Double a Penny For 30 Days – A Tale of Compounding

You’ve probably come across the tale about the game of chess and its inventor. The story goes that when chess was first invented and presented to a king, the king was so impressed that he let the inventor choose any reward he wanted.

The inventor requested as a reward a single grain of rice, placed on the first chess square and with a request that it would double in every consequent square.

The king accepted gladly but came to regret his decision when he realized the true amount of rice he would have to come up with.

Nowadays, the tale has mostly been replaced with a simple question:

Would you rather have a million dollars right now or a penny a day that doubled every day for a month?

The point of the question is to illustrate the power of compound growth.

What is Compounding?

Compounding happens when your initial investment and its reinvested earnings start to generate more earnings, and so on.

To achieve compounding returns, your initial investment needs to remain untouched, and you must keep reinvesting the profits from your original investment.

After that, you need only time and patience – which often tends to be the hardest part.

Albert Einstein described compounding as the eighth wonder of the world. If there is someone you probably shouldn’t argue mathematics with, it’s Albert.

The Penny Question

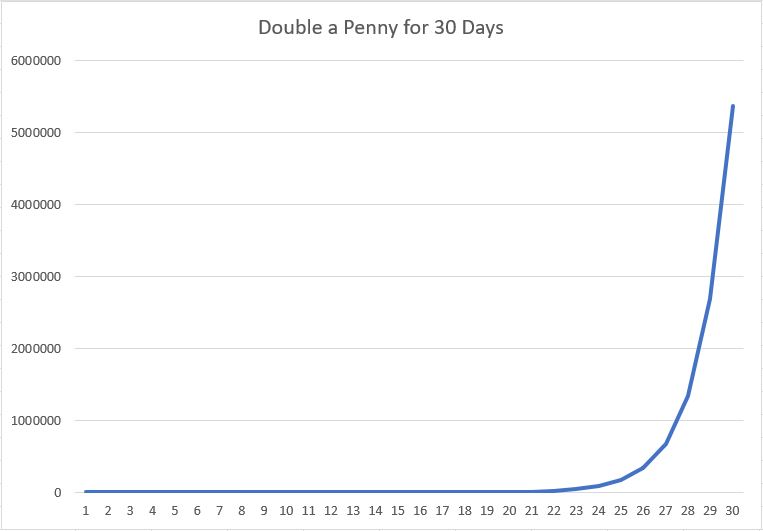

Let’s demonstrate the effects of compounding by taking a closer look at what happens when you double a penny for 30 days.

As we can see, there’s not much going on before day 25. On the first day, a penny is a penny, or $0.01.

On the 15th day, doubling in value every day, our penny has grown to $163. Five days later it’s reached $5242.

10 days later, when the month is up, the amount has suddenly increased to $5,368,709.

What’s most interesting is that the day before, on day 29, our penny is worth $2,684,354. It took 29 days to get to $2,684,354 but only one day for that amount to double.

So, the longer the time frame, the greater the effect of compounding. But how strong exactly is the compounding effect?

The Power of Compounding

One of the reasons why people are so fascinated with the rice tale and the penny question is that the human mind doesn’t do well when it comes to understanding compounding.

Most of the natural phenomena we come across are not exponential. Things like trees and grass only grow for a certain amount per year. If they would grow exponentially, we would all drown in green.

Exponential growth is not natural, which is why our mind is not accustomed to handling it.

I think the best way to understand the tremendous power of compound growth is through a case study of one of the most successful investors of all time, Warren Buffett.

Warren’s Buffet of Returns

What makes Warren unique is that he’s managed to achieve an average 20% annual rate of return for about 60 years. During this time he has achieved a net worth of over $100 billion.

While 20% annual return is an exceptional feat itself, the most impressive part is the duration Warren has managed to maintain that rate of return.

In his excellent book, The Psychology of Money, Morgan Housel examines the power of compounding returns in Warren’s investing.

According to Housel, Warren would only have a net worth of about 12 million dollars, if he had started investing in his 30s and stopped when he turned 60.

Even more interesting is that it took Warren about 40 years (age 56) to earn his first billion. Earning the next billion took only about 4 years.

After that, his net worth increased from 2 billion dollars to about 117 billion dollars in just over 30 years. So, 40 years of work for 1 billion dollars vs. 30 years of work for 115 billion dollars.

That’s the power of compounding.

When we look at the penny example, we can see exactly the same thing. Of the $5,368,709 over 87% percent was accumulated in the last three days. In other words, it took 27 days to gain just 13%.

Now, you might think that Warren or any other investor or company would sooner or later take over the world with all the compounding returns they make. Fortunately, they won’t.

Limits of Compounding

There was one minor detail I left out of the story about chess and its inventor. As the king and his treasurer counted the rice owed to the inventor, they soon concluded that they had been outwitted.

Realizing that his kingdom would be bankrupt, the king decided the best approach to solve the awkward situation was to execute the inventor. And so, he did.

Now, the story may or may not be true, but the lessons it offers are.

Exponential growth can’t be sustained forever.

If there would be a single investor who achieved endless exponential growth, he would soon own the whole world and then some.

Obviously, that kind of growth will not be allowed to endure, which is why there will, at some point, be a natural limit for compounding.

Luckily, compounding can easily last a lifetime, so there’s no need to worry about the laws of the universe spoiling your hard-earned compounding returns.

Compounding in Investing

As we learned from examining Buffett, the most important thing for compounding is time. Warren is not the greatest because of his returns but because of his consistency and time in the market.

Time

As an investor, you shouldn’t aim for extremely high occasional returns. Instead, you should strive for consistent and steady long-term returns and let compounding do the work for you.

The longer you let compounding work, the greater the effect is. More time means more money.

For an investor, it’s vital to start investing early to get achieve compound interest.

As was illustrated in the penny graph, you shouldn’t expect great returns at the beginning of your investing journey. In fact, unrealistic expectation about returns is one of the most common mistakes in regular fund investing.

If we compare the penny example to investing and consider the 30 days as 30 years, it will take quite a few years to get significant results.

That’s why investing is so hard at the beginning. You’ll make most of your returns in your later years.

Investing is like everything else in the world, it’s hard at the beginning and when compounding starts to work, it gets easier. The trick is to have discipline and keep at it for a lifetime.

Reinvesting Profits

For compounding to work, it’s crucial that you reinvest your profits. There can be no compound interest if are no reinvested profits.

This is why, for example, ETF investors are often better off with accumulating funds instead of distributing funds.

Accumulating mutual funds reinvest dividends back into the fund automatically, thus avoiding unnecessary taxes and making compounding easier.

Distributing funds, on the other hand, pays all the dividends to investors. After that, it’s left to the investor to decide whether to invest the dividends back or spend them somewhere else.

Even if the investor decides to reinvest his dividends, he still had to pay dividend taxes, which unnecessarily diminishes the compounding effect.

Summary

Compounding is what happens when your returns start to generate more returns. It’s one of the most powerful effects an investor can achieve.

Unfortunately, some investors never fully comprehend the power of compounding and the time it takes to achieve it.

To achieve compounding returns, you need to reinvest your returns. After that, you need a fair amount of time and patience.

Compound interest is a mathematical fact that can and will be achieved through disciplined and long-term investing.

So, the next time you’re losing faith in long-term investing, remember the tale about the inventor of chess and the magic penny doubling everyday.