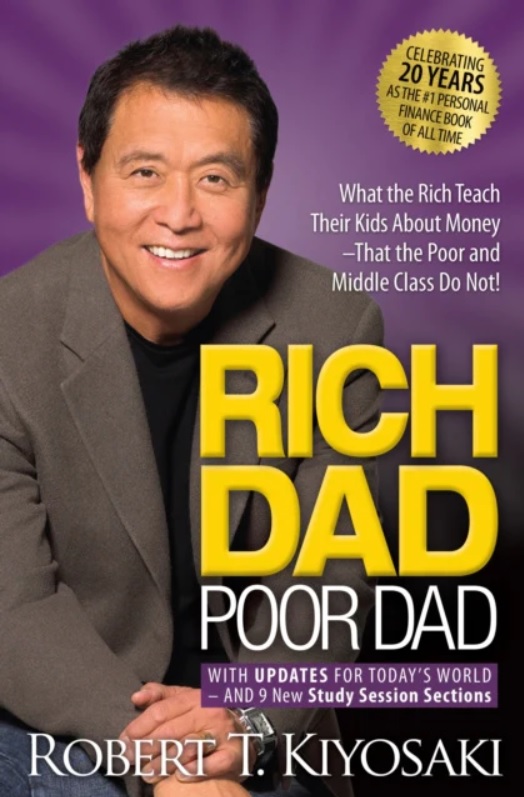

If you’d go and ask random people to name one personal finance book, most of them would say Rich Dad Poor Dad by Robert Kiyosaki.

The book is built around the idea of Kiyosaki’s real father (poor dad) who was an educated person in all but financial matters. The other main character is the rich dad, an entrepreneur with a flair for drama, who teaches Robert about accumulating wealth by becoming an investor.

The main message of the book is that you can create enormous wealth through financial education.

Rich Dad Poor Dad has sold over 40 million copies in more than 100 countries, making it the number one personal finance book ever written.

So, the question is: What is Rich Dad Poor Dad all about, and does the book live up to its reputation?

Let’s start by looking at the book’s most important lessons.

Lesson 1: The Rich Don’t Work for Money

The first lesson is all about working for money vs. letting money work for you and avoiding the so-called “rat race”.

According to Kiyosaki, the poor and middle-class work for money throughout their lives are doomed to dwell in the rat race while rich invent money and find different ways to make money work for them.

What’s important is learning about money through financial education so you can use it to work for you.

Overall, I think the mentality of this lesson could be reduced to the sentence: “A job is only a short-term solution to a long-term problem”.

While I don’t believe that all who work for a wage are idiots, there’s an undeniable logic in striving for financial independence by building passive income streams.

It’s far better to use a salary to build other sources of income than to just spend it on whatever happens to be desirable at the moment.

Of course, in reality, the rich often work a hell of a lot for their money as well as let their money work for them. You can have it both ways.

I’m also a huge advocate of the importance of financial literacy, so the idea of learning about money and the economy hit pretty close to home.

Lesson 2: The Importance of Financial Literacy and Financial IQ

I think the greatest lesson in the book was that it’s not how much money you make, it’s how much you get to keep. Therefore, you should aim to own assets, not liabilities, and know the difference between the two.

According to Kiyosaki, this is what being financially literate is all about, and you should improve your financial literacy as much as you can. The point is that rich people acquire assets while the middle class acquire liabilities, which keeps them from getting wealthy.

The difference between assets and liabilities is that assets either appreciate in value and/or produce additional income. Liabilities, on the other hand, cost you money to maintain. For example, stocks are considered assets, while owning a car is considered a liability.

Kiyosaki also offers many examples of how income statements, balance sheets, and cashflows differ between the rich and the poor.

The idea is to own a lot of assets with a minimal amount of liabilities. It doesn’t take a financial genius to understand the concept but, unfortunately, most people act exactly the opposite.

In the end, it’s mostly about successful cash flow management and not losing money needlessly.

Lesson 3: Mind Your Own Business

The third lesson is all about making your money work for you. The main idea is to keep your day job but start to buy as many assets on the side as you can.

Otherwise, you’ll be working for someone else for the rest of your life which, as Kiyosaki puts it, is the number one reason for financial struggle.

A common misconception of this part of the book is that Kiyosaki would advise everyone to start their own business. That’s actually quite far from the truth since he specifically says he doesn’t recommend starting a business, knowing how much effort it can take.

Minding your own business means minding your assets instead of your income. This way you reduce your liabilities and aren’t dependent on your salary.

To put it in another way, minding your own business is striving for passive income and financial independence by investing your money in assets that appreciate in value.

Review

So, does Rich Dad Poor Dad live up to its reputation? I’d say it does.

When we think about the main message of the book, it’s all about becoming financially literate, working hard, obtaining assets, and creating wealth through investing. That’s all extremely useful stuff.

The book has a lot of things that are useful to beginners, but it’s also important to stay critical.

Therefore, there are a couple of things I’d like to point out.

The Rich Dad

A big portion of the book is written mostly in dialogue form between the rich dad and Robert. Now, there’s a lot of speculation about whether the rich dad really influenced and mentored Kiyosaki or not. As I Googled all this, I didn’t really get a straight answer from anywhere.

Whatever the case, it’s safe to say that most of the dialogues in the book are no doubt fictional.

This is due to the fact that Kiyosaki was about 10 years old during those discussions and is most unlikely to remember them even if they did happen as described.

Then again, does it really matter? I’d say no.

The idea is to make the message clear, and in that, the book does succeed.

When it comes to the character of the rich dad, I believe there are two types of people.

There are those who find him inspirational and those who find him intolerable in all his smugness. Somehow, I found myself being both.

The (Lack of) Investment Advice

Surprisingly, the book doesn’t really offer any real advice on how to accumulate assets. Kiyosaki does mention real estate investments about a gazillion times, but that’s pretty much it.

As a beginner investor, I would be a little confused after reading the book since I’d know I needed to buy assets but wouldn’t have any idea where to begin with.

His own investment strategy (at least at the time) is to own real estate and stocks in start-up companies. His holding time in these stocks is less than a year.

If you’ve read anything I’ve written before, you know that I’m all for long-term investing. Investing in start-ups for a couple of months is pretty far from that.

So, not surprisingly, I wouldn’t recommend following Kiyosaki’s strategy. As always, it’s best to build your own investment strategy, not blindly adopt someone else’s.

Education Is Not Useless

Kiyosaki also makes it sound like he doesn’t really appreciate any formal education. What he’s basically saying is that education doesn’t prepare you for financial success, it prepares you to work for someone else (and live miserably, etc, etc).

Then again, he does hold things such as accounting and analyzing companies in high regard, and they do teach those things in schools, so there’s that.

In any case, I wouldn’t dismiss traditional education so easily. Overall, you tend to get better jobs when you have a proper education, and that correlates strongly with higher income levels.

Therefore, the chances are you’ll have more money to invest in your assets when you’re educated and have a high income.