The question of “Is now a good time to invest?” is extremely difficult, but the answer is quite simple:

It’s better to stay invested for a long time than to spend a long time figuring out when to start investing.

However, when we dive into it, the question becomes extremely interesting.

As I will show you, it all comes down to what kind of an investor you are. The question may be about the stock market, but the answer depends on you.

So, let’s get started and answer this once and for all.

What the Question is REALLY About

Let’s start by analyzing the question itself.

As I see it, it concerns the stock market as a whole, not individual stocks. Therefore, it’s about timing the market, not singular stocks.

What you want to know, then, is whether the market will offer high returns in the future.

To achieve high returns, the assets you buy must be reasonably priced – preferably cheap. The best time to buy stocks is when they’re priced cheap compared to their fundamentals.

In other words, what you really want to know is how highly the stock market (like The New York Stock Exchange, for example) is valued compared to companies’ earnings.

Simple enough. Now, let’s see how to stock market works.

How the Stock Market Works

The stock market tends to go up and down, that much is always true.

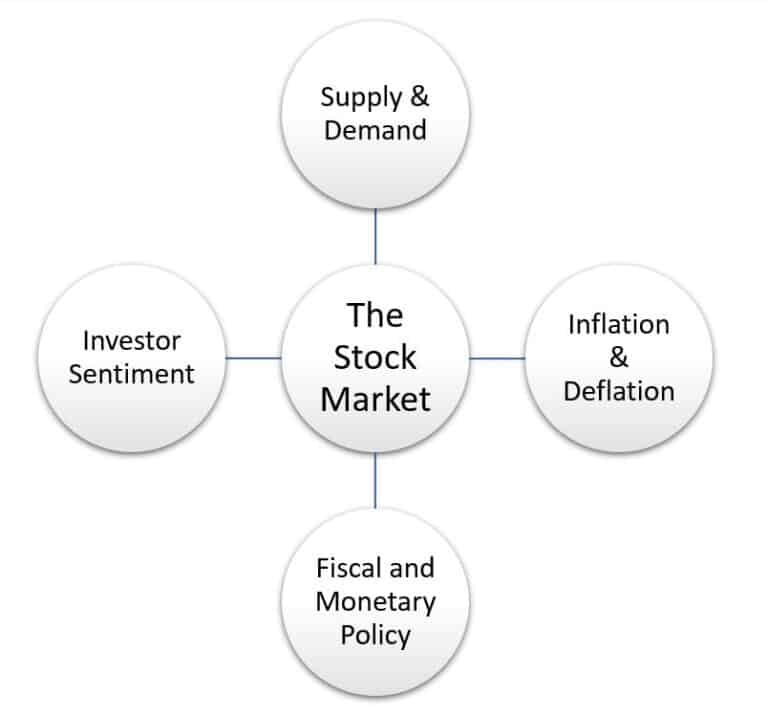

What makes the stock market move is supply and demand. When people want to buy stocks, the stock prices tend to go up, and when people want to sell stocks, the prices go down.

When we talk about the stock market as a whole, the main phenomena that move the stock market are usually related to inflation, interest rates, commodity prices, and political reasons.

Now, I’m not going to dive deeper into these reasons, but it’s safe to say that their effects are hard to predict. For example, high inflation is guaranteed to lead to higher interest rates, but the effect of those rates on stock prices is difficult to predict.

Why Predicting Market Movements is So Difficult

As we’ve established, the question was whether the stock market is overpriced or whether stocks are priced below their intrinsic value. In other words, whether it’s a good time to invest or not.

To be able to answer this, we should know how expensive/something stocks are at the moment, and how long will they stay that way.

Now, we have certain ratios like the CAPE ratio (aka the Shiller ratio) that can be used to evaluate how the stock market is overvalued or undervalued.

As you can see from the graph, according to the Shiller p/e, the stock market is now valued considerably high.

Unfortunately, we have no way of knowing how long the market can stay overpriced or underpriced. Although the market could be seen as overpriced, it can continue to be so for a long time.

Therefore, predicting the market movements and timing your transactions is extremely difficult.

Contrary to what some people claim, I believe you can’t predict market cycles. There are simply too many variables to consider. Most importantly, you’d need to know what people think collectively.

Finally, even if you got everything else right, there are always things we don’t know that we don’t know about. These are the things that happen once in a lifetime and can change everything.

