Personal finance is a field where there’s no one simple solution – there are several!

If you follow these guidelines, your probability of getting into financial trouble drops immensely.

For additional information, you might want to check my article about the essential rules of personal finance.

I’ve categorized these guidelines into three timeframes: the short term, the medium term, and the long term.

The way the steps work is that the shorter the timeframe, the easier it can be done. Also, you need to have your short-term and medium-term steps in order to be successful in the long term.

Let’s start with the short term.

The Short Term

These are steps you can take right now, and that have an immediate effect on your financial well-being.

Create a Budget

Budgeting basically means deciding how you spend your money.

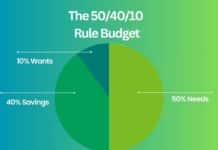

The simplest way is to build on the 50/30/20 rule, where you spend 50% on your essential needs, 30% on less-essential wants and save 20%.

You don’t have to follow the rule exactly, but it does give you a guideline on how to stay financially stable.

You can create a budget by yourself or use budgeting applications and software.

Track Your Income and Spending

Once you have a framework on which to operate, you should review your spending habits and see where your money is actually going. Although there are some financial obligations that are mandatory, most of us also spend money on things that are less than essential.

A major pillar of personal finance success is simply paying attention. Be aware of your spending habits and pitfalls.

The more aware you are, the easier it is to avoid mistakes and improve your financial stability.

The idea is to compare your financial habits to your budget and see what part of your spending creates the most trouble.

Usually, it’s either excessive debt payments or spending too much money on your wants that create problems.

Learn How to Save Money

No matter what your financial goals are, if you don’t have the ability to save money, you’re in trouble.

A major part of being money smart is to develop a mindset for delayed gratification. In other words, you need to have the ability to resist short-term temptations to secure your financial future.

Once you’ve tracked how you spend money, you can start to cut down on your non-essential expenses and transfer the extra money to a separate account.

The simplest way to reach your savings goals is to open a savings account and set up an automated monthly payment for a certain sum.

In my experience, if you do the transfers manually, your chances of success drop dramatically.

Create Your Medium-Term and Long-Term Financial Goals

There’s not much point in budgeting and tracking expenses if you have nothing you aim for.

Goals are the things that guide our behaviour. That’s why it’s important to have clearly defined financial goals that are easy to work towards to.

These goals may include things like paying off debt, becoming financially independent, building wealth, saving money and forming an emergency fund, and so on.

One effective (and a bit painful) way to set meaningful goals is to look back at your own behaviour and recognize the patterns and choices that have caused you the most financial harm.

For example, if it’s credit card debt that is the root of your problems, the goal would be to pay off the debt and stop using credit cards.

On the other hand, if it’s bad investments that have gotten you into trouble, you need to start by identifying what went wrong, question your methods, and improve.

I believe this approach to be the most effective, but it requires an immense amount of integrity.

The Medium Term

These are the steps to take during the next 1-2 years.

You can start to work on these immediately but do remember, that they take a bit of time to achieve.

Build an Emergency Fund

An emergency fund means simply having some money in your bank account that you can use for emergencies.

Depending on your lifestyle and income, your emergency fund should be about 2 or 3 times your monthly income. While it may sound like a big number at first, you’ll gather it before you even know it when you have your short-term money habits under control.

The idea of an emergency fund is that you don’t need to take loans for surprising expenses. It’s not that loans themselves are bad, it’s the interest that is.

Using your savings to pay for unexpected is a lot cheaper and you don’t risk accumulating too much debt.

Pay Off Your Credit Card Debt And Maintain A Good Credit Score

Financial advisors constantly warn people not to take too much credit card debt.

This is because it’s the most expensive kind of debt there is. Sometimes the interest rates are so high that you mostly pay interests instead of the debt itself.

The best debt reduction strategy is paying off the most high interest debt first.

After you’ve paid off your expensive debt, the important part is not to create more of it. What this means is to stop using your credit cards.

The problem with credit cards is that taking debt is too easy, and the more often you use it, the more habitual it becomes. So, what you need to do is to get rid of the habit.

Another thing that’s closely related to this is maintaining a good credit score by not having too much debt and paying your loans on time.

The better your credit score is, the more favourable terms banks offer you.

Develop Financial Literacy

It’s a lot better to be financially savvy with a mediocre income than a financial dum-dum with a high income.

Being financially successful is extremely difficult if you don’t have any idea what you’re doing.

If there was only one answer to how to be smart about money, it would be to become financially literate.

What this means is understanding the main concepts of personal finance, investing, and economy. The best way to achieve this is to read books, listen to financial podcasts and browse great websites like the one you’re reading right now!

Also, when you have a general idea on how our economic system works, the world around you starts to make a lot more (or sometimes a lot less) sense

The Long Term

The long term here means the rest of your life.

These are the types of activities and goals that build on your short-term and medium-term behaviour.

As an investor and as a financial advisor I believe that investing is a lifelong solution. Long-term investing has historically proven to be a superior strategy, and I’m quite convinced it’ll continue to be so.

Learn to Invest

All long-term financial goals usually require some form of investing.

The main idea of why you should invest your money instead of keeping it all in your savings account is to beat inflation. Inflation will slowly erode your savings, which is why it’s smart to invest in something that has a return potential greater than the average rate of inflation.

There’s no one rule to investing, but for me, disciplined long-term investing in stocks without any gimmicks seems to work pretty well.

If you are new to investing, there are tons of articles about investing in the investing archives, that will surely help you get the hang of it!

Remember Moderation and Be Patient

The ruin of many a wealthy person is greed.

When people get greedy, they take too much risk. This includes things like accumulating too much debt, making excessively risky investments and jeopardizing money they can’t afford to lose.

Investing for the rest of your life is a long-term solution, which means you also need to develop a long-term mindset .

The thing about long-term investing returns is that the compounding effect takes time to take off.

When you begin investing, it may feel like it’s not going anywhere during the first years. The thing is that it’s not supposed to. The longer you invest, the more your returns start to compound.

This is why you need to develop the patience to achieve the best results.

Develop a Mindset for Learning

The beauty of finance is that there is always something to learn.

If there’s one thing that’s permanent, it’s change. That’s why we need to keep learning just to stay on top of things.

One effective way to learn about personal finance and the economy overall is to read financial news and articles, and every time there’s a concept that you’re not familiar with, you find out what it is.

It’s also important to know why something happened, rather than just observing whatever happens around you.

The beautiful thing in learning is that the more you learn, the more lucrative investing opportunities there seems to be.

This is why it’s important to develop a curious and adaptive mindset that nurtures constant learning.