As a dedicated long-term investor, I’ve never dabbled with day trading. Or any other form of trading for that matter.

Why haven’t I?

Well, I like to invest in things I at least somewhat understand, and for me, fundamentals are more understandable than short-term price movements.

Then again, there are A LOT of traders around these days, and some of them seem to be doing quite well.

If there’s one thing an investor should have it’s an open mind.

So, let’s take a closer look at these strategies, and see whether one is really better than the other!

What Is Long-Term Investing

The idea of long-term investing is that you hold the companies you invest in for a long time to let the company grow and the profits run.

As I mentioned in my post about the 4 main benefits of long-term investing, defining how long the long term actually is, is a bit difficult.

Financial advisors and other professionals usually view long-term investments as investments that are held for more than one year.

More often than not, though, the long term can be decades. Even your whole lifetime.

The idea of long-term investing is to use fundamental analysis to buy successful companies and let them grow, which reflects in stock prices.

While long-term investors usually hold their investments for a long time, there are a couple of reasons why it might be wise to sell a stock.

If you don’t want to analyze companies, you can just invest in passive index funds or mutual funds and skip the analyzing part altogether.

What Is Day Trading

Day trading is a form of trading where transactions happen within a single trading day.

Transactions are based on technical analysis – you know, the strange-looking charts and patterns that tell you whether the stock prices will go up or down in the future.

Fundamental analysis, on the other hand, is pretty much useless for a day trader because the fundamentals rarely change during a single day.

Usually, day traders look for stocks that have high volatility which gives the trader more opportunities to sell high and buy low.

A day trader makes A LOT of trades. If they happen to be successful, the returns can be substantial. Of course, the same goes for possible losses.

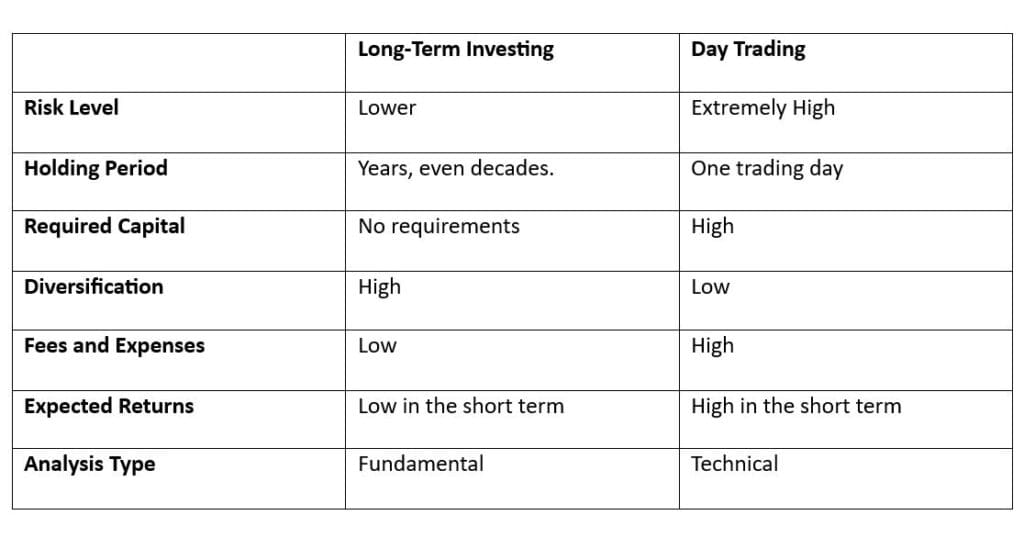

Long-Term Investing vs. Day Trading

The main difference between trading and investing is that when you invest, you literally invest your money in the company you own. The idea is to see the promising company grow fundamentally and reap the rewards.

Trading, on the other hand, focuses on buying and selling stocks at a rapid phase. The focus is on stock price movements, not on the fundamentals.

Let’s make the comparison between the two using two example investors.

The first one is a long-term investor who invests in passive index funds. The second one is a day trader who trades individual stocks.

The long-term investor can start investing in funds with a regular monthly-based plan with minimal capital and skill. He doesn’t really need to care about timing or analyzing because he can get by with a couple of well-diversified index funds and spend the rest of his life investing.

The returns aren’t stunning in the short term, but eventually, when compounding starts to kick in, he starts to make a noticeable profit.

He also pays the minimum amount of fees and has a diversified portfolio. Because short-term volatility doesn’t really matter to him, he doesn’t follow the stock market closely, which gives him time to focus on other things.

