What is Financial Literacy?

Being financially literate is understanding and knowing what to do with personal finance concepts like money management, budgeting, and investing.

In other words, being financially literate is being smart about money and taking your personal financial management seriously.

When you know how things like debt, budgeting, and investing work, it makes your life infinitely easier and prevents you from getting into financial trouble.

Why is Financial Literacy Important?

Becoming financially literate is the most important thing in managing your personal finances and a cornerstone of your financial education.

Be it applying for a loan, learning how to save, or investing your money, you’re going to need financial literacy skills. In fact, it’s practically impossible to live through your life without benefiting from it.

I’d even dare to say that being financially literate has never been as important as it is today.

One of the main reasons for this is the fact that financial products and services are everywhere. Much more so than they were a couple of decades ago.

Not only are there countless different investment and credit services available, but you also need a whole different set of budgeting skills to achieve financial success in today’s world.

It’s a well-known fact that in most developed countries it’s not so easy to afford basic goods anymore, not to mention buying an apartment or a house.

In fact, it takes a lot more financial skill than most of us like to admit.

It also seems that there’s an ever-growing polarization of financial knowledge, where some people are extremely educated in financial matters, and others are missing the very basics of personal finance.

If you wish to avoid struggling with money throughout your life, becoming financially literate is an absolute necessity.

Consequences of Financial Illiteracy

Based on experience, the first sign of financial illiteracy is getting into too much debt. What’s worse, it’s often the most expensive kind of debt like credit card debt or other high-interest debt.

I think it’s mostly because it takes financial literacy to understand just how expensive bad debt can be, how big of an effect it can have on your life, and how to budget your lifestyle so you don’t need credit.

Financially illiterate people also tend to spend too much, which leads to credit card debt and possibly a bad credit score, or even bankruptcy.

What’s behind all this is the lack of budgeting. Whereas financially literate people know how to successfully create a budget, the people who run into financial trouble usually have no idea where their money is actually going.

Financial illiteracy also makes the world a lot smaller. It’s extremely important and rewarding to be able to read financial news, for example, and to know what’s going on in the world.

Overall, financial illiteracy lowers one’s quality of life.

The Core Concepts in Financial Literacy

So far, we’ve established that financial literacy is important for everyone, which means it’s time to take a look at the most important areas of financial literacy.

The core concepts revolve around financial planning, budgeting, and investing. These are also some of the personal finance basics one needs to know.

Budgeting

As mentioned before, the lack of budgeting is what causes most financial problems, which makes budgeting the most important financial skill you can have.

When you know how to create a budget, you know where your money is going, what are your financial weaknesses, and what goals should you set.

In other words, you know what your financial situation is.

A budget is an estimation of your net monthly income and expenses for a certain period of time. Usually, when we talk about budgeting in personal finance, we refer to one’s monthly budget.

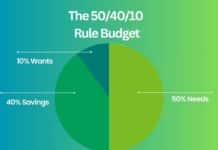

There are several different budgeting methods out there. While they all have their own pros and cons, the principle is the same in every one of them – to track your income and monthly expenses to help you achieve your financial goals.

Usually, you track your spending habits by dividing your monthly expenses into fixed expenses and variable expenses. This gives you an idea of where you actually spend money.

You can come up with a budget by hand or use a budgeting app to help you out. If you tend to make a lot of purchases, using an app might be a lot more convenient.

Saving

One thing that’s equally as important as knowing how to come up with a budget, is saving money. It doesn’t really help you out if you know where your money is going, but you can’t do anything about it.

As I mentioned in my article about the best financial advice for young adults, saving and living within your means is the cornerstone of financial well-being.

Not only is saving required for any major purchases like buying a house, but it also lowers your overall risk of getting into financial trouble.

Also, it doesn’t hurt to have more money in your bank account.

The first and most important step is to open a savings account and build an emergency fund. When you have an emergency fund, you don’t need to resort to expensive debt to pay for surprising expenses like unexpected medical bills.

The best part of saving is that when you’ve done it for a long time, it becomes automatic. In fact, it’s almost impossible not to save, when you’ve gotten used to it.

Simply put, to be able to save is the way to achieve pretty much all your financial goals.

Borrowing

When you borrow money, the most important thing is to know the difference between good debt and bad debt. Good debt is what brings you wealth in the long term and increases your overall well-being.

