Practically everyone who’s interested in personal finance dreams and aims to achieve financial freedom or be financially independent.

So, what exactly does it mean to have enough money to be financially free and how do you achieve it?

Let’s find out!

What is Financial Security

Financial security is not an easy concept to define. For some people, it means having enough income outside your job to fund your basic living expenses like food, clothing, and housing expenses.

What this would imply is that you need to have a respectable amount of passive income to fund all this. For most people, unfortunately, that is not the case.

I would argue that for most people, financial security is about having a large enough emergency fund to get through emergencies without excessive stress.

Financial security is all about feeling secure about your finances. For some, a large enough emergency fund and some investments can offer just that, if they work in a field where employment is practically certain.

The problem with financial security is that eventually, your emergency funds and investments will run out.

This is why it’s preferable to have enough passive income to fund your lifestyle in its current form.

What is Financial Independence

Financial independence takes financial security a step further. It’s about having enough passive income to fund your current lifestyle to its fullest.

So, not only do you have enough income to fund your basic necessities, but you can also pay for all the little things that make life worth living.

In other words, once you reach financial independence, you could quit your job today, retire early, and live the life you have without ever needing to work for a wage again.

Pretty sweet, eh?

Well, it could be even sweeter.

What is Financial Freedom

Financial freedom is the last (and hardest) financial milestone to achieve. It means you have enough passive income to pay for your ideal lifestyle.

Both financial freedom and financial independence mean that you don’t need to work for a wage anymore.

Financial freedom takes it a step further.

In its purest form, financial freedom means you can live exactly as you please and never worry about running out of money.

This would mean dining at the finest places, buying the fanciest items, and living like the kings and queens of old.

Then again, not all of us need to live like royalty.

What financial freedom means for most people in real life is that they live their financially independent life but can afford little extravagancies without needing to count their money.

Financial Freedom vs Financial Independence

So, all in all, there are a couple of big differences between the two.

The first difference can be found in the terms. Financial independence means that you can live independently from anyone. You don’t need to get a job or work for yourself, it’s already been taken care of.

What you don’t have is the freedom to upgrade your lifestyle. Because financial independence is all about maintaining your current lifestyle with passive income, it won’t be enough if your lifestyle becomes more expensive.

The second difference is that achieving financial independence is a lot more common than reaching financial freedom.

Achieving financial freedom is hard, and, let’s be honest, being financially independent is pretty sweet and it’s enough for most people.

Achieving Financial Freedom in Three Phases

Your quest toward financial freedom starts with achieving financial security first.

Achieving Financial Security

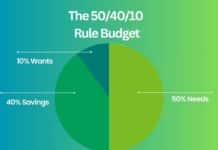

The first step toward achieving financial security is to learn how to create a budget and stick to it. It’s pretty hard to find a financially successful person who hasn’t at some point needed budgeting or learned how to save.

After you know where your money comes from and where it goes, it’s time to save and build an emergency fund. Having a suitably sized emergency fund ensures you have enough money to pay for emergencies and don’t need to resort to high-interest debt if something surprising happens.

Speaking of debt, make sure you’re not in over your head with it. A decent amount of good debt (mortgage, student loans, etc.) is acceptable, as long as its payments don’t hamper your budgeting and saving.

The final step to achieving financial security is learning how to invest. Investing creates wealth through compounding returns. Be it real estate, stocks, bonds, or whatever, investing is practically required to create sufficient passive income streams.

Of all the different investing strategies out there, I believe that long-term investing is the most efficient one.

Achieving Financial Independence

After you’ve achieved financial security and gone through all the previous steps, it’s time to strive for financial independence.

In this stage, you build your investments further to grow your portfolio and do what you can to increase your income. The fastest way to achieve financial independence is to cut down on your expenses and live frugally, increase your income, and invest heavily.

It’s also worth mentioning that if the idea is to aggressively build wealth, it’s practically mandatory to take some risk with your investments.

If you invest in something that’s low risk and yields 2-3% per year, it takes a lot of income to get wealthy. For most people, something with more risk and higher expected returns is required.

Achieving Financial Freedom

Once you’ve achieved financial independence, you can begin to build toward financial freedom.

To achieve true financial freedom, you need to have a ton of different income streams. Usually, these include passive income streams like rent, dividends, interest, and business income.

Needless to say, this last phase requires a lot of time to achieve. The way compounding works is that the effect becomes greater over time. What it means is that you’re most likely going to spend a long time in the financial independence phase. It’s simply because it takes time to accumulate wealth.

So, the best and most probable way to reach financial freedom is to focus on the first two phases, take care of your investments, and let time work for you.

What Steps Can You Take Immediately

By now we’ve covered all the basics. Knowledge is nothing without action, so let’s see what steps you can take right away!

The very first thing you can and should do is to calculate how much money and income you would need for financial security, independence, and freedom. We take a closer look at how to calculate these later in this post.

After you know how much money you need, you can come up with a financial plan. Once you know what your plan is, you can plan your budget accordingly.

All the financial planning in the world is worthless if you don’t know how to handle your finances. Therefore, you should strive to become financially literate. It’s the number one skill for anyone who wishes to become wealthy.

You can also start to read about investing as soon as possible. Having a well-diversified investment portfolio is one of the cornerstones of financial success.

How Much Money Do You Need

Financial Security. You can calculate the money needed for financial security by simply taking note of all the monthly expenses you absolutely need and have to pay. Track these expenses for six months and see what’s the average amount. Your average is your financial security number.

Financial Independence. To calculate your financial independence number, take your basic necessity expenses and add to them the things you don’t necessarily need but would like to have.

Financial Freedom. Once you’ve calculated your basic necessities and the things you like to have, it’s time to shift gears and kick up a notch. In this third and final phase, you can list ALL the things you might want to have. Anything goes.

For some people, this number can be a lot lower than one might think. Then again, some people like to live large and pump up those numbers.

In the end, it doesn’t really matter how big the numbers are, they’re there to give you something to strive for.

What Are the Benefits of True Financial Freedom

Freedom. The main reason why I invest is to live my life the way I choose to. Investing and being financially smart is what offers you the possibility of becoming truly independent.

When you’re independent, you can choose what kind of work you want to do because salary is no longer an issue. If you don’t want to work anymore, you can focus on raising your kids or doing other things that give your life real meaning. That’s freedom.

The feeling of security. Having your finances in order gives you peace of mind. Needless to say, constantly stressing over money is bad both for your physical and mental health.

When you’ve taken care of your finances, you know you’re going to be okay. Even if your house burns down, you have the means to rebuild and continue.

It’s about time. Time is something you can’t buy. Or can you? Well, as it turns out, you can.

When you have your finances in order, you can afford to work a little less and do things you truly enjoy (unless you enjoy your work, of course).

Having money also allows you to spend it on your health. Things like eating quality food and training regularly increase your lifespan considerably.

So, even though we can’t add more hours to our days, we can use our money to prolong our lifespans and make the most of the time we have.

That’s the most motivating goal there is if you ask me.