Where Does the 50/30/20 Rule Come From?

The 50/30/20 rule was originally brought to general knowledge by US Senator and 2020 presidential candidate Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth.

The point of the rule is that you don’t need to make things too complicated by overthinking your personal finance strategies.

Warren’s rule offers a simple guideline on how to divide your monthly income across the essentials, the not-so-essentials, and savings.

What is the 50/30/20 Rule About

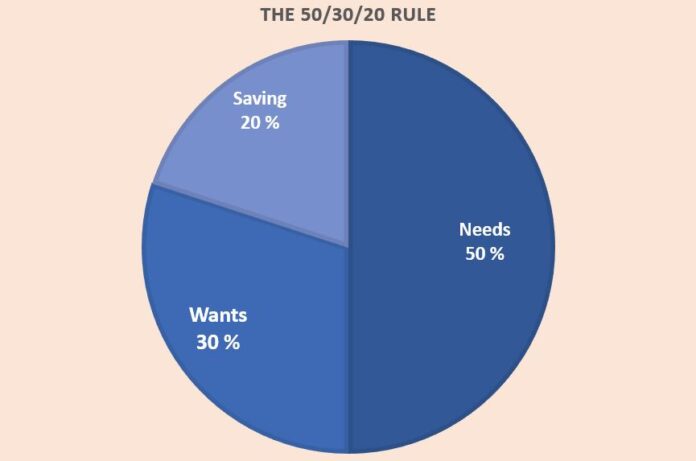

The idea is to divide your after-tax income into three spending categories. According to the rule, you should spend 50% on your needs, 30% on your wants, and put aside 20% for unexpected expenses and investments.

The percentages are only guidelines and depend on your financial goals, but they give you a general idea of how your monthly after-tax income should be allocated.

In fact, knowing where your money comes from and where it goes is an essential part of being smart about money.

Sometimes keeping track of your spending habits can be a hassle. To make things easier, you can use a budgeting app to help you keep track.

When we think about our wants and needs, the first and most important step is to separate the two from each other.

Your Needs: 50%

Needs are the kind of expenses that you absolutely have to pay. These include expenses such as:

o Rent

o Food

o Debt repayment

o Electricity and Gas Bill

o Insurance

What is characteristic of needs is that if you don’t pay them, you’re in trouble. Therefore, it’s only logical that you should reserve the biggest share of your budget for them.

After you’ve paid all your needs, you can allocate the rest of your income to your wants and savings.

Your Wants: 30%

Wants are expenses that won’t get you into trouble if you don’t pay them. These include expenses or purchases such as:

- Traveling

- Dining out

- Shopping

- Streaming services

- Entertainment

Depending on your spending habits, your wants can be a minimal part of your budget, or they can be a massive expense.

There’s no one rule on how much you can spend on your wants, but they should never compromise your needs. Unfortunately, this is not always the case.

Wants are devilish creatures. The more you accustom yourself to a certain standard or lifestyle it’s hard to downgrade. Nevertheless, wants are still non-essential, no matter how important they may feel.

Usually, the troubles begin when your wants don’t match your income. When you live beyond your means, you eventually don’t have any means left.

Your Savings: 20%

Sometimes our expenses and income are nicely balanced, but then something happens, and the income drops. No matter what the reason is, it’s always useful to have savings in case of emergencies.

According to the rule, you should save about 20% of your net income. If you can save more than 20 %, then by all means, do.

The wisest way to do this is to start with saving in your savings account and build an emergency fund, then proceed to invest in different asset classes.

A major part of the content I write is dedicated to saving and particularly investing.

Sometimes people tend to confuse the two. Yes, the terms are almost identical, but there are some differences. When you save money, it usually means putting money into your savings account. The goal of saving is not to gain profit but security.

Investments, on the other hand, are profit-driven. Savings are what keep you afloat and investing is what makes you wealthy.

Should You Follow the 50/30/20 Rule?

Yes, you should follow the 50/30/20 rule. It’s a great place to start your budgeting and offers a well-functioning guideline for everyone.

The best thing about it is that you can adjust the percentages according to your lifestyle, as long as you have enough money for all three areas.

It’s worth remembering that you don’t need to match the rule immediately. If your percentages are way off, just start to slowly work toward the rule.

For example, the most common situation is one where needs and wants consume the whole budget, and there’s nothing left for saving. If you find yourself in this situation, start by writing down your budget and find out where your money is going.

After that, you can decide what expenses are trimmable and act accordingly.

Summary

The most important thing is to be aware of where your money is going. Dividing your expenses into these three categories will definitely help.

If you find that your nonessential expenses eat a major part of your budget, it’s best to prioritize saving and build an emergency fund.

On the other hand, if your needs take more than 50 percent of your budget, you might want to take a closer look at your loans.

Sometimes expensive debt like credit card debt or car payments can become a major burden and consume more than 50 percent of your monthly income. If this happens, it’s usually best to start paying off debt more aggressively, starting from the most expensive ones.

In the end, the way you apply the 50/30/20 rule depends on your post-tax income, financial goals, and your current financial situation.

If you feel like you’re in over your head, it might be wise to consult a certified financial planner to help you.

If you want to start right away, you can use these steps for financial planning you help you out!

Also, remember to be patient – these things take time. The best results are often achieved by making constant improvements, not being overly ambitious, and making decisions you can’t stick to.