Inflation.

The answer to the question of why your interest rate has gone up and why everything seems to be even more expensive than before.

For investors, there are few topics that have been as widely followed for the past year as the level of inflation and interest rates.

Between 1960 and 2021, the average rate of inflation in the U.S. has been 3.8% per year. During the past two years, however, core inflation has surged to 4.7% in 2021 and 8% in 2022.

Looking at the numbers it’s no wonder that investors are worrying about the current inflation level and rising interest rates.

I wrote a text about what inflation is and how it affects your investments, that covers the basics, which is why I won’t do it here.

In short, when inflation rate rises it erodes your purchasing power through rising consumer prices, and usually leads to higher interest rates. Accordingly, when inflation decreases, interest rates fall. Inflation rate can be measured using the consumer price index.

Instead of talking more about the effects and the theory of inflation, this article focuses on finding out what investments are the best inflation hedges during high inflationary periods.

Stocks

Stocks are widely held as the most effective investments to combat inflation. One of the biggest reasons why stocks tend to do well during inflation is that successful companies can shift the rising costs to their product prices and keep growing.

For the past 122 years, the average inflation-adjusted and cumulative return of the S&P 500 has been 6.59%. This means that in the long run, stocks have proven to be an effective hedge against inflation.

Of course, as with everything, there is a catch. Rising inflation affects different companies in different ways. If you invest in individual stocks, the stock you pick matters.

If I would have to come up with particular stocks that are affected by inflationary times the most, it would be growth stocks with weak brands and a lot of debt. The companies would also use crude oil as a resource and would manufacture goods that people can substitute or forego entirely.

On the opposite, companies that have a moderate amount of debt, a respected brand with strong pricing power, and a business model that’s not entirely dependable on commodity prices usually do well during times of high inflation.

What this means is that you could make extra returns by selling the companies that suffer from inflation and buying the companies that benefit from it.

The problem is that it requires the right timing and the right companies. For long-term investors, it’s often not necessary to make portfolio adjustments just because inflation increases.

Then again, if you invest regularly in mutual funds or index funds with a well-diversified portfolio, you don’t really need to worry about any of this.

Real Estate

Owning your own home is probably the most common investment around the globe. There’s been a lot of discussion about whether owning a home is an investment or not – is it an asset or a liability?

I won’t go into all that Rich Dad Poor Dad stuff right now, so let’s simply agree that there are many ways to invest in real estate and they can serve as an inflation protection.

The most common way to own real estate investments is to, well, own real estate. Of course, it may require a substantial amount of capital, which is why they invented REITs (Real Estate Investment Trusts).

Essentially, a REIT is just a company that has a portfolio of real estate investments. The portfolio can include residential real estate, infrastructure, commercial real estate, and basically all sorts of buildings. The business model is quite simple, they own property, rent them out, and eventually pay out most of the profits as dividends to investors.

So, being a publicly listed company, you can easily purchase a REIT in the same way you would purchase any stock – from the stock market.

Statistically speaking, REITs have been a great investment. According to this article by the mighty MotleyFool, REITs have actually outperformed the S&P 500 over the past 25 years by 1.3% with an average annual return of 11.5%.

This would mean in my book that REITs are one of the best hedges against inflation. Although past performance is not an indication of a great future performance, I believe REITs can be a worthy addition to anyone’s investment portfolio.

Gold

Probably the most famous weapon against rising inflation rates is gold. Throughout world history, gold has had almost a legendary status among investors (as well as pirates and Bond villains).

But does the performance match the reputation of the king of precious metals?

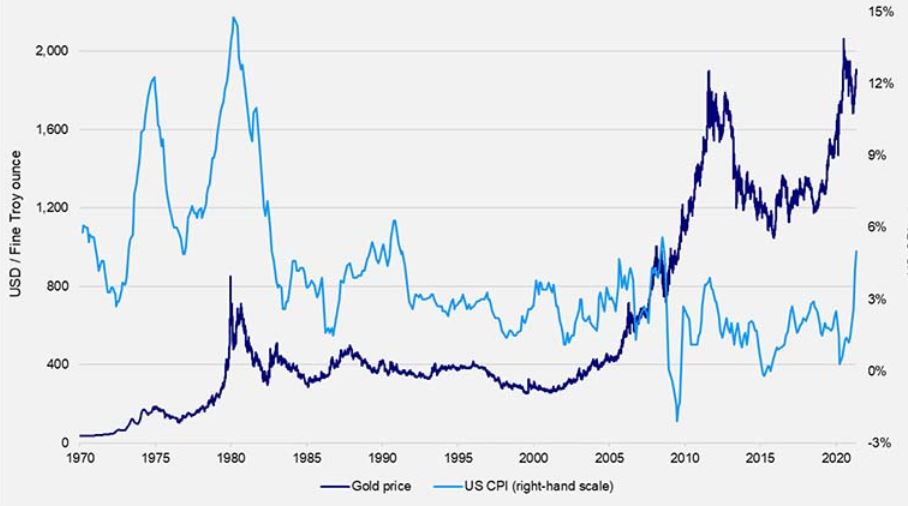

Source: Funds-Europe.com & Bloomberg

According to this graph from Funds-Europe.com, gold has indeed been a great hedge against inflation in the really long term. In the short term, on the other hand, the results are not that clear.

