose money. In the long run, you’ll do better than most investors simply by avoiding the biggest losses. It took me a long time to realize that chasing the big future winners, such as extremely expensive growth companies, can quickly turn against you. The best way to avoid losses and to succeed in the long term is to have a widely and efficiently diversified portfolio.

Avoid comparing your portfolio. Comparing your portfolio to others is rarely a good idea. It will often make you either envious of others or overconfident in your own abilities, neither of which is good.

If you do, however, compare your portfolio, make sure that the other party has the same investing strategy that you do. There’s no point in comparing a long-term portfolio to a short-term one.

Have a secure financial status. To be able to succeed in the long term, you need to make sure you don’t have to sell your holdings to pay for surprising expenses. Long-term investing only works if you stay invested. Therefore, it’s best to make sure your personal finances are in order at all times.

Know what you own. Investing in something you don’t understand is extremely risky and, well, insane. To become a successful long-term investor, you need to understand what you are investing in. Especially if you invest in individual stocks. Knowing what to expect from your investments and how they act will essentially lower your risk level and increase your chance of succeeding.