What is a Budget

A budget is an estimation of your net income and expenses for a certain period of time. Usually, when we talk about budgeting in personal finance, we refer to one’s monthly budget.

In other words, a budget can be a simple plan of how much money you’re receiving, and how much money you’re going to spend on different things during that period.

As you can imagine, it’s an essential part of everyone’s personal finances, and it’s pretty hard to be financially successful without some form of a budget.

Although, for some reason, people seem to abhor the word ‘budgeting’.

In fact, one of the best ways to make sure no one bothers you during a cocktail party is to bring up your overflowing enthusiasm for budgeting.

I’d be lying if I told you I’m a budget enthusiast myself, but I do think creating a budget and sticking to it is one of those things you just have to do.

Different Types of Budgets

While there isn’t one right answer on what’s the best type of budget, there are usually a couple of types of budgets that people use. Here are the three most common budget types.

THE budget. I have no name for the most widely used budget there is, so let’s just call it THE budget. What most people do when they come up with a personal budget is subtract their monthly expenses from their income, and if there’s any extra money left, they either spend it or save it.

This way of budgeting doesn’t necessarily include any financial goals or planning, it’s just a way of knowing where your money goes.

Cash envelopes. Cash envelope budgeting divides your net income into different categories like food, gas, paying bills, etc. The idea is that you designate a certain amount of money to each envelope, and once you’ve spent all you’ve designated to the category, you can’t spend any more money on it.

Back in the day when people used a lot more cash, they literally put cash in an envelope and used that cash for purchases. Nowadays, people use much less cash, but you can still use this method by using a budgeting app or similar software.

Percentage budgeting. Percentage-based budgeting methods are similar to cash envelopes, but instead of money units, you use percentages. You can, for example, decide you’re going to spend 5% of your monthly budget on your hobbies, 15% on food, and so on. The idea is that percentages make it easier to really budget for every dollar (or cent, or whatever) you have.

The most famous of these percentage-based budgeting ways is the 50/30/20 rule, which we’re going to take a closer look at later on.

Of all the budgeting solutions I believe that the percentage-based ones are the most effective.

How to Create a Budget for Beginners

So, how exactly do you start creating your own budget?

First, you take note of your monthly income and expenses to see where your money is coming from and where it’s going.

Then you decide where you want to be and form your financial goals. These can include things like saving 10% of your net income, paying off credit card debt, etc.

After you know where you are and where you want to be, it’s time to make a financial plan to achieve those goals.

The last and most important thing is to track your progress and adjust. Sometimes we start to slip into our old ways without even noticing it ourselves. Also, sometimes our plans simply don’t work, which is why it’s essential to adjust when needed.

Different Types of Expenses

A major part of budgeting is managing your expenses. This is simply because, in a usual situation, there are only a couple of sources of income, but a lot more expenses.

Depending on the situation, categorizing your monthly expenditures can be an extremely eye-opening experience.

Fixed and Variable Expenses

What I like to do first to simplify things is to divide expenses into fixed and variable expenses.

Fixed expenses are the kind that you know are the same month after month, and what you can prepare for.

The most common fixed expenses are your loan payments, rent, and insurance payments.

Variable expenses, on the other hand, are the kind that you’ll find hard to accurately predict. In general, these may include things like gas and medical expenses.

The idea behind dividing your monthly expenses into these categories is to find out what’s the minimum amount of money you need to get by, and how much there’s room for improvement.

If you happen to have a lot of variable expenses, you also have a lot of ways to make an immediate change. Most of our variable expenses are the kind that depends on our behaviour, which makes it a lot easier to adjust them.

In a nutshell, variable expenses are behaviour-based and fixed expenses require more arrangements if you wish to change them.

Wants and Needs

Once you know what kind of fixed and variable expenses you have, the next thing is to separate your wants from your needs.

Needs are the things that you, well, need. They are things like food, water, and shelter. Wants are the kind of expenses you can get by without, like a premium subscription to whatever streaming platform you’re using.

The difference is that when things get tough, you can choose to not spend money on wants, but your needs are always there.

The main idea of separating your wants and needs from each other is to find out what you REALLY need to spend your money on. If your wants take, let’s say over 50% of your budget, you might want to look into your spending habits.

Then again, if you spend all your money on your needs, your standard of living is probably way too high for your income. This can easily lead to financial trouble if there’s a drop in your income or there’s some other unpleasant surprise.