Compared to stock investing, the biggest difference in gold investments is that gold doesn’t pay you dividends and doesn’t actually do anything by itself. This means that it’s a lot more difficult to value gold – it’s worth just as much as someone else is willing to pay you for it.

Thus, the profits of gold come purely from price movements, so the only way to make a profit from gold is to sell it at a higher price than you bought it. If we look at the years between 1980 and 2008, the worst-case scenario is about 25 years of no returns.

One way to get regular returns from investing in gold is to invest in gold mining companies that pay regular dividends. Of course, the mining businesses can be notoriously risky ones, so investors who buy their shares need to do their homework.

Commodities

When people talk about investing in commodities, they usually mean raw materials such as oil, different metals, and agricultural goods.

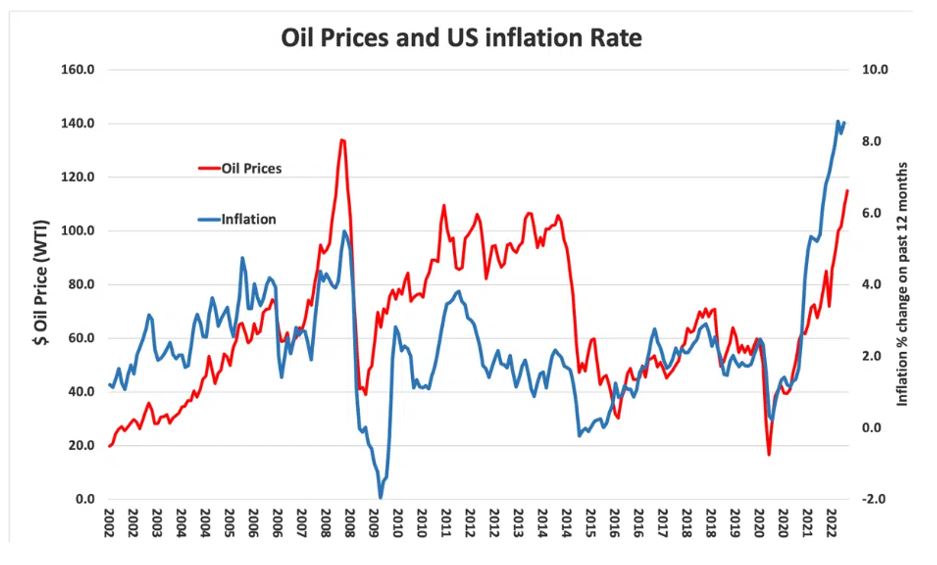

Commodity prices have a tendency to increase with inflation. For example, let’s take a look at this graph from Economics Help about crude oil prices and inflation:

Source: EconomicsHelp.com

As we can see, the correlation between the commodity price and inflation is quite straightforward.

What this means is that commodities can produce exceptional returns over the short term, but the timing is challenging, to say the least.

While practically all investment instruments are priced by supply and demand in the long term, commodities are especially so. As soon as the demand for a certain commodity drops so does the price. Supply and demand can change rapidly overnight, which makes commodity investing quite risky.

So, commodities can make a great inflation hedge if you get the timing right, can predict the supply and demand, and know what you’re doing.

Personally, I’m not that smart. Predicting something is extremely hard, especially if it’s about the future. They might serve a purpose as a diversifier, but for an individual investor, I believe there are more efficient and simpler ways to diversify.

Yourself

All right, so this last one is a bit of a bonus. Not that the words of the almighty Buffett would ever be a bonus, but this one is not exactly the type of advice most people would give, which means it most definitely needs to be on this list.

During one of Berkshire’s annual stockholder meetings, Buffett was asked about the best investments to make during periods of high inflation. Instead of giving some sort of a stock recommendation, he said the best thing to invest in is yourself and “be exceptionally good at something.

The idea behind this is the fact that inflation cannot erode your skills – if you have a skill that is in demand, it will continue to be so regardless of what the dollar or euro is worth.

I like to think about investing in yourself as an investment that literally pays off. For example, if you’d invest $100 in stocks, you can get some amount of return, but that investment will not make you wealthy.

If you invest that same amount in a well-picked book or a course that teaches you specific skills that are in demand, it can make you wealthy.

So, in the end, the best investment to beat inflation might simply be you!