The day trader, on the other hand, needs considerable starting capital and a lot of skill. The learning curve is steep.

He doesn’t diversify at all, merely buys the most promising volatile stocks, and (hopefully) makes a quick profit on short-term fluctuations.

The short-term returns are spectacular, but there are no guarantees about how long he’s going to be successful.

Because the trader makes a lot of short-term trades, he pays heavy transaction fees and most likely has a lot of tax implications due to short-term gains.

He also needs to constantly follow the stock market and work long hours to become successful.

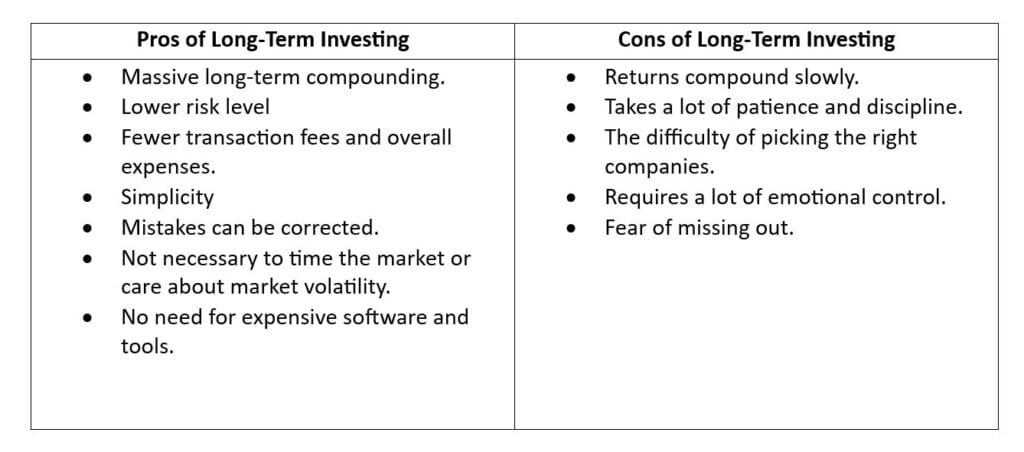

Pros and Cons of Long-Term Investing

Pros of Long-Term Investing

If done correctly, long-term investing offers massive compounding returns in the long haul with a relatively low risk level.

The transaction fees and expenses are minimal due to few transactions, and you don’t need to buy expensive software to succeed.

It’s a simple and understandable approach to investing. If you happen to make a bad investment, there’s plenty of time to either sell your holdings or wait for it to turn around.

If you invest regularly in index funds, for example, you don’t need to worry about timing or short-term stock market movements.

Cons of Long-Term Investing

Because long-term investing is designed to last decades, it takes time for the returns to start compounding. This can be too much for some investors, and it’s certainly not for those who’re looking for a quick profit.

It takes a lot of patience and discipline to follow your long-term investment plan.

If you invest in individual stocks, you need to pick the right stocks for long-term investing to make sense. Investing in a poor company for decades doesn’t do any good for anyone.

It can also be mentally taxing to watch day traders and other short-term investors make a quick profit by trending stocks.

Long-term investors will inevitably miss out on most hot stocks, which can be unbelievably frustrating.

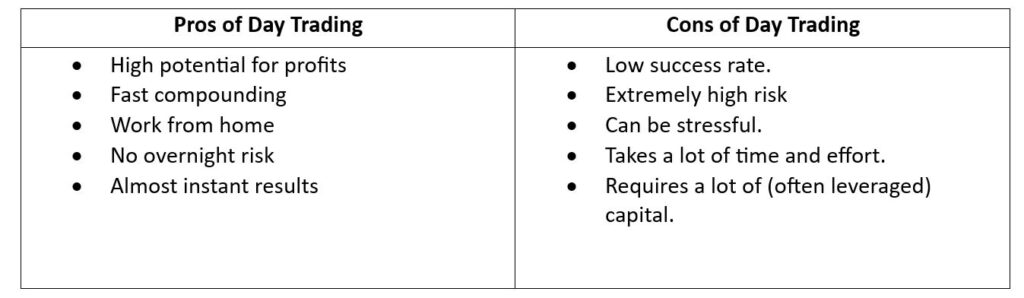

Pros and Cons of Day Trading

Pros of Day Trading

While day trading is probably the most challenging investing strategy there is, it does have some serious benefits.

In the short term, there’s not a single strategy that can offer you faster returns than day trading. You can literally make a profit in a matter of minutes.

If you manage to make trading your day job, it does allow you to work as you please during market hours.

