Have you ever dreamed of telling everyone to completely, utterly and permanently fuck off?

Having fuck you money will give you the ability to do just that.

Here we find out what exactly is fuck you money, how much do you need it, and how to build your very own screw-you fund.

I’ll warn you that there’ll be a lot of fucks flying around in this post, but I swear (pun intended) it’s all for science.

What Is Fuck You Money

The origins of the term “fuck you money” are vague at best. I dug around for a while and some say that it was used first by John Goodman in the movie “The Gambler” in 1974.

Others say it was first introduced to the public by the movie Heat in 1986.

I first heard it from my relative around 20 years ago, who told me that everyone ought to have a fuck you fund to keep people from screwing you over.

Be that as it may, according to Urban Dictionary, fuck you money is:

“The exact amount of money required in order to tell an individual or organization to go fuck themselves without facing repercussions.”

In other (more civilized) words, it means having enough money to live a financially independent life.

The core idea is to have enough money to live comfortably for the rest of your life, but I’d like to point out that it doesn’t need to last that long. Sometimes it’s enough to temporarily tell someone to fuck off.

How Much F You Money Do You Need

No matter what definition we use, they don’t directly tell you how much money you actually need to have.

That’s because it solely depends on your lifestyle, and how big of a ‘fuck you’ you want to present.

If you wish to tell your employer to permanently suck it, you’ll need to be financially independent. The more lavish your lifestyle, the more money you’ll need for financial security.

On the other hand, if you merely want to give the old fuck-around-and-find out treatment to your current employer, a lot less will do. You only need enough money to get by while you’re looking for a new job.

Ideally, of course, it’s better to have enough money to never worry about work again.

How to Calculate Your Personal Fuck You Money

The easiest way to calculate your personal screw-you-and-everyone-else number is to use this calculator from Vanguard. While it’s called a ‘retirement nest egg calculator’, it can also be used to calculate your financial independence number.

Among other things, it shows you the difference between investing in stocks or bonds and holding all your savings in cash.

If you wish to calculate a rough number by hand, you can:

· Calculate how much money you need to maintain your current or desired lifestyle for one year and add 10-20% to that to account for unexpected expenses and changes in your lifestyle.

· Multiple that number by the years you wish to live independently and add around 2-3% yearly to compensate for inflation.

This number tells you how much money you’d need to maintain your current lifestyle and never work again.

It’s worth remembering that your time frame is extremely uncertain since you have no idea how long you’re going to live. Imagine calculating your screw-you fund with a life expectancy of 80, and you’d happen to live ‘till 100. In that case, you’re the one who’s fucked.

Therefore, it’s best to overdo it and factor in the possibility of living a long life. It’s terrible, I know, but it’s best to be prepared.

Also, the more returns you get for your savings, the less money you need to save. Having $500,000 with an annual return of 6% in the long term is a lot better than having $1,000,000 with a 0% return.

The Benefits of Having Fuck You Money

Okay, so let’s talk about the benefits. Since this is about having enough money to live as you please, the benefits are close to endless.

I think the ones presented here are the biggest and apply to most people.

1) Freedom

Having a sufficient bugger-off fund offers you something very few people can enjoy – true freedom. I’m talking about the freedom to live your life the way you want to and, of course, the freedom to say (or not to say) fuck you.

No one’s forcing you to work somewhere you hate or do something that’s against your values. Neither do you have to take all the crap people are usually forcing down your throat.

In the end, it’s the sort of freedom everyone ought to have to begin with. Ironically, it’s money and capital that will most likely offer you that freedom.

2) Leverage

When you’re an employee with fuck-you money, your employer has no leverage over you.

Normally, employers get to dictate the rules for most people since they know that you’re in debt and you really need your job.

If your job happens to be valuable to the company that pays you, you have the upper hand. It doesn’t mean that you can act like a complete ass, but it does give you leverage when you’re negotiating about your salary or job description.

3) Opportunities

Building a suitable screw-you trust will not grant you opportunities itself, but it enables you to grasp opportunities as they arrive. For example, some people dream about entrepreneurship or studying for a new degree, but they can’t pursue their dreams because they’re dependent on their paycheck.

Having fuck you money enables you to get by without your paycheck, which means that you can pursue other endeavours without having to worry about money.

You can also try new things more freely since there are no serious monetary consequences if you happen to fail. Your ego will, of course, still take a pounding, but that’s probably a good thing for most of us.

FIRE vs. Fuck You / Is FIRE Movement the Same as Fuck You Money

FIRE or Financially Independent, Retire Early movement is often associated with the fuck-you money movement.

FIRE is all about maximizing your income and minimizing your expenses for an early retirement– preferably in your 30s.

Being able to retire at a young age with financial independence is pretty close to fuck-you territory, but there’s one big difference.

If you’re going to retire before you’re 40, you need to have a high annual income and an exceptionally low expense level to earn money that will last you for the rest of your life. In other words, about 50-60 years’ worth of it That’s non-negotiable.

When it comes to fuck-all-y’all money, you don’t necessarily need it for the rest of your life. Maybe a year or a couple will do.

Emergency Fund vs. Fuck You Money

Sometimes people tend to confuse having an emergency fund and having an adequate flip-everyone-off fund.

Unfortunately, if you tell your employer or whomever to stuff it with only an emergency fund, you’ll soon be stuffed yourself.

An emergency fund is merely money you keep in your savings account for emergencies. Ideally, its size is about a couple of months’ worth of living expenses, and that’s it.

No one’s going to fuck off with that kind of money.

The difference between an emergency fund and fuck you money fund is that the latter when done correctly, will regenerate and provide you passive income throughout your life.

How to Make Fuck You Money

There are some who say that the best way is to have a side hustle or whatever social marketing scheme they happen to endorse at the time.

Unfortunately, if it was that easy, everyone would do it.

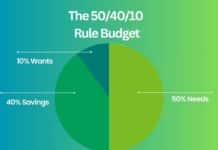

The best and most surefire way to make fuck you money is to take control of your personal finances, learn how to save, learn how to invest, and develop a little bit of patience. Financial freedom is most often built patiently in the long term.

That’s a formula that works for everyone.

It’s also worth pointing out that investing is, in most cases, required to create and maintain your fuck you fund. If you solely rely on risk-free income such as savings account interest, your return rate will most likely be too low to create enough money.

Ironically, making a lot of money without saving and investing is the opposite of having FU money because you’re completely dependent on whoever is paying you. If anything, it’s your employer who holds the fuck-you card in their sleeve.

Quite often people who achieve financial freedom have their own business that they build over time. While entrepreneurship is on everyone’s tongue nowadays, it’s not for everyone. Luckily, you can become completely financially independent by investing without being an entrepreneur.