The importance of financial literacy and money management skills can’t be overstated in today’s world.

Becoming financially literate can be a daunting task at first, but I guarantee you it’s a lot simpler than you’d expect.

No matter where you live or what your situation in life is, if you handle these five key components of financial literacy, you will be financially successful!

Budgeting

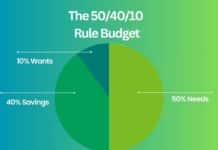

The first and most important component of financial literacy is the ability to create and maintain a budget. Being able to create a personal budget is one of the very basic financial literacy skills.

If you don’t have a budget, it may lead to overspending, taking on too much credit, and can make it difficult to achieve your financial goals.

No matter what your financial status may be, it’s not how much you earn; it’s how you spend it.

You should always know where your money is going. Especially if you seem to constantly run out of it.

While there are several different types of budgets, most people will be fine with just the very basic type of personal budget like the 50/30/20 budget.

What’s essential is to make sure your income exceeds your expenses. That’s it.

Saving Money

I have a certain rule of thumb when it comes to personal finance and financial literacy.

It’s quite simple: If you’re able to regularly save money, you’re doing okay.

The ability to save requires successful budgeting, disciplined spending habits, and developing delayed gratification.

When you have those in order, you’ll most likely be financially secure.

Then again, it’s hard to save if you don’t have a clear purpose for your saving. The most common reasons for saving include:

- Paying off debts. One way to save money is to pay the most expensive loans ahead of time. When you have a lot of high-interest debt, you’re mostly paying interest, not the debt itself. If you’re able to save money and make extra payments on your loan, you’ll have significant savings in interest payments.

- Building an emergency fund. If you’re just beginning to save and don’t have a massive debt burden, your first step is to build an emergency fund of at least three months worth of basic living expenses. Living one emergency away from bankruptcy is an extremely stressful way to live. Having emergency savings ensures you won’t get in trouble when surprising expenses arise.

- Saving for a particular purchase. Be it a down payment house, a holiday, or a car, people are usually most motivated when they have a certain goal to strive for. The best part is that once you’ve learned how to save, you can continue doing it after you’ve bought whatever it is you planned to buy.

- Retirement planning. One thing that especially young people often overlook is building sufficient retirement savings. Personally, I wouldn’t want to live the rest of my years on this Earth in misery, and most likely you wouldn’t either. Also, the sooner you start to save and plan for retirement, the sooner you can retire. In some countries, like in the U.S., employers offer a 401(k)-retirement savings account, for example, that can help you save for your retirement.

- Saving to invest. Putting money aside for investing purposes is probably one of the wisest financial decisions you can make. Not only do you cut back on unnecessary expenses, but you also make your money work for you, which is the very idea of investing.

Nowadays, social media would have us all believe that your main goal of making money is to spend it all on luxury watches and sports cars.

That’s not how it works for normal people. Besides, those who make money just for the purposes of showing off and spending it, rarely maintain or even achieve wealth.

Saving might not be sexy, but it is necessary.

Debt Management

Debt itself is not a bad thing. In fact, it’s the very thing that keeps our economy up and running. When used correctly, it can help you achieve the very things most people dream of.

What’s important is to know how to manage debt and to separate good debt from bad debt.

Good debt is the kind of debt that increases your net worth or otherwise provide financial value. Examples of good debt are:

o A mortgage

o Student loans

o Business loans

o Investments in yourself

Bad debt, on the other hand, is the kind of debt that doesn’t provide a return or otherwise add to your financial health. Usually, the things you buy with bad debt are the kind of things that require money to maintain.

Common examples of bad debt include:

o Credit card debt

o Other high-interest loans

o Auto loans

o Expensive personal loans

So, you should focus on good debt, but remember to take it in moderation. Especially during times of low interest rates. If you take on too much debt and the interest rates start to rise, it’ll cause you financial trouble no matter what kind of debt it is.

Overall, understanding how debt works is one of the key financial concepts that everyone should handle.

Managing Credit

Credit is the kind of thing that’s a lot easier to mess up than to build up again.

Taking care of your credit score will make your financial life infinitely easier. When you take care of your credit score, you get better terms for your loans and pay less expenses overall.

It also pays to be on good terms with your bank. They are usually surprisingly flexible and understanding with good customers.

While some countries don’t have a particular credit score system, per se, they do track your credit history and behaviour.

Messing up your credit history not only makes it extremely difficult to qualify for a mortgage, but you’ll also most likely get bad terms on all your credits. It can lead to a situation where you mostly pay interest and expenses without actually paying off your loans at all.

When it comes to credit, moderation is key. Personally, I believe that using credit is for emergencies and that’s it. If you need to use credit to buy something that’s not essential, you probably shouldn’t buy it in the first place.

The best ways to take care of your credit score are to make your payments on time, use credit only when you need it, and keep your credit balances low.

Investing

Once you have all the previous components under control, the last step to master is learning how to invest.

The idea of investing is to get enough returns for your savings to beat inflation and build real wealth over time through compound interest. Keeping your money in your savings account for long periods of time exposes them to inflation which will slowly erode your savings.

As you can see from the investing section, this site is dedicated purely to long-term stock investing.

There are, of course, other ways to invest, but that’s the one I’ve personally found to be most understandable as well as profitable.

Investing doesn’t have to be difficult. In fact, the simpler the better.

As a regular person whose goal is to get a decent return for his or her capital, you’ll do just fine by regularly investing in broadly diversified ETFs.

In investing, it’s best to learn the basics and keep it simple. The rest is mostly patience and discipline