Also, you don’t really have to worry about your investments when you’re not working since a day trader doesn’t hold his positions after the stock market has closed.

I think it’s also worth mentioning that a day trader can get compounding returns extremely fast if he constantly manages to make great trades.

Cons of Day Trading

Okay, so the benefits of successful day trading are substantial.

It does, however, require being a successful trader. The biggest con in day trading is the fact that the success rate is extremely low.

Most people fail to make a profit in the long run, which is why day trading requires a significant risk tolerance.

It also takes quite a bit of time and effort if you wish to do it as a full-time job. And if you don’t, the odds are not in your favour.

Because short-term trading is based on making a profit made on small price fluctuations, you need to catch those trades quickly. To do this successfully, you’re going to need software that can be expensive for a beginner investor.

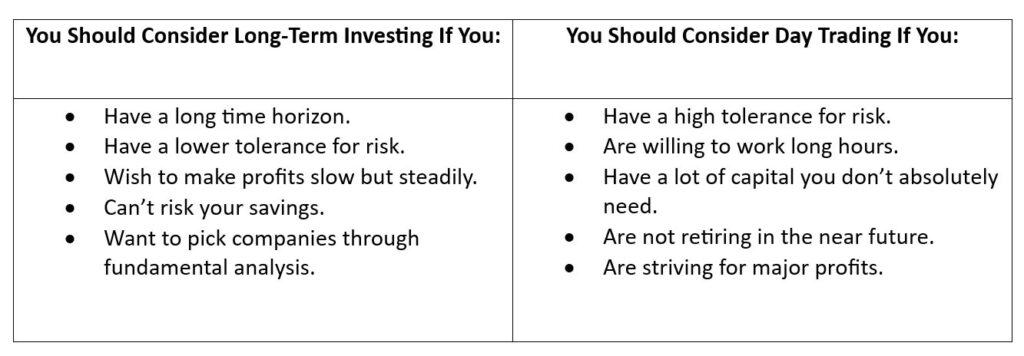

Which One Is Better for You?

I can say without a doubt that long-term investing is by far a better investment strategy for most investors.

Speaking statistically (or just by using common sense), the success rate for long-term investors is much higher than that of day traders. Especially if you’re a beginner.

If you invest regularly in index fund like the S&P 500, for example, you can get started with minimal amount of capital and knowledge. The best part is that you’ll likely do better than most investors in the long run.

Day trading, on the other hand, requires quite a bit of knowledge, to begin with, and also the right tools (software, etc.) to do it correctly.

While financial markets can be (and widely is) used for speculation, there aren’t a lot of winners in the speculation game.

On the other hand, those who win, win big.

So, if you have an extremely high tolerance for risk, a lot of capital, and you really do know what you’re doing, then day trading can be a suitable choice.

Can You Be a Long-Term Investor AND A Day Trader

Yes, it’s possible to choose both, but there’s a twist.

If I was a day trader, I would keep at least a little portion of my portfolio in long-term investments. Just in case.

BUT, as a long-term investor, I see no point in dabbling with day trading. The reason is that a day trader can easily become a successful long-term investor, but not the other way around.

For example, a day trader can choose to invest regularly in an index fund and reap the benefits of long-term investing quite effortlessly.

A long-term investor, on the other hand, has to spend countless hours learning how to trade, and the odds of success would still be close to zero.

So, if you’re a long-term investor who’s considering day trading, I would suggest starting with a smaller amount.

A recommendable starting sum would be around 10% of your portfolio. This way you get some returns if you succeed, but won’t be in trouble if you fail.

The Social Media Hoax

I feel I need to separately point out that you shouldn’t believe everything you see online.

Especially when it comes to trading.

The amount of content we are being force-fed on a daily basis is distorting our perception of reality.

When you look at trading videos on YouTube or, even worse, some random trading clips on TikTok or whatever platform, they make it seem about a billion times easier than it actually is.

You know how they go. Their day starts at 5 a.m. with a cold shower, meditation, exercise, and a leisurely stroll through the penthouse apartment in some big city. After that, they execute a couple of trades, make tens of thousands of dollars, and end their night in a 5-star restaurant with a couple of supermodels.

What a load of crap.

There are people who’ve made a fortune by trading, but I guarantee you they’re not the ones making those videos.

Being a successful day trader is a full-time job that takes an immense amount of skill and effort. The success rate is extremely low, and very few make it in the long run.

So, if you’re thinking about becoming a day trader, remember to stay critical and try to maintain a realistic perspective!