In personal finances, it’s hard to find a thing that’s as important as successful budgeting.

While the basic principles behind budgeting are simple, there are quite a few different personal budgets to choose from.

Choosing the right budgeting method can be a difficult task because we all have our own financial situations.

Here I’ve listed the 7 different types of personal budgets you can choose from when creating your own budget.

If you’re new to the world of budgeting, I have also written a whole guide on creating a personal budget you can read through.

Traditional Budget aka THE Personal Budget

I decided to put the most common budget type first, which is the traditional budget. The traditional way of budgeting is simply subtracting your monthly expenses from your income.

The traditional budget is great for beginners and for those who just want to know how they are spending money.

It’s worth noting that the expenses you list here are usually the very basic kind, like bills, debts, and food expenses. Then, if you have some money left over, you can either spend it or save it.

As you can see, of all the types of personal budgets, the traditional budgeting method includes the least amount of planning and is the most simple budgeting method there is.

If you have clearly defined financial goals you want to achieve, this might not be the right budget system for you.

For achieving clear financial goals, you might want to consider some other budgeting methods.

Zero-Based Budgeting Method

The zero-based budgeting method is where you assign a task for every dollar you earn. So, it’s not about spending everything you earn, but rather deciding what you use your money for.

For example, you can categorize your expenses into categories like bills, groceries, and saving, so that at the end of the month, you have nothing left. Compared to the traditional budget, there’s a lot more planning involved.

It’s important to know that there’s a significant difference between a zero-based budget and living from paycheck to paycheck.

In the latter, you’re merely getting by. A zero-based budget, on the other hand, allows you to meet your financial goals by allocating your money accordingly.

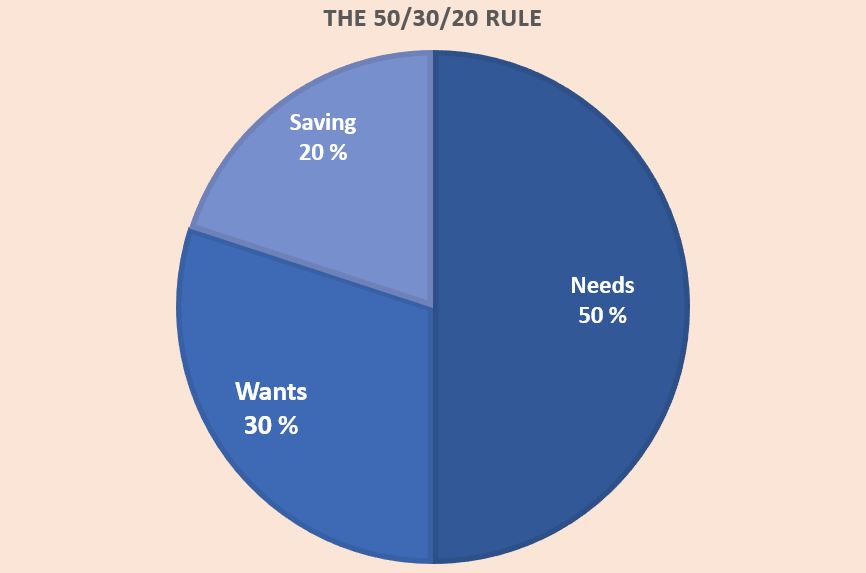

The 50/30/20 Budget

The idea behind the 50/30/20 budgeting model is to divide your after-tax income into three spending categories. It’s the most well-known percentage budgeting method there is.

According to the rule, you should spend 50% on your needs, 30% on your wants, and put aside 20% for unexpected expenses and investments.

The percentages are only guidelines and depend on your financial goals, but they give you a general idea of how your monthly after-tax income should be allocated.

What’s essential in this budgeting rule is to know how to separate your wants and needs from each other.

Needs are the kind of necessary expenses that you absolutely have to pay, like rent and food. Wants are the non-essential expenses s you don’t necessarily need but can increase the quality of your life. These can be things like traveling, dining out, shopping, etc.

After you’ve paid for all your needs and discretionary expenses, you can put the remaining money toward your savings goals.

The 50/30/20 budget system gives you clear guidelines on how you might want to categorize your income and makes sure you have some money left over for saving and investments.

Pay Yourself First Budget AKA The Reverse Budget

The pay-yourself-first budget or the reverse personal budget method is a strategy where you set money aside for your saving goals first and use the rest of your money for expenses.

You can, for example, assign 10% or 20% of your monthly income for saving and investing, and use the rest on your wants and needs.

The idea is that you achieve your saving goals right away and can spend what’s left as you see fit. What this means is that you don’t need to track your spending habits, you just spend what’s left.

The upside of the pay-yourself-first budget method is that it can be a very effective way to achieve financial success as well as financial independence because you make sure you will always reach your savings goals.

It can also be extremely useful in building an emergency fund or saving for a down payment.

The downside is that the pay-yourself-first method works best for those who already have a budget surplus. If your money is tight and you pay yourself first, there’s always the risk that you don’t have enough money for your expenses, and you need to use debt.

So, before you implement this method, make sure you have a strong financial status.

Envelope System Budget

The envelope budgeting system gets its name from money-stuffed envelopes.

How the system works is that you categorize your cash envelopes into different spending categories and decide how much money you’ll spend on each.

The idea is that when you’ve spent all the cash in a certain envelope, you can’t spend any more in that category.

I think using cash has a huge mental impact on your spending. When don’t use cash, we can’t really visualize how much many we’re spending. When you use cash for purchases, it becomes a lot more painful to spend money.

Nowadays, paying bills and other purchases with cash can be a bit problematic, though, which is why some people have shifted to using budgeting apps like the Goodbudget app, which uses an enveloping budgeting system.

It’s worth noting that the envelope method doesn’t work so well for fixed expenses because they usually stay the same month after month.

Of all your expenses, it’s the most convenient to include your non-essential expenses in your envelope system because those are the expenses you can affect.

Extreme Budgeting

The extreme budgeting method (or no-spending budget) is for people who wish to achieve their financial goals quickly. As the name suggests, extreme budgeting has an immensely restricted spending budget and is not for the faint-hearted.

The idea is to use your money on what is absolutely necessary and cut back on everything that’s not. In other words, you spend money only on your needs, not wants or any other unnecessary expenses, and prioritize savings.

It also involves paying as little as possible for your needs and finding ways to save on those expenses.

As you can imagine, you can save a lot with a no-spend budget. For saving money and especially getting through temporary financial emergencies, this is the way to go.

I wouldn’t recommend using extreme budgeting in the long term, though. When you cut out everything that’s not absolutely necessary, you also cut out quite a bit of the things that bring pleasure to your life.

While some individuals thrive on living on an extremely tight budget, it can eventually be too much for others.

The Debt-Avalanche Method

The debt-avalanche method is a goal-oriented budgeting plan, where the goal is to pay off your highest interest-rate debt as soon as possible. Usually, it is credit card debt you pay off first.

To achieve this, you first find out how much money you have available for paying debts, pay the minimum debt payments on all your loans, and use your spare money to make additional payments to the debt with the highest interest.

The idea behind the method is to save money on interest payments and stop expensive debt from accumulating further.

If you wish to achieve maximum benefit in your debt repayment, you might want to combine the avalanche method with another goal-based budget like the 50/30/20 rule to pay off the debt as fast as possible.

The downside of this approach is that while it’s an extremely efficient way to pay off your debts, it does require quite a bit of willpower in the long term.

Luckily, if you do it right, you don’t need to do it for long.