Many investors cite the famous “Don’t fight the Fed” phrase when talking about the market.

Let’s see what the phrase is all about, and whether there is anything useful in it for the long-term investors.

Definition of Don’t Fight the Fed

Originally, the Fed (Federal Reserve aka the Central Bank of the U.S.) was established to improve the stability of the financial system.

According to Wallstreetmojo.com, the phrase ‘Don’t fight the Fed’ means that investors shouldn’t oppose or underestimate the actions of the Federal Reserve

The phrase was (most likely) first introduced by Martin Zweig in the late 1980s, so it’s been around for a while now.

It’s based on the idea that the Fed has a strong effect on the stock market when it adjusts the interest rate levels and/or the money supply. Therefore, when the Fed lowers interest rates, investors would be better off by being more aggressive, and vice versa.

Has ‘Don’t Fight the Fed’ Actually Worked?

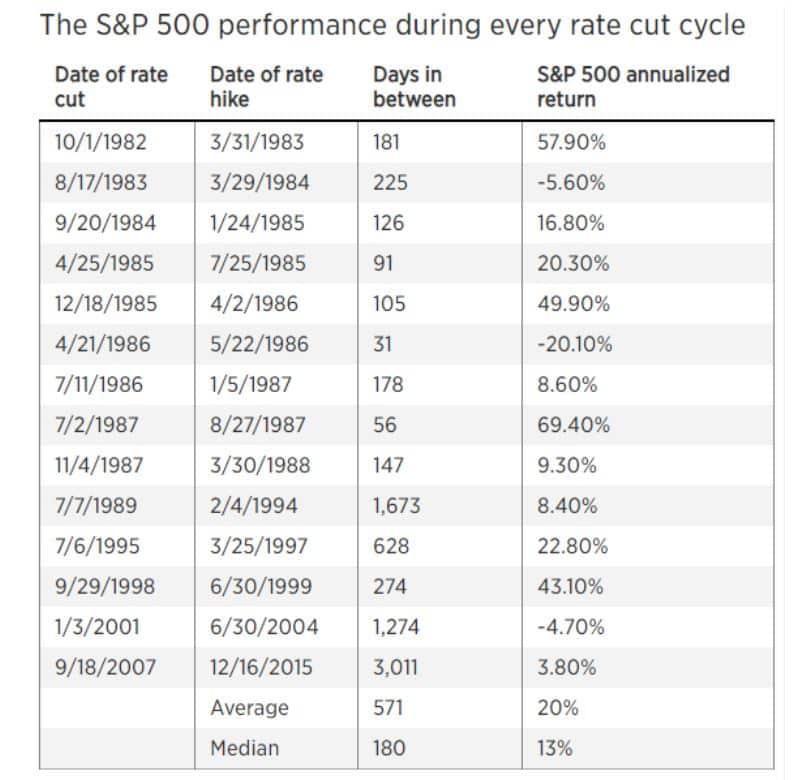

According to CNBC, stocks have indeed done extremely well during periods of lower interest rates. Between 1982 and 2015, the average annual return for the S&P 500 during interest rate cuts has been 20%. The median return was 13% annually:

