What Is a Personal Financial Statement

A personal financial statement is a document, usually an Excel spreadsheet where you list your assets and liabilities.

In other words, it paints a clear picture of an individual’s financial position at a given point in time.

The idea of a personal financial statement is to show your net worth by subtracting your assets from your liabilities. Net worth is what you would have left after you sell everything you have and pay off all your debts.

If your net worth is positive, you have more assets than liabilities. Having a positive net worth is a sign of financial health.

Knowing how to prepare a personal financial statement is an essential part of your personal finances.

What to Include in Your Own Personal Financial Statement

Your personal financial statement should include full disclosure of your assets and liabilities.

Assets

Assets are the things you own that can be turned into cash and/or generate cash flow.

The most common assets a person can have include things like:

o Cash in your checking and savings accounts

o Stocks and financial assets

o Personal property such as cars, jewelry, collectibles, etc.

o Real estate

As you can see, your income is not directly listed in assets, although your savings and account balances are.

Usually, you list your assets in the order of liquidity. In other words, you list the assets that are easiest to sell first and those that are the hardest last.

For example, stocks are a lot faster to sell than a house, which is why they are listed above real estate.

Liabilities

Liabilities, unlike assets, are the things you can’t turn into money, but instead need money to get rid of. In other words, debt.

The most common liabilities include:

o Mortgage

o Student loans

o Credit card debt

o All other kinds of personal loans

o Unpaid bills

o Unpaid taxes

To see whether your net worth is positive or negative, just subtract your liabilities from all your assets.

If your net worth is positive, well done. It means that you have succeeded in taking care of your personal finances and creating wealth.

Income Statement (optional)

Usually, it’s best to write down your income and expenses on a separate sheet for clarity. Most personal financial statements that are for personal use rarely include an income statement.

You can and should include your personal income statement in your financial statement when you’re applying for a loan.

Otherwise, I think it’s best to keep it separate. This is not to say that an income statement is not an essential part of your personal finance. It gives you a great overview on your personal financial position.

Your personal income statement includes all your income, such as your salary, investment income, and any other income you might have.

It also has a detailed list of your expenses. This way it gives you and your creditor a more detailed description of where your money comes from and where it’s going.

The key thing here is to be precise. There’s no point in listing all your expenses if you omit expenses or downsize the ones you’re less proud of.

What to do if Your Net Worth is Negative

Okay, so you calculated your net worth correctly and it turned out to be negative. Now what?

Well, the first thing to do is to be honest with yourself and refrain from adjusting the numbers to your benefit. That won’t help anyone.

What will help, on the other hand, is to find out why your liabilities exceed your assets.

Usually, the reason is that people live beyond their means, which is why they need to resort to credit card debt and other high-interest debt.

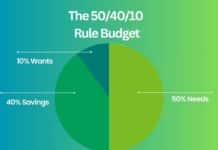

The upside is that overspending can be avoided easily by successful budgeting to decrease your liabilities. It’s a lot faster than increasing your assets like, for example, getting a raise.

After you’ve come up with a suitable budget, it’s time to create a plan and set financial goals to work toward.

Overall, it’s best to aim for decreasing liabilities and increasing assets.

Pros of Creating a Personal Financial Statement

A personal financial statement helps you track your financial status and see whether your net worth is growing or diminishing.

It’s worth remembering that your financial statement shows your financial position only at that exact moment. It doesn’t tell you anything about what your situation was like a week ago or a day from today.

If you use your financial statement as a monitoring tool, remember to update it regularly.

Creating a personal financial statement is also extremely useful when applying for a loan, since it gives the creditor a quick overview on the applicant’s financial situation.

Having a positive net worth informs your creditor that you’re a responsible borrower and know how to manage your finances.

Then again, if your financial statement gives a negative net worth, it can be a highly motivating factor for being more cautious with your money and creating more beneficial financial goals.