According to American Psychological Association, 72 percent of Americans have reported feeling stressed about money.

72 percent.

What it means is that almost 4 out of 5 people in the U.S. actively worry about their financial situation and have reported that it affects their quality of life.

When people say that “money stress is killing me”, it can be true literally.

Stressing about money is a major source of health problems like chronic stress, heart disease, and high cholesterol. Overall, financial stress has a great impact on your mental and physical health.

I believe that some financial difficulties could be solved and, above all, prevented quite easily.

That’s why I decided to introduce eight efficient and proven ways to reduce money stress and prevent financial difficulties.

Become Financially Literate

The more you know, the more confident you will feel.

Becoming financially literate is by far the best thing you can do to avoid money problems and prevent financial worries.

It is the ability to understand things such as money management, budgeting, and investing. Being financially literate is knowing how to function in a world that’s governed by money.

Nowadays, finances are everywhere. Whether you want it or not, it’s a major part of your life.

Even if you don’t really care that much about personal finances, it’s important to at least understand the basics.

If you’re serious about being smart about money, you can check out these books that will undoubtedly make you financially literate in no time!

In addition, you might find this guide to financial literacy from Investopedia.com extremely helpful.

Know Your Enemy

Your stress won’t go anywhere before the reason for it does. The first thing to get rid of financial stress to do is to recognize the things that give you the most stress.

These can be things like too much debt, too many expenses, insecure income, etc.

I would strongly recommend writing down a list of all the financial issues that stress you out. After that rearrange them in the order of how long it takes to solve them.

Doing this gives you a clear picture of the problems you can start to fix right away.

Peace of mind comes from action, and the most important thing is to take the first step!

Create a Budget

Ironically, money-related stress is often not caused by the lack of money but by the lack of control.

Sometimes people aren’t even sure where their money is going. It just always seems to mystically disappear at the end of the month and run out.

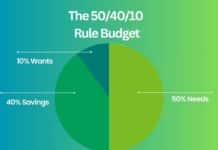

The best way to combat erratic spending and lack of control is to come up with a budget and stick to it.

Having a budget prevents overspending, helps you save money, and prepares you for financial emergencies.

After you’ve created your monthly budget, you should have a pretty clear picture of how you spend money.

If you’re new to budgeting, you can use this list of the most common types of budgets to help you get started!

Learn How to Save and Build an Emergency Fund

After you’ve created a sound budget and made sure you have enough money for living expenses and other basic needs, it’s time to start saving and building an emergency fund.

Despite its dramatic name, an emergency fund is just money that you put aside in your bank account for surprising expenses.

In other words, it’s your financial safety net.

The point of having an emergency fund is that you can pay for surprising expenses straight without having to resort to expensive debt like credit card debt.

It’s safe to say that most money problems could be handled with an emergency fund before they even begin.

Equally important is to start rebuilding your find right after you’ve taken money from it.

Create a Financial Plan

If you wish to get your personal finances in order to less stress about money, you need to come up with a financial plan.

Your financial plan should include things such as creating a budget and your personal financial statement, defining your financial goals, and coming up with an investment plan.

When you do it correctly, you know exactly what your financial situation is, how much debt you have, and what are your financial weak points.

Creating a sound financial plan is also a significant stress reliever.

It provides you with clear financial goals, exposes your financial weak points, teaches you financial skills, and above all, greatly reduces money-related stress.

Deal With Debt

If I were to name one thing that causes the greatest money-related stress known to man, it’s being over your head in debt.

While debt can be used to significantly enhance your quality of life, it can also be the very thing that ruins it.

Especially with expensive bad debt like credit card debt, it’s the interest payments that will start to accumulate and eventually become a massive burden.

The rule of thumb with debt is to pay the most expensive debt first. The idea is that the less interest you have to pay, the better.

How this is usually done is that you make the minimum payments on debt with the lowest interest and use that money to pay off the high-interest debt.

Debt problems are a lot easier to prevent than to deal with, so if you start to feel like you have a problem with debt, it’s wise to look for credit counseling immediately.

Put the Bottle Down

Okay, this one’s not financial advice per se, but it is something that’s closely related to money stress.

Some people turn to drinking when they try to manage financial stress, and it’s unfortunately also the very thing that often causes long-term anxiety.

Drinking screws up your brain chemistry and makes problems seem about a million times bigger than they actually are.

It also makes it more difficult to take initiative and actively solve your problems, which can turn a bad situation into a complete disaster.

So, putting the bottle down is one of the fastest and most reliable ways to reduce stress and anxiety.

Not to mention it’s a pretty costly habit, which means you’ll probably start to save money right away.

Seek Professional Help

Sometimes financial problems and money worries get so bad that you feel completely paralyzed and feel like there’s nothing that can be done.

Luckily, there’s always a way out. Even if you can’t see it when the times are tough.

It often takes someone from the outside to make rational decisions and to see things clearly.

If you find yourself constantly worrying about your personal finance situation, it’s wise to consult a financial coach or a debt counselor if things get bad.

Because financial anxiety can lead to severe mental health issues as well as serious physical symptoms, it’s equally important to seek both financial and medical help if needed.

Seeking help can be an extremely difficult thing to do, but it’s better to suffer the pain of asking for help than go bankrupt or jeopardize your mental health.