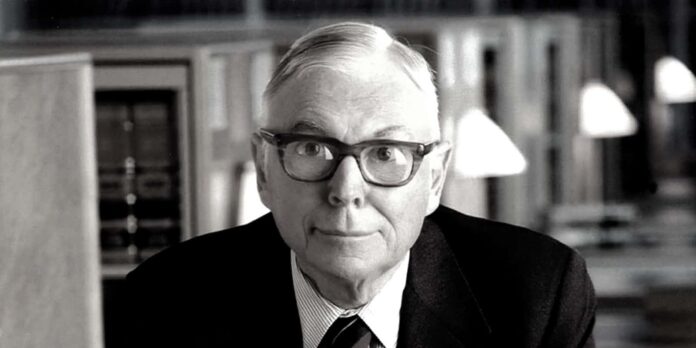

One of the giants of the investing world, Charlie Munger, passed away in November this year.

Known as the vice chairman of Berkshire Hathaway, Munger was famous for his quick wit, sharp intellect, and down-to-earth mindset.

The very core of Munger’s investing philosophy is picking great companies at bargain prices and holding them for a long time.

He also had a tremendous gift for expressing complex subjects in a simple, no BS manner.

Here I’ve gathered the most famous quotes from Charlie on rational long-term mindset that will no doubt inspire all investors out there.

Enjoy!

“The big money is not in the buying or selling, but in the waiting.”

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotions under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.”

“It’s remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

“Someone will always be getting richer faster than you. This is not a tragedy.”

“It’s waiting that helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

“Lifelong learning is paramount to long-term success.”

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder and you deserve the mediocre result you’re going to get.”

“Those who keep learning, will keep rising in life.”

“Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.”

“The world is full of foolish gamblers, and they will not do as well as the patient investor.”

“Neither Warren nor I are smart enough to make decisions with no time to think. We make actual decisions very rapidly, but that’s because we have spent so much time preparing ourselves by quietly reading.”

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

“It takes character to sit with all that cash and do nothing. I didn’t get to where I am by going after mediocre opportunities.”

“You have to keep learning if you want to become a great investor. When the world changes, you must change.”

“If you want to be a good investor, you have to have a long-term perspective. You have to be willing to be very patient and wait for the right pitch. And when you get the right pitch, you have to be ready to swing hard. You can’t just take a little teeny tiny swing. You have to swing with all your might.”

“I always laugh when people talk about how they’re going to learn how to invest. It’s not a subject you learn in a few weeks. It takes a lifetime to learn how to invest properly.”

“Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things.”

“The great investors are always very careful. They think things through. They take their time. They’re calm. They’re not in a hurry. They don’t get excited. They just go after the facts, and they figure out the value. And that’s what we try to do.”

“If you’re going to invest in stocks for the long term or real estate, of course there are going to be periods when there’s a lot of agony and other periods when there’s a boom. And I think you just have to learn to live through them. As Kipling said, treat those two imposters just the same. You have to deal with daylight and night. Does that bother you very much? No. Sometimes it’s night and sometimes it’s daylight. Sometimes it’s a boom. Sometimes it’s a bust. I believe in doing as well as you can and keep going as long as they let you.”

“There are huge advantages for an individual to get into a position where you make a few great investments and just sit on your ass: You are paying less to brokers. You are listening to less nonsense. And if it works, the governmental tax system gives you an extra 1, 2 or 3 percentage points per annum compounded.”

“Mimicking the herd invites regression to the mean (merely average performance).”