Should You Try to Time the Market

This one’s a bit tricky. Sometimes the stock market is wildly overpriced, and sometimes stocks are unbelievably cheap. So, there are a lot of opportunities to benefit from market movements.

But, as I mentioned earlier, timing the market is extremely difficult, and most investors will fail to do so.

In my experience, trying to sell your holdings at market peaks and buy them back at the bottom simply doesn’t work. Not only do you have to sell at the right time, but you also need to buy at the right time.

Adding all the taxes, expenses, and miscellaneous fees, I think timing the market overall is just not worth it.

The better solution is to hold a certain amount of cash in your portfolio so you can buy more stocks when they’re reasonably priced.

It’s also okay to make small adjustments to your portfolio. For example, sometimes individual stocks can become wildly overpriced and throw your portfolio out of balance.

In these situations, it might be perfectly fine to sell a portion of those stocks to take home some of the profits and rebalance your portfolio.

The Answer Depending on Your Investment Strategy

All right, so now we can finally add all this up and figure out how different investors with different investment strategies should approach the original question of “Is now a good time to invest?”.

Day Traders

Let’s think about stock trading and day traders who buy and sell their holdings during one market day. As you can imagine, the question about whether it’s a good time to invest or not is completely pointless for them. Every day is a good (or a bad) day to trade when you’re a day trader, so that’s that.

Long-Term Fund Investors

For long-term investors who invest regularly in stock funds like index funds, mutual funds, or ETFs, the question becomes a bit more interesting. Some long-term investors tend to alter their monthly investments according to market cycles.

In other words, they invest less when markets are overpriced and more when stocks are cheap. The most important thing is that you don’t stop investing entirely. Statistically speaking, it’s best to stay invested at all times so you don’t miss the best days on the market.

Therefore, a long-term fund investor shouldn’t wonder whether it’s a good time to invest or not, he should stay invested at all times.

Long-Term Individual Stock Investors

How about long-term investors who invest in individual stocks? The thing is that individual companies can be overpriced during bear markets and bargains during bull markets.

Of course, your chances of finding bargains increase during bear markets, but it doesn’t necessarily guarantee it.

Therefore, it’s often best to focus on firm-specific pricing and factors instead of the stock market as a whole. So, once again, the question about whether it’s a good time to invest or not is quite meaningless.

Short-Term Fund Investors

Let’s imagine you’re a short-term investor with an investment horizon of less than five years. Suddenly, timing becomes extremely important.

In fact, short-term fund investors are the only ones for whom “Is now a good time to invest” is a relevant question.

The way I see it, the stocks have to be cheap or at least moderately priced for investing to make sense. As mentioned before, predicting the stock market and the duration of market cycles is next to impossible, and basing your investment strategy on timing requires quite a bit of risk tolerance.

Therefore, the short-term fund investor is in a difficult position. In my opinion, it’s exactly this reason why investing in stocks for just a few years isn’t worth it.

The answer to the question would then be, that the short-term investor should start investing in the long term to avoid the problem entirely.

Short-Term Individual Stock Investors

Short-term individual stock investors should focus on firm-specific factors instead of the stock market as a whole. The reason is the same as it was with long-term investors who invest in individual stocks.

How to Make Sure It’s Always a Good Time to Invest

Let’s summarize what we’ve established so far:

- The original question is about the stock market, not individual stocks.

- You can’t predict market cycles.

- Timing the market is extremely hard.

- The question about whether it’s a good time to invest or not is pretty much pointless for most investors.

- For those for whom the question is relevant, are investing in a way that’s considerably and unnecessarily difficult.

- Those who invest in individual stocks should focus on analyzing the companies, not the market or the stock price.

So, what we can quite safely say is that the most guaranteed way of getting satisfying results is by investing regularly and having a diversified portfolio.

For long-term fund investors, the winning strategy would seem to be to have a monthly-based investment plan on low-cost index funds or ETFs (Exchange Traded Funds). This way you get the benefits of dollar-cost-averaging as well as the added bonus of not worrying about market movements or timing.

For short-term fund investors, unfortunately, there’s no single way of telling whether it’s truly a good time to invest or not. Buying and selling stocks according to market movements is a feat that many investors try, and very few succeed.

Therefore, the best way to ensure great results would be to have a longer time horizon and shift toward long-term investing.

Time in the market is a lot more efficient way to build wealth than timing the market.