Introduction

Sometimes I come across the notion that investing is merely speculating with stock prices. In some ways this is true.

No matter how thorough you are in your research, investing always includes some amount of speculation because random things always happen in the stock market.

The thing is, that there are certain factors that reduce the uncertainty of your investment decisions and move you from speculating toward investing.

In this article, I take a look at what investing and speculating actually are, and what are the key differences between the two. As always, I focus on stock investments.

I know this might be a bit of a controversial subject since speculating is often linked to day trading and technical analysis. I have no intention of saying one is better than the other. I’m merely opening my own views on the subject as a long-term fundamental investor.

So, what exactly is the difference between investing and speculating?

Let’s start by defining the terms, so we know what we’re talking about.

What is Investing?

Perhaps the most famous definition of investing has been given by Benjamin Graham, the father of value investing.

Graham defined investing in his book The Intelligent Investor:

So, according to Graham, investing consists of fundamental analysis, a margin of safety, and expecting an adequate return instead of extremely high returns.

In other words, you would analyze a certain company with an intrinsic value, buy the stock at a reasonable price, and expect the growing business to reflect on the stock price.

Most common examples of investments include traditional assets like stocks, real estate, and bonds. Fundamental investors tend to favor these asset classes mostly because they have fundamental factors to analyze.

What is Speculating?

Now, whereas investing is a long-term activity that’s based on fundamental principles like the value of the business itself, speculative investments are a bit different.

A speculator bases his decision mostly on asset prices. In essence, the idea is to buy a stock or other asset that the speculator believes someone else will pay even more upon selling it.

So, speculating is a short-term endeavor, but it can in some cases be a long-term one. For example, you could invest in a start-up company that has little chance of succeeding but eventually a huge profit potential.

Therefore, I think it’s important to separate speculative investing and speculative trading from each other. Speculative traders have the shortest possible time horizon, while speculative investors can occasionally have a longer time frame.

In this article, I view speculating as a short-term activity because most of the time, it is.

Usually, speculative assets are ones that you’d have a hard time making a fundamental analysis of. These include assets like cryptocurrencies, certain commodities, and long-shot penny stocks.

The Key Differences

Now that we know what we’re talking about, it’s time to see what exactly separates speculating from investing.

Time Frame

The first difference between investing and speculating is the time frame. As mentioned, investing is a long-term activity, and speculating usually has a shorter time horizon.

Of course, day trading can be a long-term investment strategy, but trades themselves are still short-term.

The core of investing is to buy a successful company that will create wealth for decades to come. A speculator, on the other, can create wealth by executing numerous trades in a single day.

Another time-related difference is related to the decision-making process.

There’s no rush when making an investment decision based on fundamentals. You can go through every possible source of information and take your time. A truly great company is still great even if you waited for a year or two.

For a speculative trade, on the other hand, the timing is often essential. If you’d want to benefit from market events or other time-essential incidents, you can’t afford to wait for long.

Basis of Decision

If we simplify the matter just a little bit, we can say that speculators base their purchases on short-term price fluctuations and investors on fundamental matters like the company’s business model and financials.

For a speculator, fundamentals don’t matter all that much. I believe that sooner or later the stock price will reflect the company’s fundamentals, but it might in some cases take a considerably long time.

Daily market movements are, most of the time quite random, which is why fundamentals aren’t an issue for a day trader. If a stock goes up or down 5% in a day, there’s not necessarily any real reason behind it.

In this context, it’s worth pointing out that the same asset, for example, a certain company’s stock, can be either a great or a poor investment. The result depends on your investment strategy.

A short-term speculator can make a great profit out of a poor company, but a long-term fundamental investor probably won’t.

Risk Level

Speculating is usually considered riskier than investing. The riskiness of an endeavour can be evaluated, for example, by its time frame (short or long term), the amount of information available, and the probability of making a positive return (obviously).

I think that by familiarizing yourself with a company’s fundamentals, you can reduce the probability of making a bad investment and losing money. When you invest in a company, it’s completely possible to separate a great company from a poor one.

Personally, I only invest in things that have a certain amount of fundamental information to them.

I have no idea how to define an acceptable value for a cryptocurrency, for example. With stocks and real estate, it’s a whole lot easier.

The difference between investing and speculating is that a speculator usually has a hard time reducing his risk level with analysis because the fundamentals for the analysis are sometimes extremely scarce.

Also, the short time frame increases the speculator’s risk level. When you put your money into something for a day or two, you can’t really tell whether its price will go up or down. With increasing uncertainty, the risk level also increases.

The main thing in all risk-related issues is that an investor knows how to define his personal risk profile correctly. One should only make investments or speculative bets according to his or her unique risk tolerance.

Summary

While there are some similarities between investing and speculating, at the end of the day, they are quite different from each other.

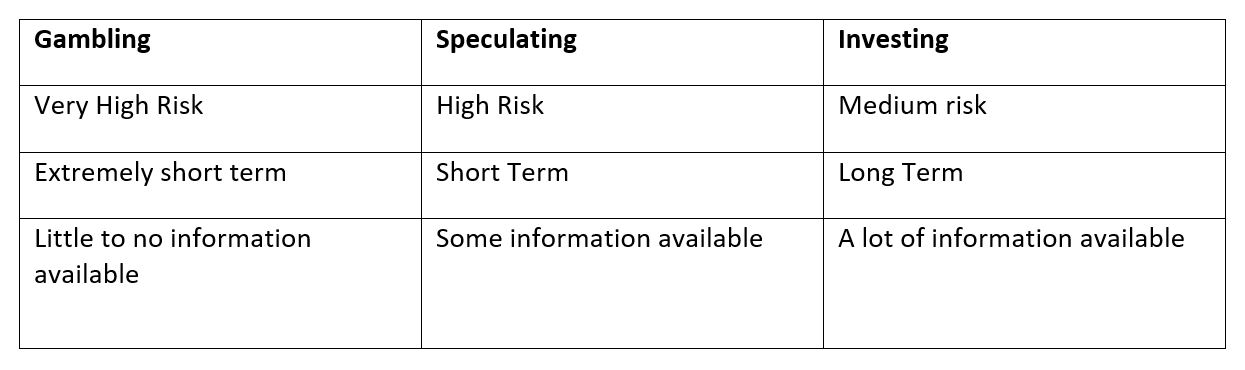

A while ago I wrote an article about the differences between investing and gambling. The way I see it, speculating is somewhere between the middle of those two. The definition depends on the risk factor, the time horizon, and the information available:

I do want to clarify, that there’s nothing wrong with speculating. When we think about it, speculation is the key to innovation and funding promising growth companies in their earliest stages.

The biggest success stories have all started as long-shot investments with a high probability of failure. In most cases, long-term investors would’ve never invested in them because the fundamentals would’ve proven to be too fragile.

So, one is not necessarily better than the other. Your investment strategy should always be based on your personal traits and goals, not on something that some random guy from Finland says on the internet.

Obviously, I just scratched the surface in this article. There are numerous speculative investment operations that can be done, from short selling to other futures contracts and the like.

The most important thing is that you know whether you’re making a speculative investment or not and are aware of the risk involved as well as your own risk tolerance.