Personal finance is a subject that tends to divide people. For some, it’s one of the most important areas of life, while others start to zone out as soon as the subject comes up.

I’m not there to judge or try to convince you that personal finance skills matter.

What I am saying, though, is that I’m pretty sure it doesn’t hurt to pay a little attention to your financial life.

While everyone has their own way to handle their money, there are some universal rules that apply to everyone.

Here I’ve gathered 11 personal finance rules that have worked for me and my clients over the years, and I’m certain they will work for you too.

So, without further ado, let’s dive into it!

Have a Budget

The cornerstone of financial well-being is to make sure you know where your money is coming from, where it’s going, and whether you have a budget surplus or not.

To summarize, your income should always exceed your expense. Simple as that.

Unfortunately, this is easier said than done.

Every once in a while, everyone should calculate where their money is actually going.

One thing that’s so basic that it’s often overlooked is having a financial budget. While the word ‘budgeting’ may be quite repulsive for some, it’s the foundation of your financial well-being, whether you acknowledge it or not.

The truth is that if you have no idea where your money is going, it’s almost impossible to save money and have a reliable personal finance plan.

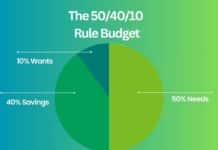

The simplest way to arrange your budget is through the 50/30/20 rule. According to the rule, 50% of your net income should go to your needs, 30% to your wants, and 20% to your savings.

While the percentages may need some adjusting depending on your situation and savings goals, the rule itself gives a solid foundation on what to aim for.

Don’t Buy a Lavish Lifestyle Before You Can Afford It

In the end, it doesn’t matter how much money you make if you spend even more. You could make a gadzillion dollars per year and even if you spend one dollar more, you will be bankrupt.

One thing that’s closely related to this is that you should never buy to impress others. When you aim to show people how much money you have, you have less of it.

There’s a little mind trick I use to check whether a purchase is worth it or not. Imagine that you’re the only one who lives on this planet, and no one would ever see the things you have or know about the things you do.

If you’d still buy something just for your own amusement, then go right ahead. If, on the other hand, you buy something just to show people you have it, it’s probably not worth it.

Also, it’s important to separate assets from liabilities. An asset is a thing that generates an income. A liability requires income to maintain it. For example, a car is not an asset, it’s a liability.

In the end, if you spend more on liabilities than assets, you will eventually be in trouble.

Learn to Separate Wants and Needs

Sometimes we tend to confuse our essential needs with not-so-essential wants.

What we need is food, water, and a place to sleep safely. What we want is everything that makes our lives a bit more comfortable, and sometimes the things that inflate our egos.

For the record, there’s nothing wrong with indulging yourself every now and then if you can afford it. Sometimes it’s the little things that make the biggest difference and make life worth living.

The problem is that on some occasions, these indulgences can get a little out of hand and prevent us from achieving our long-term financial goals.

What’s even more problematic is that we humans thrive on instant gratification. Our brains are wired to seek immediate pleasures rather than long-term success. This is why it’s so tempting to buy a new toy instead of saving, and the companies that provide these temptations know it.

The thing to realize here is that the way our economic system works is not for the benefit of the consumer, it’s for the benefit of the companies that offer the goods we consume.

When a company makes a product and an advertiser brands it as a need and tells you to buy it, it’s you who ultimately decides whether it’s truly a want or a need.

My rule of thumb is that if it needs to be advertised aggressively, it’s not a need.

Don’t Get into Too Much Debt

This is one of those things that everyone knows, but still, it can happen to the best of us.

You should be especially wary of credit card debt. It has a nasty habit of compounding, and the more you use it, the more customary it becomes. Buying on credit should not be a habit.

While credit card debt is the most notorious, you can get in trouble with mortgages and every other kind of debt too. You should always remember that there’s no free money.

It’s not the debt itself that gets you, it’s the interest payments. Especially when the interest rate starts to rise and there’s nothing you can do about it.

You should be extra careful during times of rising inflation because interest rates will soon follow.

Take Care of Your Credit Score

A solid credit score is what can make or break your future. It’s a golden ticket when all goes well, and a massive burden when things go wrong.

If you’ve taken care of your credit score and handled your finances exemplarily, your bank will take notice, offer you better terms on your loans, and, to be honest, you’ll probably get better service overall.

On the other hand, the worst-case scenario is where you have accumulated debt and start to fall behind on your payments. This is when banks start to lower your credit score, which means higher interest rates and more payments.

The downward spiral can be a fast one since missed payments start to accumulate incredibly fast. As a financial advisor, I come across these problems on a daily basis.

The best way to stay financially afloat is to avoid expensive high-interest debt like car loans and credit card debt.

I can also let you in on a little secret.

Banks can be extremely flexible with terms and payments if you handle your end well. If you don’t, they can also be remarkably strict. Banks also usually appreciate the effort. If you show them, that you’re truly doing your best to improve your situation, they will sometimes accommodate you.