Good debt includes things like mortgages, business loans, and educational debts like student loan debt.

What they all have in common is that they include some form of a long-term goal. For example, a goal for a better job, a better house, or building a business.

Bad debt, on the other hand, is an expensive form of debt that is mostly used in buying stuff. By far the most common form of bad debt is credit card debt.

While there are differences between credit and debit cards, it’s safe to say that credit card debt and overdraft fees are universally extremely expensive. Combined with common expenses like student loan payments and such, they start to quickly add up.

Investing

A major part of becoming financially literate is to become an investor. The main idea of investing is to put your money into different assets that are expected to generate profit.

If you wish to become financially independent or create any amount of real wealth, you usually need some form of investing.

This is simply because if you keep all your money in your savings account, inflation will eventually erode your savings. Also, the interest rates aren’t usually high enough to really make a difference in your wealth.

While there are numerous different investment assets, this site focuses purely on stocks. This is because stocks are proven to be the best long-term investments there are.

If you’re new to personal finance and investing, I’d recommend reading these investing books to get you started!

Economy

As a financial advisor and economics major, I (less surprisingly) have a soft spot for economics.

In fact, understanding how our economy works is one of those common knowledge things that everyone should know.

For example, imagine being an investor or a house owner without knowing how the interest rates work or what things affect the housing market.

One thing that is often overlooked when people talk about economics is that knowing how the economy works makes it easier to understand the world around you.

How to Improve Financial Literacy?

The best way to improve financial literacy is to read books, listen to podcasts, watch YouTube, and consult a professional financial advisor.

It should be mentioned that the more information we have available, the more careful we should be about what kind of information we consume.

The number one reason why I prefer books over any other platform is that they are time-tested. If a book is read decade after decade, there’s a good chance it has something useful in it.

When it comes to the web, it’s best to stay critical of the information you consume. The links I’ve provided here are for sites and channels I can vouch for any day of the week.

Reading

If you’ve read my posts before, you’re probably aware that I like to learn by reading.

Well, learning financial literacy is no exception.

In finances, learning by doing can lead to expensive mistakes. Usually, our biggest mistakes are made when we know nothing about the subject, and when we think we know everything.

Reading books is, by far, the best way to absorb real and correct information without unnecessary distractions.

I recently wrote a piece about the very best books to improve your financial literacy that I highly recommend you check out.

There are also a lot of different informational websites like Investopedia, Corporate Finance Institute, and NerdWallet.

Listening to Podcasts

For the past years, podcasts have literally been the talk of the town. If you can come up with a subject, you can find a about it.

The beauty of podcasts is that you can do other things while you listen to them, which makes them perfect learning tools for busy people.

I used to listen to a lot of financial stuff while doing housework, for example and found it extremely useful.

The great thing is that since there’s an ample supply of different podcasts, you have tons of different niches to choose from. Whatever you’re interested in, there’s bound to be a podcast about it.

You can use this list from The Investors Podcast to help you.

Tube It

What if someone would’ve told you twenty years ago that you could have a private tutor on any subject in the world appear in front of your face at any time, and you could do this in less than 10 seconds?

Well, at least I would’ve been quite skeptical.

Nowadays, we take this for granted. In the past 10 to 15 years, YouTube has become the go-to resource for learning.

While we use YouTube mostly for entertainment purposes, it’s also an invaluable educational tool.

The reason why I don’t list any channels is that I watch YouTube videos based on the subject I’m interested in at any given time.

For example, if I wish to know how to value a company, I binge-watch videos that seem legit to me – no matter the channel.

Consult a Professional

If you have no interest in studying things yourself but would like to know how things work, you can always consult a professional financial advisor.

For some reason, people sometimes have a high threshold for consulting a professional. For example, one of my clients told me that he thought these services are only for the rich. Nothing could be farther from the truth.

One of the most rewarding experiences a financial advisor can have is building wealth with a client in the long term. So do not hesitate to consult a professional!

Depending on your location, advisory services might vary a little bit, but any advisor worth his salt should be able to help you with budgeting, loans, and investing decisions.

While the field of finance is a highly regulated one, there are differences between advisors.

Unfortunately, some advisors are straight-up salesmen with questionable morals, so if you’re a beginner, it’s best to go see more than one. Especially before you make a big investment decision.