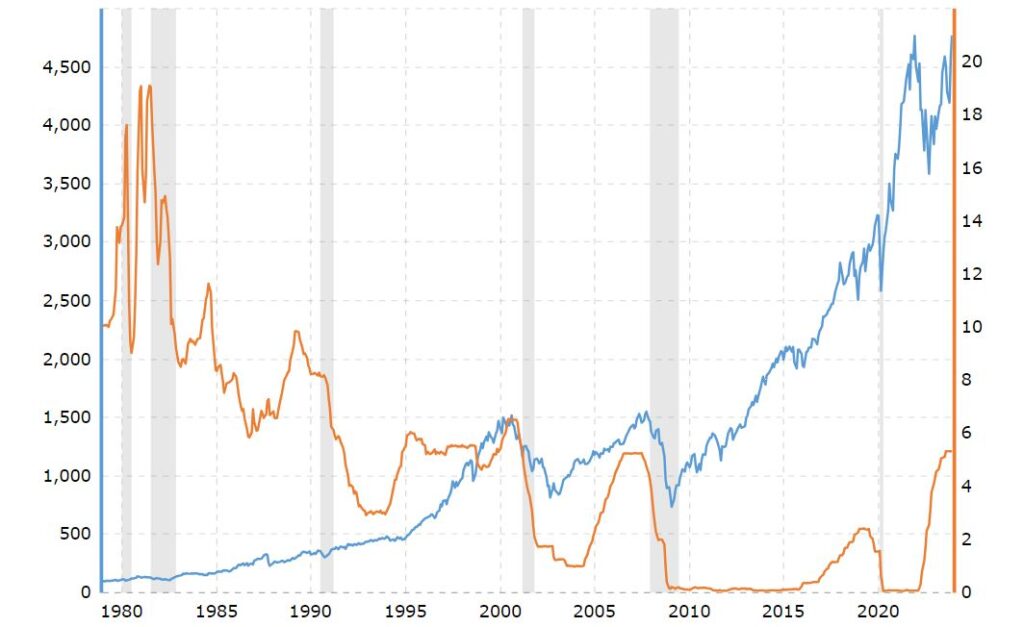

The same effect of lowering interest rates can also be seen in this chart from Macrotrends.net:

As you can see, stocks have indeed recuperated after interest rate cuts. It should be remembered, though, that the Fed has a lot more tools at its disposal than just controlling the interest rates. After the COVID-19 crisis, for example, the Fed purchased immense amounts of debt securities to boost the economy.

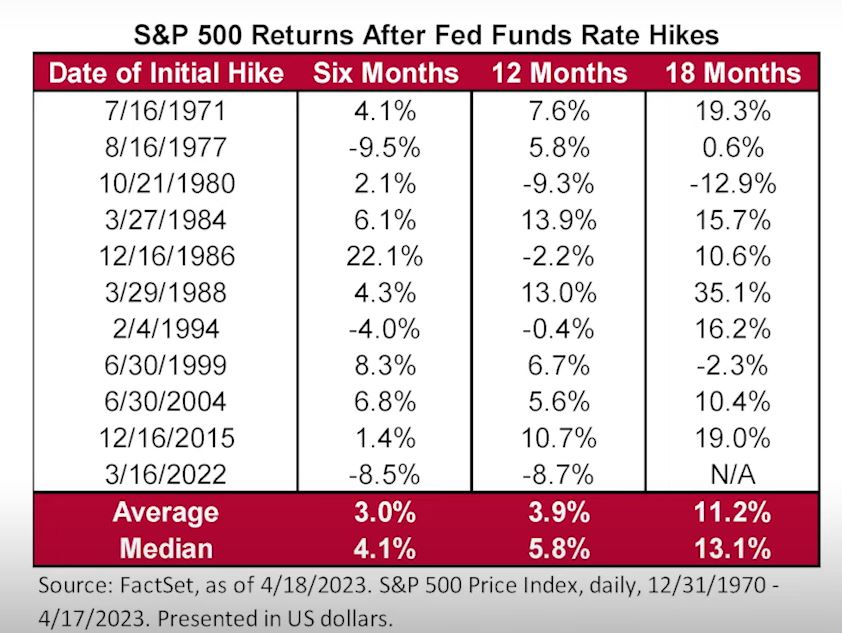

But is this simple? Well, I’m afraid not. As Ken Fisher shows in his book Debunkery, interest rate adjustments don’t have a large long-term effect on the financial markets.

As you can see from the chart below, the S&P 500 has also done quite well after the Fed has raised interest rates:

What Does It All Mean for Long-Term Investors

It’s pretty obvious that lowering the interest rates to zero and shovelling money into the stock market tends to cheer up stock prices. Historically speaking, investors have been well off not fighting the Fed.

While the effect that Fed has on the market is indisputable, there are a couple of things to consider.

First, the Fed is not the only thing affecting the stock market. Considering how complex the stock market is, making investment decisions based purely on the actions of the Fed is not advisable.

Second, as was shown before, the long-term effects of interest rate changes on the stock market may not be as easily predicted as one might at first think.

Yes, the market does seem to do better when the Fed aggressively cuts interest rates, but it also does reasonably well after tightening monetary policy.

The conclusion here would be that long-term investors shouldn’t bother thinking about the Fed too much.

In general, investment decisions are based on either company fundamentals or, if you’re a regular fund investor, a long-term dollar cost averaging. A successful long-term investment strategy shouldn’t be made or broken with market trends or the actions of the Fed.