The best way to have a pleasant relationship with your bank is to take care of your credit score. This cannot be emphasized enough.

Only Borrow Money You’re willing to Lose

Sometimes we like to help those who’re close to us, and there’s absolutely nothing wrong with lending money to those close to you.

What can be wrong are expectations. When we borrow money, we do expect to get it back, but often that’s not the way things work.

A safe approach is to assume that you never get your borrowed money back. This way you won’t get disappointed and maybe ease the strain that an unpaid loan inevitably puts on a relationship.

Another debt-related rule is that one should never guarantee a loan for another person, especially for a friend. Sometimes people say that a true friend would guarantee a loan, but I’d say that a true friend would never ask.

Also, it should go without saying that you should never borrow the money you’d need yourself in the near future. Even though the people you borrow to would say they pay it back immediately.

Have an Emergency Fund

Having an emergency fund is one of the essential rules of personal finance.

The idea of an emergency fund is that you don’t need to use a credit card or other high-interest loans when something unexpected happens. Depending on your budget and savings, an expensive loan can overthrow your budget and get you into too much debt faster than you can imagine.

Let’s take a simple example. Imagine you’d spend around $2000 a month and had savings of exactly $2000. What this would mean is that if you’re out of income for a month, you would survive exactly one month before you had to look for a loan.

What would then happen is that you’d need to loan around $2000 every month just to stay afloat. When start to earn an income again, you not only have your living expenses of $2000 to cover, but you also have debt and interest to pay.

This diminishes your chances of creating a new emergency fund and increases your monthly expenses, which creates the need for additional income or, in the worst-case scenario, another loan. Before you know it, you’re in over your head in debt.

Then again, if you had savings of, let’s say $6000, you might be able to avoid all the trouble. As you can see, money troubles have a tendency to accumulate, which is why it’s important to prevent the possible downward spiral with emergency savings.

Be Careful Whom You Marry

Saving and accumulating wealth as a couple is pretty hard if the other one spends like a drunken sailor.

We’ve all heard stories about couples who’ve gotten into trouble because of hidden debt burdens or reckless spending.

I think that couples should divide expenses equally. It’s only fair.

Some couples have different arrangements, and that’s completely okay. The main thing is that both parties are on the same page, and can talk about their spending habits.

Also, this should go without saying but it shouldn’t be necessary to impress your spouse with your money or constantly shower your loved one with expensive gifts (unless it’s a mutual agreement, then who am I to judge).

I believe in keeping your finances separate, and having a prenup is a must.

They say that love is eternal, and it sure is. It’s just that the ones you love tend to change over time. Divorces sometimes bring out the worst in us, and things can get ugly extremely fast. Having a prenup prevents a lot of trouble.

Start Saving Before You Start Investing

Sometimes people skip saving money entirely and use investing as a form of saving for surprising expenses. This is something I can’t really recommend because every time you sell your investments it ruins the compounding returns you would achieve in the long term.

The way I see it there are three different categories of money. The first category is your spending money in your checking account where you pay your bills and other purchases from. This is the most volatile category of all three.

Second, there’s your savings account where you keep your emergency and/or buffer fund, which is a bit more stable than your checking account. While you have to move money from your savings account to your checking account every once in a while, you should still aim to keep a certain fixed amount of money saved in case of emergencies (and for peace of mind).

Investing is what comes last. Your investments are the type of assets you shouldn’t have to sell ever. This is to ensure you don’t have to sell your budding retirement savings just because your washing machine broke down.

The idea is to get the first two, your everyday spending money and savings in order before you invest to give you a more solid foundation for your investments.

The Importance of Financial Literacy

If there is one thing that is the key to a better financial life, it’s being financially literate.

The best way to achieve financial literacy is reading.

Of course, it’s not enough to just read, we need to apply what we’ve learned, otherwise it’s mostly a waste of time.

Personal finance is a subject you can learn both by doing and by reading. The thing is that it’s a lot easier to learn by reading because you can learn from the mistakes others have made without making them yourself.

The more you read, the more likely it is that you’ll avoid making expensive mistakes.

The problem nowadays is that the amount of information at your disposal is endless. Especially in the field of investing.

Here I’ve gathered the best financial literacy books for beginners that will surely get you where you need to go!

Assume Responsibility

All right, so this last one is probably the most important of these personal finance rules. This could’ve been the first one on the list, but I wanted to save this for last to really make a point.

When it comes to personal finances, you’re the one responsible for yourself. Acknowledging this is the first step in taking control of your finances.

One of the most common things I hear is that “the system is against people like me“, or “I didn’t have a chance in the first place”. While these statements can be true on some occasions, most of the time they definitely are not.

The thing is that our economic system is neither great nor terrible. The result you get depends on how you work with the system.

Because capitalism is a system where capital and profits tend to accumulate, it’s important to be on the winning side. I believe the best way to do this is through saving and investing.

I wrote an article on why you should invest, that you definitely want to read too!