Some people have more needs than others. Depending on things like family size and the place you live in, your needs can take a major part of your budget. While there are no simple solutions on how much they should take, there are some basic rules that can offer some guidance.

The 50/30/20 Rule

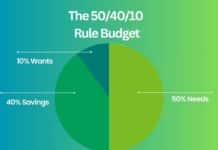

One of the most widely used ways of creating your budget is the 50/30/20 rule.

The idea of the rule is to divide income into three spending categories: needs, wants, and saving.

According to the rule, you should spend 50% on your needs, 30% on your wants, and put aside 20% for unexpected expenses and investments.

The main point is that your wants shouldn’t take up too much of your budget, since your mandatory expenses and saving should be a top priority.

When we think about our wants and needs, the first and most important step is to separate the two from each other.

Needs, like rent and food, are the kinds of expenses you absolutely need to pay. Wants, on the other hand, are things like dining out and shopping – they are not essential.

While the percentages of the rule are not set in stone, they do offer you a great place to start. It’s important to remember that you don’t have to match the rule right away.

If your percentages are way off, just start to slowly work toward spending a little less on wants and a little more on the important stuff, and you’ll get there!

Build an Emergency Fund

If there is one timeless personal finance lesson, it’s having an emergency fund. While it’s practically mandatory for your personal financial success, it’s also one of the best ways to help you keep up with your budget.

The idea of the fund is to save some money, preferably a sum that covers at least 2-3 months’ worth of expenses.

By saving an emergency fund you don’t need to use a credit card or other high-interest loans when something unexpected happens. Depending on your budget and savings, an expensive loan can overthrow your budget and get you into too much debt faster than you can imagine.

While it can be a difficult task to save money for a sizeable fund, the most important thing is to start.

No matter how little you can save at first, even a little is far better than nothing.

What are the Pros of Having a Budget

Peace of mind. The biggest upside and the reason why you should create a budget is the fact that it gives you peace of mind over your personal finances. When you know your monthly income and expenses and have a balanced budget, it takes the weight off your shoulders.

Helps you through emergencies. When you have managed to form a working budget with some extra money left over, it also provides safety for emergencies. Saving an appropriately sized emergency fund helps you through surprising expenses without you having to take expensive credit card loans.

Offers you clear financial goals. When you make a budget, it will reveal your financial weak points. Once you know your weaknesses, it’s easy to set goals to combat your weak points.

Prevents spending money. The beauty of sticking to a budget is that eventually, it becomes almost painful to live in any other way. Once you’ve gotten used to living on a budget, you start to feel bad if you spend too much.

Saves you from most financial troubles. In my experience, not having a budget and living beyond your means is the fastest and the most common way of getting into financial trouble. It forces you to live on credit, and sooner or later, your finances will crumble. Budgeting is the number one way to prevent really big financial problems.

Are There Any Cons to Budgeting?

While taking responsibility for your personal finances is a great thing overall, there are some possible downsides to budgeting that are worth mentioning.

Can be restricting. First of all, creating and following a budget can be quite restricting. It might feel that it takes all the fun and excitement out of your life, and you never get to be impulsive again. Fortunately, this doesn’t have to be the case. If you so wish, you can include the impulsive things in your budget. Just don’t spend too much on them.

Time and effort. Coming up with a budget, tracking your monthly expenses, and analyzing your finances will require a certain amount of effort. It can be especially arduous if you do it by hand, which is why you might want to consider using an app to track your expenses.

Honesty. Being honest with yourself about your finances can be extremely difficult. There are a lot of things that we unconsciously tend to forget and may find hard to admit to ourselves.

Successful budgeting requires integrity and sometimes owning up to one’s mistakes, which can make it a painful experience at times.

Why You Need to Make a Budget

Okay, we’ve pretty much covered all the basics of budgeting, so let’s summarize why you actually need a budget.

Having a well-organized budget gives you peace of mind, helps you through emergencies, and offers you clear financial goals on which to improve.

It prevents you from overspending and will most certainly save you from the most common financial troubles like taking on too much bad debt.

During my time as a financial advisor, I’ve worked with a lot of people that are in financial distress. What almost all of them have had in common is that they had no budget.

It’s an extremely rare sight to see someone able to save for years and years and be financially successful without some form of budgeting.